Privately negotiated agreements allow parties to customize terms directly without involving public bidding or market exposure, ensuring confidentiality and tailored solutions. This approach often leads to faster transactions and can build stronger business relationships through mutual trust. Explore the full article to understand how privately negotiated deals can benefit your strategic objectives.

Table of Comparison

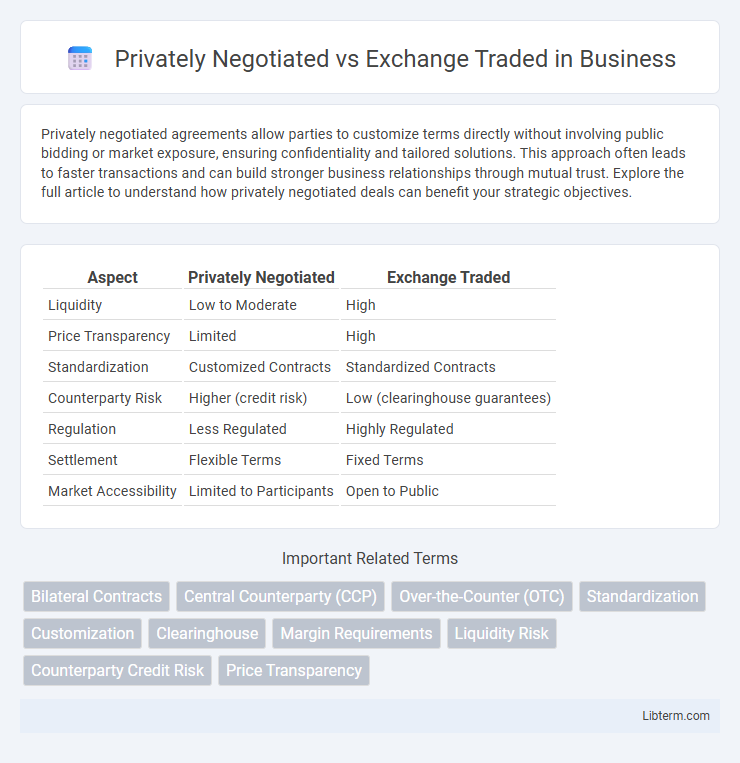

| Aspect | Privately Negotiated | Exchange Traded |

|---|---|---|

| Liquidity | Low to Moderate | High |

| Price Transparency | Limited | High |

| Standardization | Customized Contracts | Standardized Contracts |

| Counterparty Risk | Higher (credit risk) | Low (clearinghouse guarantees) |

| Regulation | Less Regulated | Highly Regulated |

| Settlement | Flexible Terms | Fixed Terms |

| Market Accessibility | Limited to Participants | Open to Public |

Understanding Privately Negotiated and Exchange Traded Transactions

Privately negotiated transactions involve direct agreements between parties, allowing customized terms and flexibility in pricing and settlement, often used in over-the-counter (OTC) markets for tailored financial instruments. Exchange traded transactions occur on regulated platforms where standardized contracts are bought and sold, providing transparency, liquidity, and reduced counterparty risk due to centralized clearinghouses. Understanding these differences helps investors choose between personalized deal structures and the efficiency and security of exchange trading.

Key Features of Privately Negotiated Trades

Privately negotiated trades involve direct agreements between parties, allowing customized terms such as price, quantity, and settlement dates tailored to specific needs. These trades offer enhanced flexibility and confidentiality compared to standardized exchange-traded contracts. Counterparty risk is higher in privately negotiated transactions due to the lack of centralized clearing and regulatory oversight.

Main Characteristics of Exchange Traded Instruments

Exchange traded instruments, such as stocks and futures, are standardized contracts that are listed and traded on regulated exchanges, providing high liquidity and transparency in pricing. These instruments benefit from centralized clearinghouses that reduce counterparty risk and ensure settlement efficiency. Market participants gain access to real-time price discovery and regulated environments which enhance investor protection and market integrity.

Advantages of Privately Negotiated Contracts

Privately negotiated contracts offer tailored terms that directly match the specific needs of both parties, providing enhanced flexibility compared to exchange-traded contracts. These agreements enable customized pricing, delivery schedules, and contract sizes, which can optimize risk management and operational efficiency for businesses. Confidentiality in privately negotiated deals can also provide a competitive advantage by keeping strategic intentions and pricing proprietary.

Benefits of Exchange Traded Markets

Exchange traded markets offer enhanced liquidity and transparency, allowing investors to buy and sell securities rapidly at publicly quoted prices. Standardized contracts and centralized clearing reduce counterparty risk, ensuring greater security and market integrity. Regulatory oversight in exchange traded markets fosters investor confidence and efficient price discovery, making them a preferred venue for trading a wide range of financial instruments.

Risks Associated with Privately Negotiated Deals

Privately negotiated deals carry higher counterparty risk due to the absence of a centralized exchange guaranteeing the transaction, increasing the likelihood of default. These transactions often lack transparency and standardized terms, which can lead to valuation challenges and reduced liquidity compared to exchange-traded contracts. Market participants must conduct thorough due diligence and enforce robust legal agreements to mitigate risks inherent in over-the-counter (OTC) privately negotiated trades.

Risk Factors in Exchange Traded Transactions

Exchange traded transactions carry lower counterparty risk due to standardized contracts and clearinghouse guarantees that mitigate default risk. However, they pose market risk through price volatility and potential liquidity constraints during periods of high market stress. Operational risks persist from reliance on electronic trading platforms and exchange infrastructure vulnerabilities.

Regulatory Differences Between Private and Exchange Trading

Private trading operates under less stringent regulatory oversight, allowing parties to negotiate terms directly but often lacks the transparency and standardized reporting required by exchanges. Exchange-traded transactions are subject to rigorous regulatory frameworks established by bodies such as the SEC or CFTC, ensuring market integrity, price transparency, and systematic risk management. This contrast in regulatory environments impacts compliance requirements, disclosure obligations, and investor protections, with exchange trading typically offering greater regulatory assurance.

Use Cases: When to Choose Private vs Exchange Traded

Privately negotiated contracts are ideal for customized transactions requiring tailored terms, such as bespoke risk management in commodity trading or complex mergers and acquisitions. Exchange-traded instruments provide standardized contracts with increased liquidity and transparency, making them suitable for hedging standardized risks in equity, commodity, and interest rate markets. Choosing privately negotiated agreements is preferable when flexibility and confidentiality are paramount, while exchange-traded products excel in environments demanding regulatory oversight and price discovery.

Comparing Costs and Liquidity: Private vs Exchange Transactions

Privately negotiated transactions typically incur higher costs due to bespoke contract terms and less standardized processes, whereas exchange-traded transactions benefit from lower fees and transparent pricing driven by competitive market environments. Liquidity in exchange-traded markets is generally superior, providing immediate access to buyers and sellers through centralized order books, contrasting with the often limited counterparties and longer negotiation periods found in private deals. The trade-offs between cost efficiency and liquidity define the strategic choice between private negotiations and exchange-based trading methods.

Privately Negotiated Infographic

libterm.com

libterm.com