Crowdfunding enables you to raise capital by collecting small amounts of money from a large number of people, typically via online platforms. This funding method offers unique opportunities for startups, entrepreneurs, and creatives to access resources without traditional financing. Discover how crowdfunding can transform your project in the rest of this article.

Table of Comparison

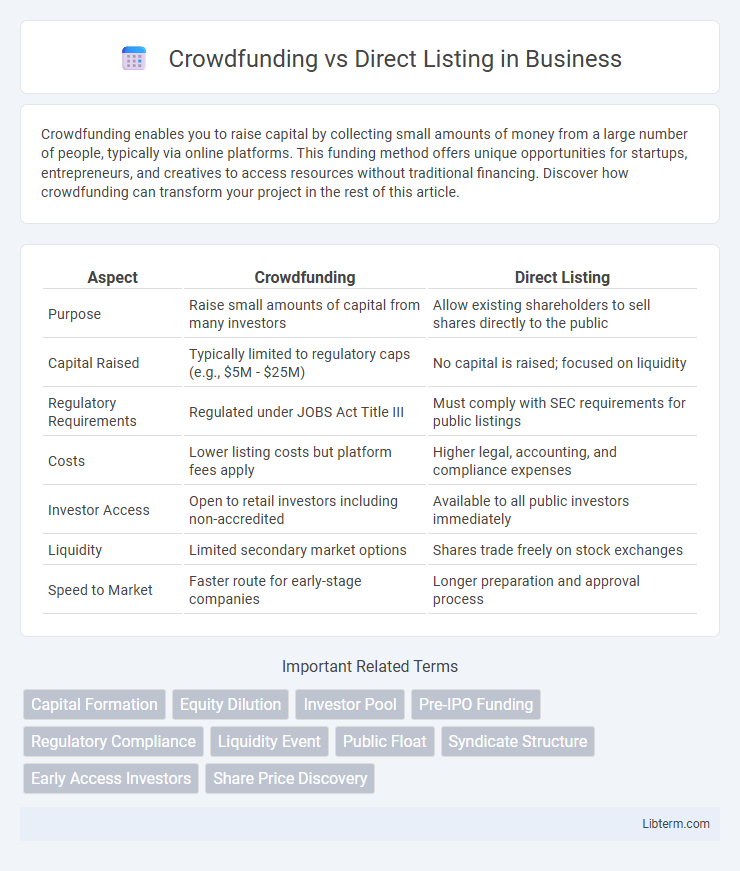

| Aspect | Crowdfunding | Direct Listing |

|---|---|---|

| Purpose | Raise small amounts of capital from many investors | Allow existing shareholders to sell shares directly to the public |

| Capital Raised | Typically limited to regulatory caps (e.g., $5M - $25M) | No capital is raised; focused on liquidity |

| Regulatory Requirements | Regulated under JOBS Act Title III | Must comply with SEC requirements for public listings |

| Costs | Lower listing costs but platform fees apply | Higher legal, accounting, and compliance expenses |

| Investor Access | Open to retail investors including non-accredited | Available to all public investors immediately |

| Liquidity | Limited secondary market options | Shares trade freely on stock exchanges |

| Speed to Market | Faster route for early-stage companies | Longer preparation and approval process |

Introduction to Crowdfunding and Direct Listing

Crowdfunding enables companies to raise capital by collecting small investments from a large pool of individuals, often through online platforms, making it accessible for startups and small businesses to gain funding without traditional intermediaries. Direct listing allows established companies to enter public markets by selling existing shares directly to investors without issuing new shares or underwriters, providing liquidity to shareholders and avoiding dilution. Both methods offer unique pathways to accessing capital markets, with crowdfunding focused on early-stage funding and direct listing suitable for mature companies seeking public trading.

Key Differences Between Crowdfunding and Direct Listing

Crowdfunding enables companies to raise capital directly from a large pool of individual investors, often with lower entry barriers and regulatory requirements compared to traditional public offerings. Direct listing allows established companies to list existing shares on a stock exchange without issuing new shares or raising fresh capital, providing liquidity without underwriting fees typically associated with IPOs. Key differences include fundraising objectives--crowdfunding seeks new capital, while direct listing offers shareholder liquidity--and regulatory frameworks, where crowdfunding is governed by specific securities exemptions, and direct listings adhere to exchange and SEC rules for public offerings.

Pros and Cons of Crowdfunding

Crowdfunding allows startups to raise capital from a large pool of investors with relatively low regulatory barriers, offering access to diverse funding sources without relinquishing significant control. However, it often limits the amount of capital raised and may require extensive marketing efforts to attract backers, potentially diluting focus from core business operations. The transparency and communication needed to maintain investor relations can also be resource-intensive, contrasting with the streamlined nature of direct listings.

Pros and Cons of Direct Listing

Direct listing offers companies the advantage of avoiding underwriter fees and enabling existing shareholders to sell shares immediately, which increases liquidity and market-driven price discovery. However, the absence of a traditional underwriting process can lead to greater price volatility and less capital raised compared to an initial public offering (IPO). Companies must also rely heavily on market demand and investor awareness without the promotional support typical of underwritten offerings.

Fundraising Process: Crowdfunding vs Direct Listing

Crowdfunding democratizes the fundraising process by allowing numerous small investors to contribute capital through online platforms, often enabling startups to raise funds quickly with minimal regulatory requirements. Direct listing bypasses traditional fundraising by allowing existing shareholders to sell shares directly to the public without issuing new ones, emphasizing liquidity over capital generation. The choice between crowdfunding and direct listing depends on whether the company seeks new capital infusion or merely public trading access.

Eligibility Requirements and Regulations

Crowdfunding platforms require startups to meet eligibility criteria such as being a private company, adhering to fundraising limits set by the SEC under Regulation Crowdfunding, and providing financial disclosures to investors. Direct listings mandate that companies comply with SEC registration rules, including filing a Form S-1, meeting minimum shareholder and market capitalization thresholds, and satisfying exchange-specific listing standards. Regulatory frameworks for crowdfunding prioritize investor protection through caps on individual investments, whereas direct listings demand comprehensive transparency to public markets without raising new capital.

Costs and Fees Comparison

Crowdfunding platforms typically charge fees ranging from 5% to 10% of the total funds raised, plus payment processing costs, making it a cost-effective option for early-stage startups seeking capital. Direct listings on stock exchanges, such as NASDAQ or NYSE, involve significant expenses including underwriting fees, regulatory compliance costs, and listing fees, often exceeding $1 million, which are generally higher than crowdfunding costs. While crowdfunding minimizes upfront expenses with variable percentage fees, direct listings require substantial fixed costs but offer liquidity and market access benefits.

Investor Access and Participation

Crowdfunding platforms democratize investor access by allowing a broad range of individuals to participate in early-stage funding with relatively low minimum investments. Direct listings enable existing shareholders to sell shares directly to the public without underwriters, but typically attract institutional investors and accredited individuals due to higher share price volatility and limited regulatory protections. Investors in crowdfunding benefit from diversified portfolio opportunities, while direct listing participants gain liquidity from established companies with a transparent market valuation.

Risk Factors for Companies and Investors

Crowdfunding presents high risk for companies due to regulatory complexities and potential dilution of control, while investors face uncertainties from limited company transparency and project viability. Direct listings eliminate underwriter involvement, reducing fees but increasing market volatility risks for both companies and investors given the absence of price stabilization mechanisms. Both approaches pose significant financial unpredictability, requiring thorough risk assessment and strategic planning by stakeholders.

Choosing the Right Approach for Your Business

Choosing between crowdfunding and a direct listing depends on your business goals, capital needs, and investor engagement strategy. Crowdfunding offers access to a broad base of retail investors, ideal for early-stage companies seeking market validation and community support. Direct listings provide established companies with a cost-effective way to enter public markets, allowing existing shareholders to sell shares without underwriting fees.

Crowdfunding Infographic

libterm.com

libterm.com