Capex, or capital expenditures, refers to the funds a company invests in acquiring, upgrading, or maintaining physical assets such as property, industrial buildings, or equipment. Managing Capex efficiently is crucial for sustaining long-term growth and ensuring operational efficiency while balancing cash flow. Explore the rest of this article to understand how optimizing your Capex strategy can enhance business performance.

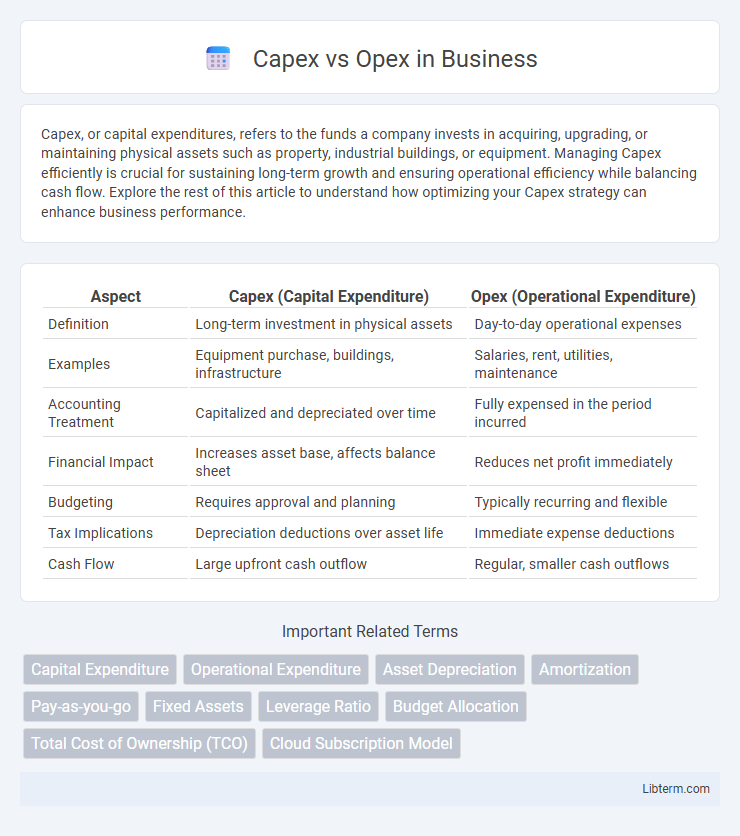

Table of Comparison

| Aspect | Capex (Capital Expenditure) | Opex (Operational Expenditure) |

|---|---|---|

| Definition | Long-term investment in physical assets | Day-to-day operational expenses |

| Examples | Equipment purchase, buildings, infrastructure | Salaries, rent, utilities, maintenance |

| Accounting Treatment | Capitalized and depreciated over time | Fully expensed in the period incurred |

| Financial Impact | Increases asset base, affects balance sheet | Reduces net profit immediately |

| Budgeting | Requires approval and planning | Typically recurring and flexible |

| Tax Implications | Depreciation deductions over asset life | Immediate expense deductions |

| Cash Flow | Large upfront cash outflow | Regular, smaller cash outflows |

Introduction to Capex and Opex

Capital Expenditure (Capex) refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment. Operating Expenditure (Opex) encompasses the ongoing costs for running day-to-day business activities, including rent, utilities, and salaries. Understanding the distinction between Capex and Opex is crucial for financial planning, budgeting, and investment decision-making.

Defining Capex: Capital Expenditures Explained

Capital Expenditures (Capex) refer to funds invested by a business to acquire, upgrade, or maintain physical assets like property, equipment, or technology infrastructure. These expenditures are capitalized on the balance sheet and depreciated over the asset's useful life, impacting long-term financial planning and tax strategies. Understanding Capex enables companies to manage growth, optimize asset value, and align spending with strategic goals.

Understanding Opex: Operational Expenditures Overview

Operational expenditures (Opex) encompass the ongoing costs required to run day-to-day business activities, including rent, utilities, salaries, and maintenance. These expenses are essential for sustaining operational efficiency and are typically expensed within the accounting period they occur. Understanding Opex is crucial for budgeting and financial planning, as it impacts cash flow and profitability without reflecting long-term asset investments like capital expenditures (Capex).

Key Differences Between Capex and Opex

Capex (Capital Expenditure) refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment, characterized by long-term benefits and depreciation over time. Opex (Operational Expenditure) involves the day-to-day expenses required for the company's operational activities, including rent, utilities, salaries, and maintenance, with immediate impact on profit and loss statements. Key differences include Capex being capitalized and amortized, whereas Opex is fully expensed in the accounting period, affecting cash flow management and tax implications differently.

Financial Impact: Budgeting Capex vs Opex

Capex (Capital Expenditures) impacts budgeting by requiring significant upfront investments in assets, resulting in long-term depreciation and influencing cash flow over multiple fiscal periods. Opex (Operating Expenditures) involves ongoing, recurring costs necessary for daily business operations, directly affecting short-term profit and loss statements and providing greater flexibility in budget adjustments. Effective financial management balances Capex and Opex to optimize liquidity, tax benefits, and overall organizational financial health.

Tax Treatment: Capex vs Opex Deductions

Capital expenditures (Capex) are typically capitalized and depreciated over the asset's useful life, spreading tax deductions across multiple years, while operating expenses (Opex) are fully deductible in the year incurred, providing immediate tax relief. Tax codes often require businesses to differentiate Capex from Opex to comply with depreciation schedules and expense recognition rules. Understanding the distinct tax treatment of Capex versus Opex deductions can optimize cash flow and reduce taxable income efficiently.

Examples of Capex and Opex in Business

Capital expenditures (Capex) in business commonly include the purchase of physical assets such as machinery, buildings, and technology infrastructure that provide long-term value and support operational capacity. Operating expenditures (Opex) consist of ongoing costs like rent, utilities, salaries, and maintenance expenses required for daily business operations. Businesses often invest in Capex for asset acquisition and upgrade, while Opex covers recurring expenses necessary to sustain regular activities.

Decision-Making: When to Choose Capex or Opex

Choosing between Capex and Opex depends on factors such as cash flow, tax implications, and long-term business goals. Capex is optimal for investments with a useful life extending beyond one fiscal year, providing asset ownership and depreciation benefits. Opex suits operational expenses needing flexibility and immediate deduction, supporting scalability and reducing upfront investment.

Industry Perspectives on Capex and Opex

Industry perspectives on Capex and Opex vary significantly by sector, with manufacturing and utilities emphasizing Capex to invest in long-term assets like machinery and infrastructure, enabling future productivity and operational capacity. Technology and service industries prioritize Opex for its flexibility, favoring operational expenses such as cloud services and subscription software that support rapid innovation and scalability. Strategic financial planning in industries increasingly balances Capex for foundational growth with Opex for agile resource management to optimize overall performance and cost-efficiency.

Future Trends: The Shift from Capex to Opex

Future trends indicate a significant shift from Capex (Capital Expenditure) to Opex (Operational Expenditure) driven by the growing adoption of cloud computing, subscription-based software, and as-a-service models. Businesses prioritize flexibility, scalability, and cost-efficiency, favoring Opex to reduce upfront investments and improve cash flow management. This evolving financial strategy supports digital transformation and agile business models, reshaping budgeting and asset management practices across industries.

Capex Infographic

libterm.com

libterm.com