Provision for tax represents the estimated amount a business sets aside to cover its tax liabilities for a specific financial period, ensuring accurate financial reporting and compliance with tax regulations. This accounting entry reflects the anticipated tax expense, which might differ from actual tax payments due to timing differences and adjustments. Explore the article further to understand how your business can effectively manage tax provisions and optimize financial outcomes.

Table of Comparison

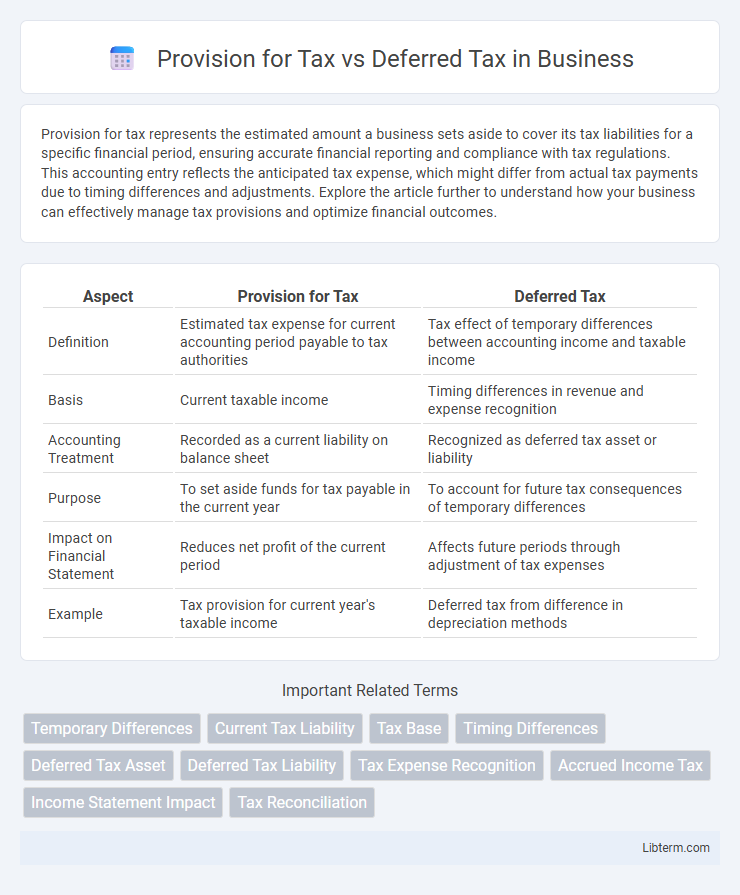

| Aspect | Provision for Tax | Deferred Tax |

|---|---|---|

| Definition | Estimated tax expense for current accounting period payable to tax authorities | Tax effect of temporary differences between accounting income and taxable income |

| Basis | Current taxable income | Timing differences in revenue and expense recognition |

| Accounting Treatment | Recorded as a current liability on balance sheet | Recognized as deferred tax asset or liability |

| Purpose | To set aside funds for tax payable in the current year | To account for future tax consequences of temporary differences |

| Impact on Financial Statement | Reduces net profit of the current period | Affects future periods through adjustment of tax expenses |

| Example | Tax provision for current year's taxable income | Deferred tax from difference in depreciation methods |

Understanding Provision for Tax

Provision for tax represents the estimated amount a company sets aside within its financial statements to cover tax liabilities based on taxable income for the current accounting period. It is recorded as a liability on the balance sheet and adjusted periodically to reflect changes in tax laws, rates, or the company's profitability. Understanding provision for tax involves recognizing its role in ensuring accurate profit reporting and compliance with tax regulations, differentiating it from deferred tax, which deals with temporary timing differences between accounting income and taxable income.

What is Deferred Tax?

Deferred tax represents the tax effects of temporary differences between the carrying amounts of assets and liabilities in the financial statements and their corresponding tax bases. It arises when income or expenses are recognized in accounting records in one period but are taxable or deductible in another, resulting in deferred tax liabilities or assets. Understanding deferred tax is essential for accurate financial reporting and compliance with accounting standards like IAS 12.

Key Differences between Provision for Tax and Deferred Tax

Provision for tax represents the current tax liability estimated based on taxable income for the accounting period, reflecting taxes payable to tax authorities within the year. Deferred tax arises from temporary differences between accounting profit and taxable profit, leading to future taxable or deductible amounts, and is recorded as deferred tax assets or liabilities on the balance sheet. Key differences include timing of recognition, with provision for tax recognized in the current period, while deferred tax accounts for future tax effects due to timing disparities in income and expense recognition.

Importance of Provision for Tax in Financial Statements

Provision for tax represents the estimated current tax liability a company expects to settle within the financial year, directly impacting net income and cash flow reporting accuracy. Accurate provisioning ensures compliance with accounting standards such as IFRS and GAAP, enhancing the reliability and transparency of financial statements for stakeholders. This provision plays a critical role in financial planning and risk management by reflecting anticipated tax expenses and avoiding unexpected liabilities.

How Deferred Tax Arises

Deferred tax arises from temporary differences between the accounting profit and taxable profit, resulting in tax liabilities or assets recognized in financial statements but not yet payable or recoverable in the current period. These differences occur due to timing variances in recognizing income and expenses under accounting standards versus tax laws, such as depreciation methods or revenue recognition. The provision for tax reflects current tax obligations, while deferred tax accounts for future tax consequences of these timing differences.

Accounting Treatment for Provision for Tax

Provision for tax is recorded as a current liability on the balance sheet representing estimated income tax payable for the current period based on taxable profits. Accounting treatment for provision for tax involves recognizing it as an expense in the income statement and adjusting the liability as actual tax payments are made or tax assessments change. Deferred tax, conversely, arises from temporary differences between accounting income and taxable income, recorded as deferred tax assets or liabilities to reflect future tax consequences of current events.

Recognition and Measurement of Deferred Tax

Provision for tax refers to the estimated amount a company expects to pay for current tax liabilities, recognized based on taxable profit for the period. Deferred tax arises from temporary differences between the carrying amount of assets and liabilities in the financial statements and their tax bases, recognized using the balance sheet liability method. Measurement of deferred tax involves applying enacted tax rates to these temporary differences, adjusting for changes in tax laws and rates to reflect future tax consequences accurately.

Impact on Profit and Loss: Provision vs Deferred Tax

Provision for tax directly reduces the current period's profit and loss by accounting for taxes payable based on taxable income, reflecting an immediate cash outflow liability. Deferred tax affects profit and loss through timing differences between accounting income and taxable income, leading to recognition of deferred tax assets or liabilities that adjust profits without cash impact in the current period. The key impact distinction is that provision for tax influences reported profit in the current year whereas deferred tax smooths tax effects over multiple periods by recognizing future tax consequences.

Common Examples Illustrating Tax Provision and Deferred Tax

Provision for tax typically arises from current taxable income differences, such as accrued income taxes on profits reported in financial statements but not yet paid to tax authorities, while deferred tax reflects future tax effects from timing differences like depreciation methods varying between accounting and tax records. Common examples of tax provision include estimated corporate income tax liabilities based on current year earnings and adjustments for prior year tax assessments. Deferred tax examples often involve recognizing asset impairments in financial books before tax deduction eligibility or utilizing tax loss carryforwards that reduce taxable income in future periods.

Best Practices for Managing Tax Provisions and Deferred Taxes

Accurately distinguishing between provisions for tax and deferred tax liabilities is crucial for compliant financial reporting and effective tax management. Best practices include regularly updating tax position assessments, maintaining detailed documentation for temporary differences, and leveraging tax software to automate calculations and enhance accuracy. Consistent collaboration between finance and tax departments ensures timely adjustments and minimizes risks of under or overestimation in tax provisions and deferred tax accounts.

Provision for Tax Infographic

libterm.com

libterm.com