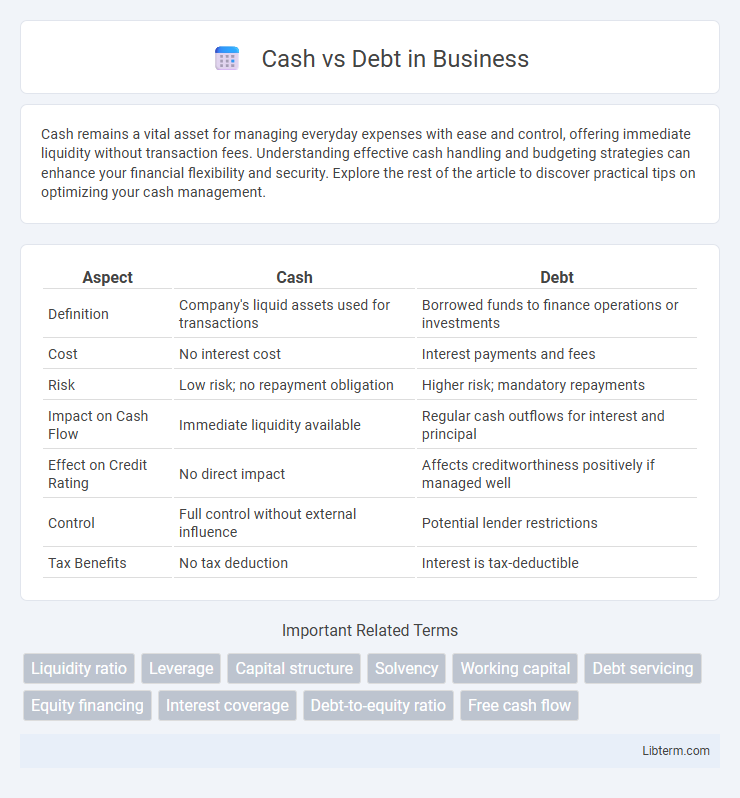

Cash remains a vital asset for managing everyday expenses with ease and control, offering immediate liquidity without transaction fees. Understanding effective cash handling and budgeting strategies can enhance your financial flexibility and security. Explore the rest of the article to discover practical tips on optimizing your cash management.

Table of Comparison

| Aspect | Cash | Debt |

|---|---|---|

| Definition | Company's liquid assets used for transactions | Borrowed funds to finance operations or investments |

| Cost | No interest cost | Interest payments and fees |

| Risk | Low risk; no repayment obligation | Higher risk; mandatory repayments |

| Impact on Cash Flow | Immediate liquidity available | Regular cash outflows for interest and principal |

| Effect on Credit Rating | No direct impact | Affects creditworthiness positively if managed well |

| Control | Full control without external influence | Potential lender restrictions |

| Tax Benefits | No tax deduction | Interest is tax-deductible |

Introduction to Cash and Debt

Cash represents a company's most liquid asset, crucial for meeting immediate financial obligations and operational needs, while debt refers to borrowed funds that must be repaid, often with interest, over a specified period. Effective cash management ensures business liquidity and solvency, whereas strategic debt utilization can leverage growth opportunities and optimize capital structure. Balancing cash reserves with manageable debt levels is essential for financial stability and long-term success.

Understanding Cash Flow

Cash flow represents the actual inflow and outflow of cash within a business, crucial for evaluating operational liquidity and financial health. Debt impacts cash flow by introducing mandatory interest and principal payments, which reduce free cash available for reinvestment or expenses. Monitoring cash flow ensures a company can meet its debt obligations while maintaining sufficient cash reserves for ongoing operations and growth opportunities.

Types of Debt Explained

Types of debt include secured debt, which is backed by collateral such as mortgages or auto loans, and unsecured debt, like credit card balances or personal loans, that lack collateral protection. Revolving debt allows borrowers to use credit up to a limit and repay over time, while installment debt involves fixed payments over a specified period, including student loans or car financing. Understanding these debt types helps businesses and individuals manage cash flow and leverage borrowing strategies effectively.

Advantages of Using Cash

Using cash for purchases eliminates the risk of incurring interest charges and helps maintain a debt-free financial profile, enhancing creditworthiness. Immediate payment through cash ensures greater control over spending and reduces the likelihood of overspending compared to credit options. Cash transactions also facilitate simpler budgeting and improved liquidity management by avoiding monthly debt repayments.

Benefits and Risks of Debt

Debt provides businesses with immediate capital to fund growth and operations without diluting ownership, leveraging future income for present advantage. However, it introduces financial risk through fixed repayment obligations and interest costs, potentially leading to cash flow challenges and insolvency during downturns. Careful management of debt levels and interest rates is essential to balance growth benefits against default risks.

Cash vs Debt: Business Perspectives

Cash reserves provide businesses with liquidity to manage daily operations, invest in opportunities, and cushion against economic downturns. Debt financing offers access to capital without diluting ownership but increases financial risk through interest obligations and repayment schedules. Balancing cash flow management with prudent debt levels is crucial for sustaining growth and maintaining financial stability in competitive markets.

Personal Finance: When to Use Cash or Debt

Using cash in personal finance is ideal for everyday expenses, emergencies, and avoiding interest charges, ensuring financial stability and liquidity. Debt can be strategically utilized for large purchases like homes or education, where investment in future value outweighs borrowing costs. Balancing cash reserves with manageable debt levels optimizes credit scores and long-term wealth growth.

Impact on Credit Score

Maintaining a healthy balance between cash reserves and debt levels significantly impacts credit score by influencing credit utilization ratios and payment reliability. High cash availability reduces reliance on credit, lowering utilization rates and enhancing creditworthiness, while excessive debt increases risk and can lead to missed payments, which negatively affect credit scores. Timely debt repayment combined with sufficient cash flow supports positive credit history and improves credit scoring models.

Financial Planning: Balancing Cash and Debt

Effective financial planning requires balancing cash reserves and debt levels to maintain liquidity while leveraging opportunities for growth. Holding sufficient cash ensures operational stability and emergency readiness, whereas strategic debt utilization can enhance capital investment without diluting equity. Optimizing this balance improves financial flexibility, creditworthiness, and long-term business sustainability.

Conclusion: Making the Right Choice

Choosing between cash and debt hinges on a company's financial health, growth prospects, and risk tolerance. Cash offers liquidity and flexibility, minimizing financial risk, while debt can leverage growth opportunities but increases financial obligations. A balanced approach aligning capital structure with strategic goals ensures optimal financial stability and operational efficiency.

Cash Infographic

libterm.com

libterm.com