Net income represents the total profit of a company after all expenses, taxes, and costs have been deducted from total revenue. This key financial metric indicates the company's profitability and efficiency in managing its operations. Discover how understanding net income can improve your financial strategies by reading the rest of this article.

Table of Comparison

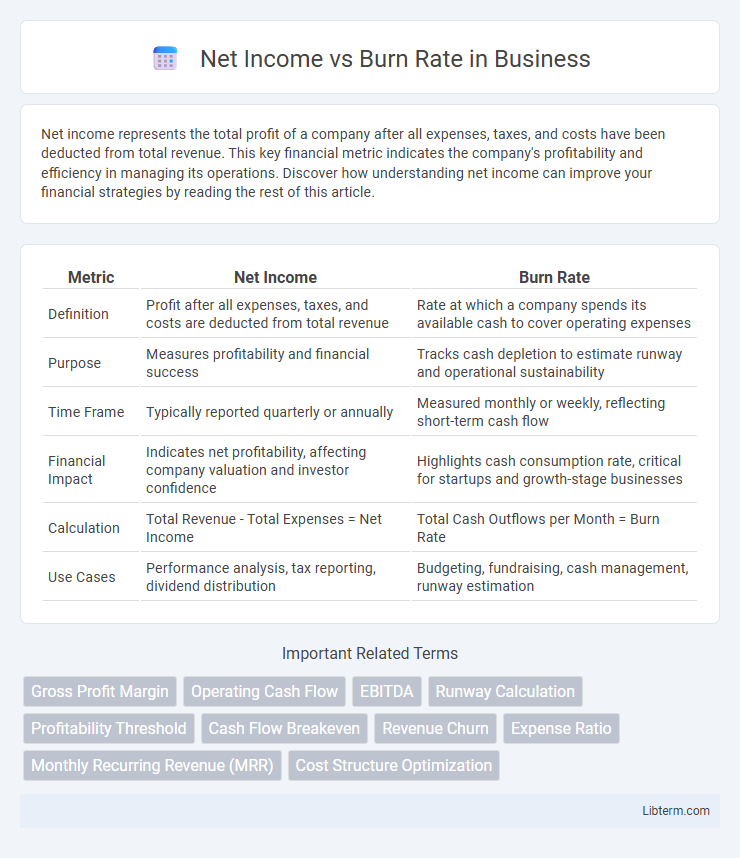

| Metric | Net Income | Burn Rate |

|---|---|---|

| Definition | Profit after all expenses, taxes, and costs are deducted from total revenue | Rate at which a company spends its available cash to cover operating expenses |

| Purpose | Measures profitability and financial success | Tracks cash depletion to estimate runway and operational sustainability |

| Time Frame | Typically reported quarterly or annually | Measured monthly or weekly, reflecting short-term cash flow |

| Financial Impact | Indicates net profitability, affecting company valuation and investor confidence | Highlights cash consumption rate, critical for startups and growth-stage businesses |

| Calculation | Total Revenue - Total Expenses = Net Income | Total Cash Outflows per Month = Burn Rate |

| Use Cases | Performance analysis, tax reporting, dividend distribution | Budgeting, fundraising, cash management, runway estimation |

Understanding Net Income: Definition and Importance

Net income represents the total profit a company earns after deducting all expenses, taxes, and costs from its revenue, serving as a key indicator of financial health. It reflects the company's ability to generate positive returns and sustain operations, influencing investor confidence and strategic planning. Understanding net income is crucial for assessing profitability compared to the burn rate, which measures the rate at which a company expends its cash reserves.

What is Burn Rate? Key Concepts Explained

Burn rate is the rate at which a company spends its available capital to cover operating expenses before generating positive cash flow or profits. It serves as a crucial metric for startups and growing businesses to gauge how quickly they are depleting their cash reserves, impacting runway and survival time. Understanding burn rate alongside net income helps investors and management assess financial health, longevity, and funding needs.

Net Income vs Burn Rate: Core Differences

Net income represents the actual profit a company retains after all expenses and taxes, reflecting its financial health and profitability. Burn rate indicates the speed at which a startup or business spends its available capital, critical for assessing cash flow sustainability and runway duration. The core difference lies in net income measuring net profitability, while burn rate quantifies cash consumption pace, making them essential yet distinct metrics for financial management.

Why Net Income Matters for Business Growth

Net income reflects a company's profitability by calculating total revenue minus total expenses, indicating sustainable financial health essential for business growth. Burn rate measures the speed at which a company spends its capital, critical for startups but less informative without positive net income. Prioritizing net income ensures adequate profit margins to reinvest in operations, fund expansion, and attract investors, driving long-term success.

The Role of Burn Rate in Startup Survival

Burn rate measures the speed at which a startup spends its cash reserves, directly influencing its runway and ability to sustain operations before needing additional funding. Unlike net income, which reflects profitability, burn rate emphasizes cash flow and liquidity crucial for managing expenses like salaries, marketing, and product development. Monitoring burn rate allows startups to make strategic financial decisions, optimize spending, and extend survival during early-stage growth or funding gaps.

Calculating Net Income: Essential Formulas

Calculating net income involves subtracting total expenses, including operating costs, taxes, and interest, from total revenue to determine a company's profitability over a specific period. The essential formula is Net Income = Total Revenue - Total Expenses, where accurately categorizing costs ensures precision in financial analysis. Understanding this calculation helps businesses balance their burn rate, the rate at which they spend capital, to maintain sustainable growth and avoid cash flow issues.

How to Measure Your Company's Burn Rate

To measure your company's burn rate, calculate the total cash expenditures over a specific period, typically monthly, and subtract any incoming revenue to determine net cash outflow. Tracking both gross burn (total operating expenses) and net burn (expenses minus revenue) provides a clearer picture of financial health and runway. Utilizing financial software or spreadsheets to monitor these metrics regularly helps predict how long current capital will sustain operations before additional funding is required.

Impact of Net Income and Burn Rate on Cash Flow

Net income directly affects cash flow by reflecting the profitability of a business, where positive net income increases available cash, while negative net income decreases it. Burn rate measures the speed at which a company uses its cash reserves, particularly in startup environments, impacting the sustainability of operations and the timing of capital requirements. Analyzing both net income and burn rate together provides critical insights into financial health, helping businesses manage liquidity and plan for future funding or cost control measures.

Strategies to Improve Net Income and Control Burn Rate

To improve net income and control burn rate, businesses should implement cost reduction strategies such as renegotiating supplier contracts and optimizing operational efficiency through automation. Enhancing revenue streams by diversifying products or expanding into new markets can boost overall profitability, while maintaining strict budget monitoring ensures expenses align with financial goals. Implementing regular financial forecasting and cash flow analysis helps identify potential issues early, enabling proactive adjustments to sustain a positive net income and manageable burn rate.

Net Income vs Burn Rate: Which Metric Should You Prioritize?

Net Income measures profitability by calculating total revenue minus expenses, indicating if a company is generating positive earnings, while Burn Rate tracks the rate at which a company spends its capital, primarily used by startups to monitor cash depletion. Prioritizing Net Income helps assess long-term financial health and sustainability, essential for established businesses focused on growth and profitability. Conversely, Burn Rate is critical for early-stage companies needing to manage cash flow carefully to avoid running out of funds before reaching profitability.

Net Income Infographic

libterm.com

libterm.com