Bank loans provide a critical source of funding for individuals and businesses seeking to finance major purchases or expand operations. Understanding interest rates, repayment terms, and eligibility criteria can help you secure the best possible loan tailored to your financial needs. Explore the rest of the article to learn how to navigate bank loans effectively and make informed borrowing decisions.

Table of Comparison

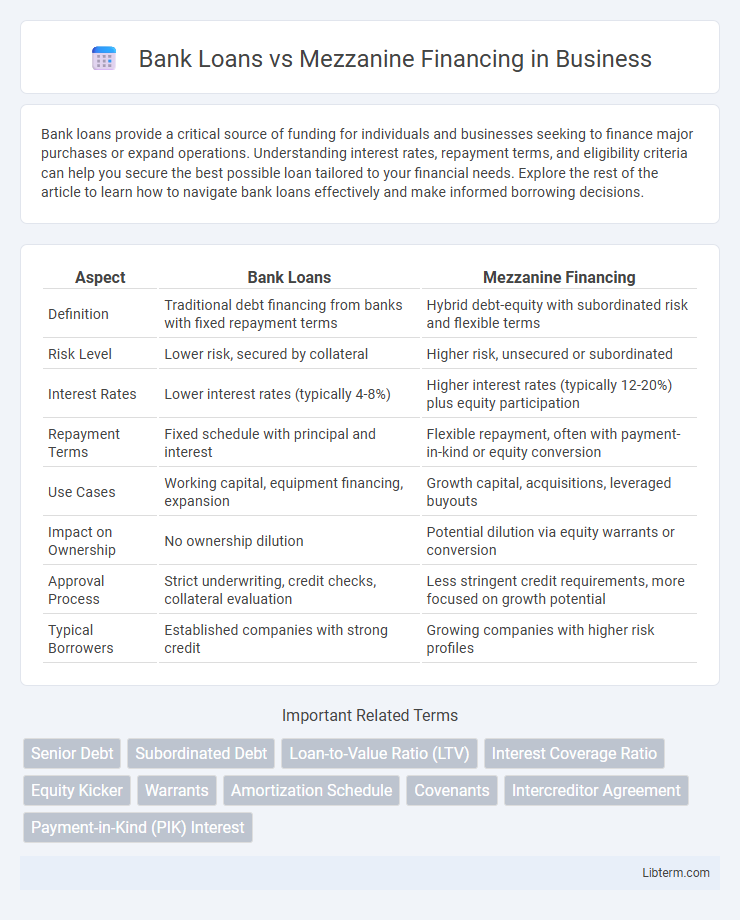

| Aspect | Bank Loans | Mezzanine Financing |

|---|---|---|

| Definition | Traditional debt financing from banks with fixed repayment terms | Hybrid debt-equity with subordinated risk and flexible terms |

| Risk Level | Lower risk, secured by collateral | Higher risk, unsecured or subordinated |

| Interest Rates | Lower interest rates (typically 4-8%) | Higher interest rates (typically 12-20%) plus equity participation |

| Repayment Terms | Fixed schedule with principal and interest | Flexible repayment, often with payment-in-kind or equity conversion |

| Use Cases | Working capital, equipment financing, expansion | Growth capital, acquisitions, leveraged buyouts |

| Impact on Ownership | No ownership dilution | Potential dilution via equity warrants or conversion |

| Approval Process | Strict underwriting, credit checks, collateral evaluation | Less stringent credit requirements, more focused on growth potential |

| Typical Borrowers | Established companies with strong credit | Growing companies with higher risk profiles |

Introduction to Bank Loans and Mezzanine Financing

Bank loans are traditional debt instruments where borrowers receive a fixed sum with scheduled repayments and interest, typically secured by collateral and used for various business needs. Mezzanine financing is a hybrid capital form combining debt and equity features, offering higher interest rates and subordinate claims in exchange for flexibility and potential equity participation. These financing options differ in risk, cost, and structure, catering to distinct stages of business growth and capital requirements.

Key Differences Between Bank Loans and Mezzanine Financing

Bank loans typically offer lower interest rates and fixed repayment schedules but require collateral and stringent credit qualifications, making them suitable for companies with strong balance sheets. Mezzanine financing, positioned between debt and equity, carries higher interest rates and often includes equity warrants, providing flexible capital for businesses with higher risk profiles or those seeking growth without immediate collateral. The key differences lie in risk tolerance, cost of capital, and control, with bank loans favoring security and predictability, while mezzanine financing emphasizes growth potential and subordinated claims.

Structure and Terms of Bank Loans

Bank loans typically feature fixed repayment schedules with predetermined interest rates and require collateral to mitigate lender risk. These loans generally involve covenants that impose operational and financial restrictions on the borrower to ensure timely repayment. The structure emphasizes lower risk exposure for banks through secured claims and priority in the capital stack compared to mezzanine financing.

Structure and Terms of Mezzanine Financing

Mezzanine financing typically combines debt and equity features, often structured as subordinated debt with attached warrants or options, granting lenders potential equity participation. Its terms usually include higher interest rates than traditional bank loans due to increased risk, with repayment schedules that may be flexible or linked to company performance. Unlike senior bank loans, mezzanine financing is subordinate in the capital structure, positioned between senior debt and equity, providing growth capital without immediate dilution of ownership.

Eligibility Criteria for Each Financing Option

Bank loans typically require strong credit scores, stable cash flow, and substantial collateral to ensure repayment capacity, making them suitable for established businesses with solid financial histories. Mezzanine financing, however, targets companies with higher growth potential but less collateral, emphasizing business scalability and willingness to accept higher interest rates or equity participation. Lenders for mezzanine debt prioritize companies demonstrating strong EBITDA growth and a clear exit strategy, while banks focus on risk mitigation through tangible asset-backed security.

Cost Comparison: Interest Rates and Fees

Bank loans typically offer lower interest rates ranging from 3% to 7%, with fees including origination and appraisal costs, making them a cost-effective option for borrowers with strong credit profiles. Mezzanine financing carries higher interest rates, often between 12% and 20%, plus equity participation or warrants, reflecting the increased risk to lenders and compensating for subordinate repayment priority. The overall cost of mezzanine financing surpasses traditional bank loans due to these elevated interest rates and additional fees, but it provides flexible capital when senior debt limits are reached.

Risk and Security Considerations

Bank loans typically offer lower interest rates but require strong collateral and rigorous credit checks, posing less risk to lenders but stricter terms for borrowers. Mezzanine financing carries higher risk and interest rates, often unsecured or subordinated to bank loans, making it attractive for companies needing flexible capital without diluting equity. The increased risk for mezzanine lenders is balanced by higher returns, reflecting its position between traditional debt and equity in the capital structure.

Flexibility and Repayment Structures

Bank loans typically feature fixed repayment schedules and stricter covenant requirements, limiting flexibility for borrowers. Mezzanine financing offers more customizable repayment structures, often including options for interest-only payments or equity conversion, providing greater adaptability in cash flow management. This flexibility makes mezzanine financing attractive for companies seeking tailored solutions to bridge financing gaps without immediate pressure on cash outflows.

Pros and Cons of Bank Loans vs Mezzanine Financing

Bank loans offer lower interest rates and secured collateral, providing predictable repayment terms but require strict credit qualifications and can limit flexibility. Mezzanine financing, typically unsecured, combines debt and equity features, allowing higher leverage and access to growth capital without immediate dilution, yet it carries higher interest costs and potential equity dilution risk. Choosing between them depends on balancing cost efficiency with capital structure flexibility and risk tolerance.

Choosing the Right Option for Your Business

Bank loans provide lower interest rates and fixed repayment schedules, making them suitable for businesses with strong credit and predictable cash flows. Mezzanine financing offers flexible terms and access to capital without immediate dilution of equity, ideal for companies seeking growth funding and willing to accept higher risk and cost. Evaluating your business's financial stability, growth potential, and risk tolerance is crucial in choosing the optimal funding option.

Bank Loans Infographic

libterm.com

libterm.com