The cliff period refers to the initial phase in a vesting schedule during which no equity or stock options are granted to employees. This period is designed to encourage long-term commitment by ensuring that you must stay with the company beyond this timeframe to earn any shares. Discover how understanding your cliff period can impact your financial planning and career decisions by reading the rest of this article.

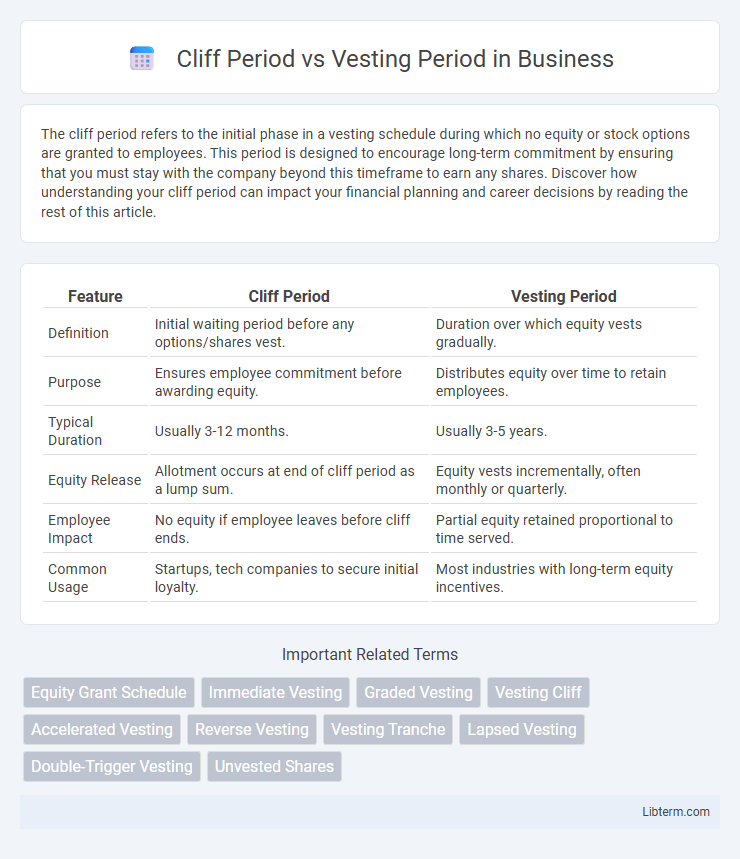

Table of Comparison

| Feature | Cliff Period | Vesting Period |

|---|---|---|

| Definition | Initial waiting period before any options/shares vest. | Duration over which equity vests gradually. |

| Purpose | Ensures employee commitment before awarding equity. | Distributes equity over time to retain employees. |

| Typical Duration | Usually 3-12 months. | Usually 3-5 years. |

| Equity Release | Allotment occurs at end of cliff period as a lump sum. | Equity vests incrementally, often monthly or quarterly. |

| Employee Impact | No equity if employee leaves before cliff ends. | Partial equity retained proportional to time served. |

| Common Usage | Startups, tech companies to secure initial loyalty. | Most industries with long-term equity incentives. |

Understanding Cliff Period: Definition and Purpose

The cliff period is a specific initial duration in an equity compensation plan during which employees do not earn any stock options or shares. It serves as a probationary timeframe, ensuring that recipients remain with the company for a minimum period before receiving any ownership benefits. This mechanism protects employers by aligning employee incentives with long-term commitment and performance before vesting begins.

What is a Vesting Period? Key Concepts Explained

A vesting period is the timeframe an employee must work before gaining ownership of employer-granted benefits, such as stock options or retirement contributions. During this period, the employee earns rights to the benefits incrementally, typically through graded or cliff vesting schedules. Understanding the vesting period is crucial for employees to maximize financial incentives and for companies to improve retention strategies.

Cliff Period vs Vesting Period: Main Differences

The cliff period marks the initial duration during which no equity is vested, serving as a probationary phase before any shares are granted, whereas the vesting period represents the total timeline over which the entire equity allocation becomes fully owned by the employee. Cliff periods usually last between three to twelve months, acting as a milestone for employees to earn their first portion of stock options. Vesting schedules, commonly spanning three to four years, gradually release equity, aligning employee retention incentives with company performance goals.

How Do Cliff and Vesting Periods Work Together?

Cliff and vesting periods work together by defining when and how an employee gains full ownership of stock options or equity grants. The cliff period sets an initial waiting time, often 12 months, before any equity vests, ensuring commitment from the employee. After the cliff, the vesting period gradually unlocks the remaining shares over time, typically monthly or quarterly, until reaching 100% ownership.

Advantages of a Cliff Period for Employers and Employees

A cliff period offers employers a safeguard by ensuring employees commit to a minimum tenure before earning equity, reducing turnover and administrative complexities. Employees benefit from a clear milestone that guarantees they receive a significant portion of their equity only after proving their dedication and value, fostering motivation and retention. This structure aligns interests and minimizes the risk of premature equity loss, enhancing long-term engagement for both parties.

Common Vesting Schedules and Their Impact

Cliff periods and vesting periods are essential components of employee stock option plans, where a cliff period represents the initial time before any shares vest, often set at one year, while the vesting period defines the full duration over which stock options vest gradually, commonly spanning three to four years. Common vesting schedules, such as the 1-year cliff followed by monthly or quarterly vesting, align employee incentives with company performance and retention goals. Understanding these schedules' impact helps companies reduce turnover by ensuring employees commit to a minimum tenure before gaining ownership while maintaining motivation through incremental equity rewards.

Why Companies Use Cliff Periods in Equity Compensation

Companies use cliff periods in equity compensation to ensure employee retention during the initial critical phase of employment, typically requiring a one-year minimum before any stock options vest. This mechanism protects the company from granting equity to short-term employees who leave prematurely, aligning incentives with long-term commitment. The cliff period acts as a probationary interval that promotes stability and loyalty before gradual vesting begins.

Legal Implications of Cliff and Vesting Periods

The legal implications of cliff and vesting periods center on the enforceability of employee rights to equity compensation, ensuring that ownership interests are granted according to predefined timelines. Cliff periods establish a minimum duration before any rights vest, preventing premature claims and protecting employers from forfeiture risks, while vesting periods delineate the schedule over which incremental ownership is granted, influencing taxation and contract compliance. Employers must carefully draft these provisions in equity agreements to comply with employment laws, securities regulations, and tax codes, mitigating potential disputes related to ownership, termination, or equity forfeiture.

Tips for Negotiating Cliff and Vesting Terms

When negotiating cliff and vesting periods, request a shorter cliff period to gain earlier access to equity and reduce risk if you leave the company prematurely. Negotiate for a gradual vesting schedule instead of immediate vesting after the cliff, ensuring steady equity accumulation aligned with long-term contribution. Clarify terms around acceleration clauses and consider market standards in your industry to achieve balanced and fair equity compensation.

Frequently Asked Questions: Cliff Period vs Vesting Period

The cliff period is the initial timeframe in which an employee must stay before any equity or benefits begin to vest, typically lasting 3 to 12 months. The vesting period refers to the total duration over which equity or benefits are earned gradually, often spanning 3 to 4 years. Common questions often revolve around whether equity is lost if an employee leaves before the cliff ends and how the cliff affects the overall vesting schedule.

Cliff Period Infographic

libterm.com

libterm.com