Effective asset management maximizes the value and performance of your investments by strategically monitoring and optimizing resources. Employing advanced tools and data-driven insights helps in making informed decisions that reduce risks and enhance returns. Explore the rest of the article to learn how to implement successful asset management practices tailored to your needs.

Table of Comparison

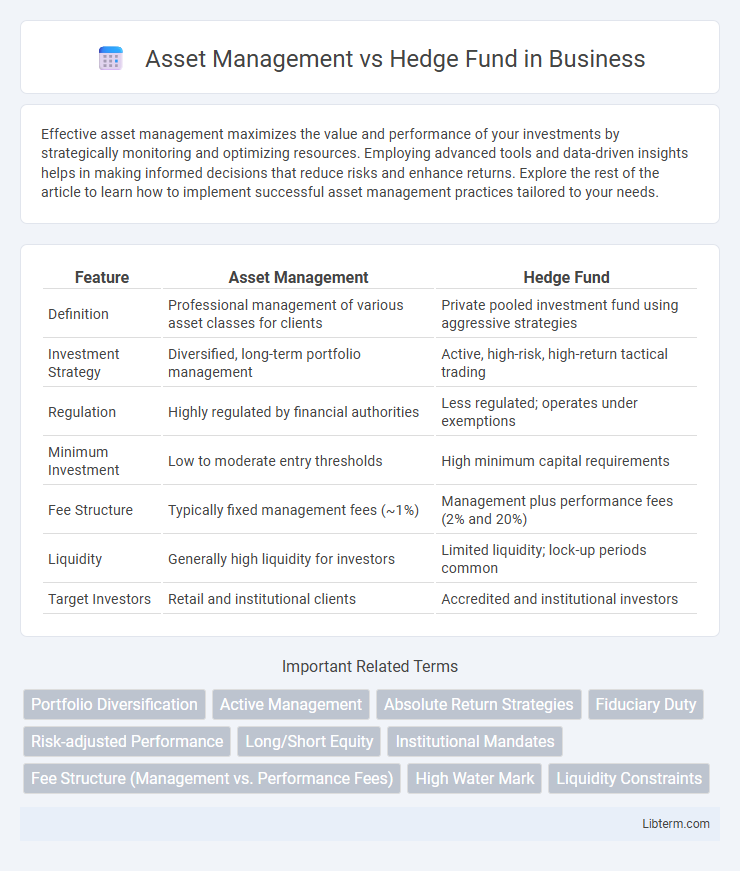

| Feature | Asset Management | Hedge Fund |

|---|---|---|

| Definition | Professional management of various asset classes for clients | Private pooled investment fund using aggressive strategies |

| Investment Strategy | Diversified, long-term portfolio management | Active, high-risk, high-return tactical trading |

| Regulation | Highly regulated by financial authorities | Less regulated; operates under exemptions |

| Minimum Investment | Low to moderate entry thresholds | High minimum capital requirements |

| Fee Structure | Typically fixed management fees (~1%) | Management plus performance fees (2% and 20%) |

| Liquidity | Generally high liquidity for investors | Limited liquidity; lock-up periods common |

| Target Investors | Retail and institutional clients | Accredited and institutional investors |

Introduction to Asset Management and Hedge Funds

Asset management involves the professional handling of various investment portfolios to achieve specific financial goals, typically by managing stocks, bonds, and real estate for individual and institutional clients. Hedge funds are specialized investment vehicles that employ diverse strategies, including leveraging, short selling, and derivatives, to maximize returns often with higher risk tolerance and less regulation. Both asset management firms and hedge funds play crucial roles in capital markets, with asset management focusing on steady growth and risk management while hedge funds seek opportunistic, high-yield outcomes.

Key Differences Between Asset Management and Hedge Funds

Asset management involves managing a diversified portfolio of assets on behalf of clients to achieve long-term growth and income, typically with a focus on risk management and regulatory compliance. Hedge funds pursue aggressive investment strategies including leverage, derivatives, and short selling to generate high returns, often catering to accredited investors with higher risk tolerance. The primary differences lie in investment objectives, risk profiles, fee structures, and regulatory oversight, with asset management emphasizing steady growth and hedge funds targeting market-beating returns through more complex, high-risk techniques.

Investment Strategies: Asset Management vs Hedge Funds

Asset management firms typically employ diversified investment strategies focused on long-term growth, risk management, and portfolio balance across stocks, bonds, and other asset classes. Hedge funds utilize more aggressive approaches including leverage, short selling, derivatives, and arbitrage to achieve higher absolute returns and capitalize on market inefficiencies. Asset management emphasizes steady wealth accumulation for clients, while hedge funds aim for high alpha generation through dynamic, opportunistic trading tactics.

Risk Management Approaches

Asset management firms employ diversified portfolios and quantitative models to balance risk and return, utilizing strategies such as asset allocation, risk budgeting, and stress testing to mitigate market volatility. Hedge funds implement more aggressive risk management through leverage control, short selling, and dynamic hedging techniques tailored to exploit market inefficiencies while managing downside exposure. Both approaches incorporate advanced analytics and scenario analysis but differ in risk tolerance and investment horizons, with hedge funds often pursuing higher-risk, high-reward opportunities compared to the typically more conservative asset management practices.

Fee Structures and Performance Incentives

Asset management firms typically charge a fixed percentage of assets under management (AUM), commonly around 1%, aligning fees directly with portfolio size rather than performance. Hedge funds often employ a "2 and 20" fee structure, including a 2% management fee on AUM and a 20% performance fee on profits, incentivizing managers to generate high returns. The performance incentives in hedge funds aim to reward alpha generation, whereas asset management fees emphasize steady asset growth and long-term investment strategies.

Regulatory Environment and Legal Structures

Asset management firms operate under a regulatory framework primarily governed by agencies such as the SEC in the United States, emphasizing fiduciary duty and investor protection across diverse investment vehicles. Hedge funds, often structured as limited partnerships, benefit from exemptions under the Investment Company Act of 1940, allowing them more flexibility but subject to strict rules under the Investment Advisers Act regarding accredited investors and disclosure. Regulatory scrutiny for hedge funds intensifies around transparency and leverage, contrasting with the broader compliance obligations faced by traditional asset managers in their varied legal structures.

Target Clients and Investor Profiles

Asset management firms typically serve a broad range of clients including retail investors, high-net-worth individuals, and institutional investors seeking diversified portfolios and long-term growth. Hedge funds primarily target accredited investors and ultra-high-net-worth individuals willing to accept higher risk for potentially outsized returns through alternative strategies. The investor profile for asset management leans towards risk-averse to moderate investors, while hedge fund clients often exhibit higher risk tolerance and seek active, opportunistic investment approaches.

Transparency and Reporting Standards

Asset management firms prioritize transparency by adhering to strict regulatory reporting standards, providing detailed disclosures about portfolio holdings, risk exposures, and performance metrics. Hedge funds often operate with less transparency, benefiting from lighter reporting requirements that shield proprietary strategies but increase investor risk. Enhanced reporting standards in asset management improve investor confidence and regulatory compliance compared to the relatively opaque nature of hedge fund disclosures.

Pros and Cons of Asset Management Firms

Asset management firms offer diversified investment strategies and professional portfolio management, providing clients with risk mitigation and long-term growth opportunities. However, they often charge management fees regardless of performance, which can reduce overall returns compared to performance-based fees in hedge funds. Limitations include less flexibility in investment choices and lower potential for outsized gains due to typically more conservative approaches.

Pros and Cons of Hedge Funds

Hedge funds offer the advantage of leveraging diverse investment strategies, including long-short equity, arbitrage, and derivatives, aiming for higher returns and risk hedging. However, their cons include higher fees, typically a 2% management fee plus 20% performance fee, limited liquidity due to lock-up periods, and increased risk from leveraging and complex strategies. Asset management firms usually provide more traditional, transparent investment options with lower fees and greater regulatory oversight, making hedge funds less suitable for risk-averse investors.

Asset Management Infographic

libterm.com

libterm.com