Market price reflects the current value at which a product or asset can be bought or sold in a competitive marketplace, driven by supply and demand dynamics. Understanding market price helps you make informed decisions about buying, selling, or investing. Explore the full article to uncover how market price influences financial strategies and consumer behavior.

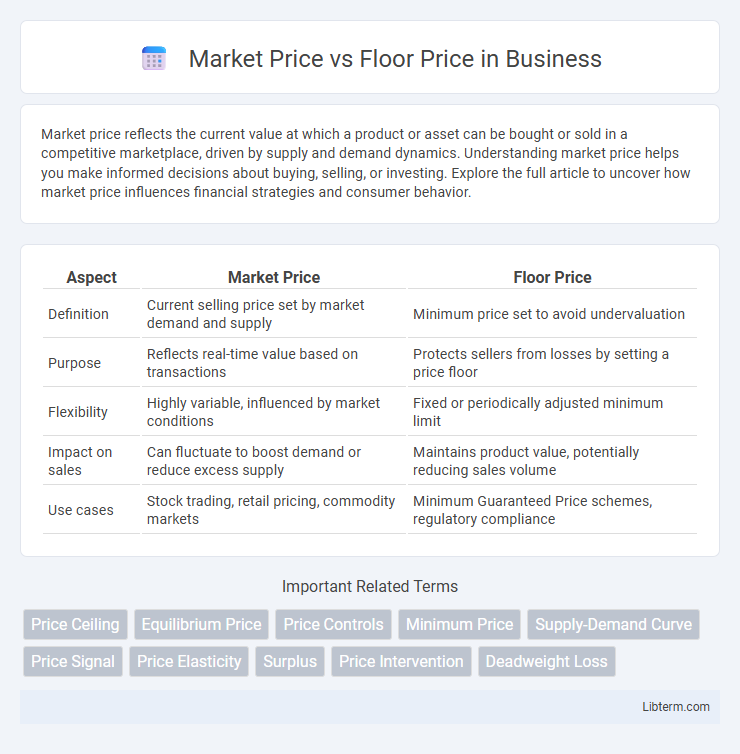

Table of Comparison

| Aspect | Market Price | Floor Price |

|---|---|---|

| Definition | Current selling price set by market demand and supply | Minimum price set to avoid undervaluation |

| Purpose | Reflects real-time value based on transactions | Protects sellers from losses by setting a price floor |

| Flexibility | Highly variable, influenced by market conditions | Fixed or periodically adjusted minimum limit |

| Impact on sales | Can fluctuate to boost demand or reduce excess supply | Maintains product value, potentially reducing sales volume |

| Use cases | Stock trading, retail pricing, commodity markets | Minimum Guaranteed Price schemes, regulatory compliance |

Introduction to Market Price and Floor Price

Market price refers to the current value at which a good or asset can be bought or sold in a competitive marketplace, fluctuating based on supply and demand dynamics. Floor price is a predetermined minimum price set to prevent the value of a product or asset from falling below a certain level, ensuring market stability and protecting sellers from severe losses. Understanding the distinction between market price and floor price is essential for analyzing pricing strategies and market interventions.

Key Differences Between Market Price and Floor Price

Market price fluctuates based on real-time supply and demand dynamics in the marketplace, reflecting what buyers are willing to pay. Floor price is a predetermined minimum price set by authorities or sellers to prevent prices from falling below a certain threshold, ensuring market stability and protecting producers. The key difference lies in market price varying naturally, while floor price acts as a regulatory or strategic control to maintain minimum value.

How Market Price Is Determined

Market price is determined by the forces of supply and demand within a competitive marketplace, where buyers and sellers negotiate prices based on current conditions. Factors such as consumer preferences, production costs, availability of substitutes, and overall market sentiment influence the equilibrium price at which goods or services are exchanged. Unlike floor price, which is a government-mandated minimum price to prevent prices from falling below a certain level, market price fluctuates dynamically in response to real-time economic activities and trends.

Government Role in Setting Floor Prices

The government plays a crucial role in setting floor prices to protect producers from market volatility and ensure a minimum income level. By establishing a legally mandated minimum price, authorities prevent prices from falling below sustainable levels, especially in agricultural and essential commodity sectors. This intervention helps stabilize markets, supports rural livelihoods, and maintains economic balance in sectors prone to price fluctuations.

Advantages of Market Price Systems

Market price systems offer dynamic pricing based on real-time supply and demand, ensuring efficient resource allocation and reflecting true market conditions. This flexibility encourages competition, innovation, and consumer choice, leading to higher quality products and services at optimal prices. By responding swiftly to market fluctuations, market price systems help stabilize economies and promote overall economic growth.

Pros and Cons of Floor Price Policies

Floor price policies establish a minimum price to protect producers from selling goods below cost, ensuring income stability and market fairness, especially in volatile markets like agriculture. However, these policies can lead to market distortions, causing surpluses as supply exceeds demand at the artificially set price, and potentially higher consumer prices due to reduced competition. While floor prices safeguard producer welfare, they risk inefficiencies by discouraging market equilibrium and potentially resulting in government intervention to manage excess supply.

Real-World Examples of Floor Price Implementation

In India, the government sets a floor price for sugarcane to protect farmers from volatile market prices, ensuring a minimum return regardless of market fluctuations. The US Federal Milk Marketing Orders establish floor prices for raw milk, stabilizing income for dairy farmers amid seasonal demand changes. Similarly, in the UK, the National Minimum Price for alcohol prevents prices from falling below a certain level to reduce harmful consumption and support market stability.

Effects of Market and Floor Prices on Consumers

Market price directly influences consumer purchasing power by reflecting real-time supply and demand dynamics, often leading to price fluctuations that can affect affordability. Floor price stabilizes the minimum price, protecting producers but potentially limiting consumer access by preventing prices from falling below a certain level. Consumers may face higher costs and reduced choices when floor prices are set above equilibrium market prices, impacting overall market efficiency and consumer welfare.

Impact on Producers and Industry Dynamics

Market price reflects real-time supply and demand, allowing producers to maximize profits when prices rise but exposing them to volatility risks that can disrupt production planning. Floor price establishes a minimum revenue threshold, providing producers with income stability and encouraging sustained investment but potentially distorting market signals and leading to surplus supply. Industry dynamics shift as floor prices can safeguard small producers and stabilize sectors, while market prices drive competition and efficiency, influencing production scale and innovation rates.

Conclusion: Choosing Between Market Price and Floor Price

Choosing between market price and floor price depends on the seller's goals and market conditions. Market price reflects current demand and supply dynamics, maximizing profits when the market is favorable. Floor price provides a safety net, ensuring minimum revenue and protecting against undervaluation in volatile or uncertain markets.

Market Price Infographic

libterm.com

libterm.com