Net income represents the total profit a company retains after deducting all expenses, taxes, and costs from its total revenue, serving as a key indicator of financial health and profitability. Accurately understanding net income helps you assess a business's operational efficiency and long-term sustainability. Explore the rest of this article to learn how net income impacts investment decisions and financial planning.

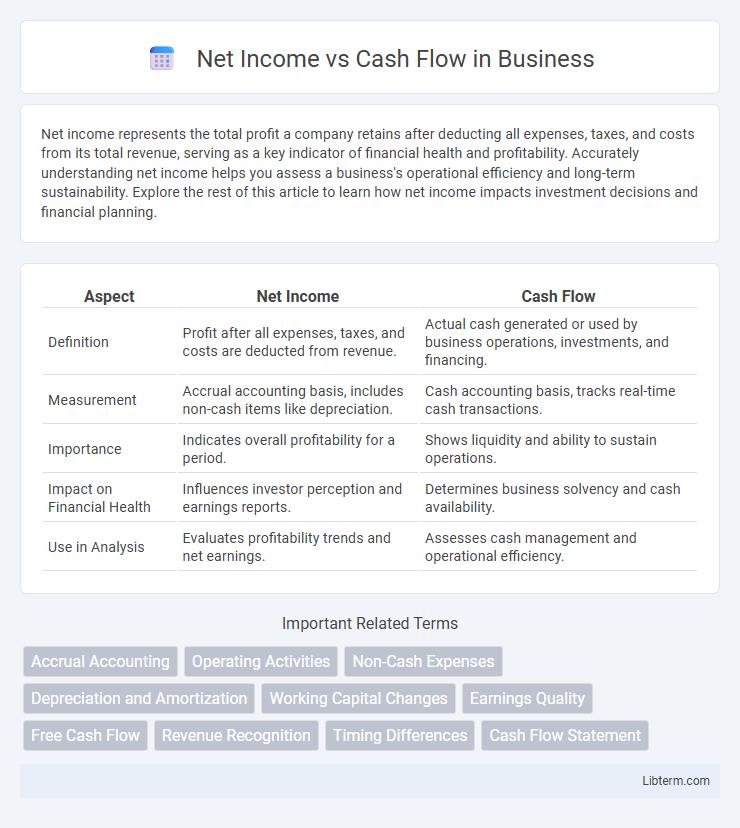

Table of Comparison

| Aspect | Net Income | Cash Flow |

|---|---|---|

| Definition | Profit after all expenses, taxes, and costs are deducted from revenue. | Actual cash generated or used by business operations, investments, and financing. |

| Measurement | Accrual accounting basis, includes non-cash items like depreciation. | Cash accounting basis, tracks real-time cash transactions. |

| Importance | Indicates overall profitability for a period. | Shows liquidity and ability to sustain operations. |

| Impact on Financial Health | Influences investor perception and earnings reports. | Determines business solvency and cash availability. |

| Use in Analysis | Evaluates profitability trends and net earnings. | Assesses cash management and operational efficiency. |

Introduction to Net Income and Cash Flow

Net income represents a company's total profit calculated by subtracting total expenses from total revenues, reflecting profitability over a specific period. Cash flow measures the actual inflow and outflow of cash within a business, highlighting liquidity and operational efficiency. Understanding the distinction between net income and cash flow is essential for assessing a company's financial health and sustainability.

Defining Net Income

Net income represents a company's total profit after deducting all expenses, taxes, and costs from total revenue, reflecting profitability over a specific period. It is calculated according to accounting standards and includes non-cash items like depreciation and amortization, which do not impact cash flow directly. Understanding net income is crucial for assessing financial performance, but it differs from cash flow, which measures the actual liquidity generated or used by business operations.

Understanding Cash Flow

Cash flow represents the actual inflow and outflow of cash within a business, reflecting its liquidity and ability to meet immediate financial obligations. Unlike net income, which includes non-cash expenses like depreciation, cash flow provides a clearer picture of operational efficiency and financial health. Tracking cash flow ensures companies maintain sufficient cash reserves for payroll, debt repayment, and investment opportunities.

Key Differences Between Net Income and Cash Flow

Net income represents a company's profitability by calculating total revenues minus expenses, including non-cash items like depreciation and accruals, during a specific period. Cash flow measures the actual inflow and outflow of cash, reflecting liquidity by showing how much cash is generated or used in operations, investing, and financing activities. The key difference lies in net income accounting for non-cash transactions and accruals, while cash flow provides insight into real-time cash availability and operational efficiency.

Importance of Net Income in Financial Reporting

Net income is a critical metric in financial reporting as it represents the company's profitability over a specific period, reflecting revenues minus expenses, taxes, and costs. It provides stakeholders, including investors and analysts, with a snapshot of the company's operational efficiency and overall financial health, influencing stock valuation and dividend decisions. Unlike cash flow, which tracks actual cash movements, net income incorporates non-cash items such as depreciation and accruals, making it essential for assessing long-term profitability and business sustainability.

Significance of Cash Flow for Business Operations

Cash flow represents the actual liquidity available for daily business operations, making it crucial for meeting short-term obligations like payroll, inventory purchases, and debt repayments. Unlike net income, which includes non-cash items such as depreciation and accounts receivable, cash flow indicates the real-time financial health and operational efficiency of a business. Positive operating cash flow ensures sustainable growth by enabling reinvestment and preventing solvency issues, often serving as a more accurate indicator of business viability than net income alone.

Net Income vs Cash Flow: Which Is More Reliable?

Net income reflects a company's profitability by accounting for all revenues and expenses, including non-cash items like depreciation, while cash flow measures the actual cash generated or used in operations, investing, and financing activities. Cash flow is often considered more reliable for assessing liquidity and the company's ability to meet short-term obligations, as it shows real cash movement. Net income can be influenced by accounting policies and estimates, which might distort the true economic performance compared to cash flow statements.

Common Misconceptions About Net Income and Cash Flow

Many confuse net income with cash flow, assuming both represent a company's profitability and liquidity identically. Net income includes non-cash expenses like depreciation and recognizes revenue on an accrual basis, while cash flow reflects actual cash inflows and outflows, crucial for assessing operational sustainability. Misinterpreting net income as cash availability can lead to flawed financial decisions, underscoring the importance of analyzing cash flow statements for a true picture of business health.

Impact on Investment and Business Decisions

Net income reflects a company's profitability by accounting for revenues and expenses, influencing investor confidence and stock valuations. Cash flow provides insight into the actual liquidity available for operations, debt repayment, and capital expenditures, crucial for assessing the firm's financial health. Investors and business managers rely on cash flow analysis to make informed decisions on funding, expansions, and risk management beyond what net income alone reveals.

Conclusion: Balancing Net Income and Cash Flow for Financial Health

Balancing net income and cash flow is crucial for maintaining solid financial health, as net income measures profitability while cash flow ensures liquidity. Businesses with strong net income but weak cash flow risk insolvency due to inability to meet short-term obligations. Effective financial management requires monitoring both metrics to support sustainable growth and operational stability.

Net Income Infographic

libterm.com

libterm.com