A lock-in period restricts the withdrawal or transfer of investments for a predetermined time, ensuring financial stability and encouraging long-term growth. This mechanism is commonly applied to retirement accounts, fixed deposits, and certain mutual funds, preventing premature access to funds and potential penalties. Discover how understanding lock-in periods can protect your investments and enhance your financial planning by exploring the details in the rest of this article.

Table of Comparison

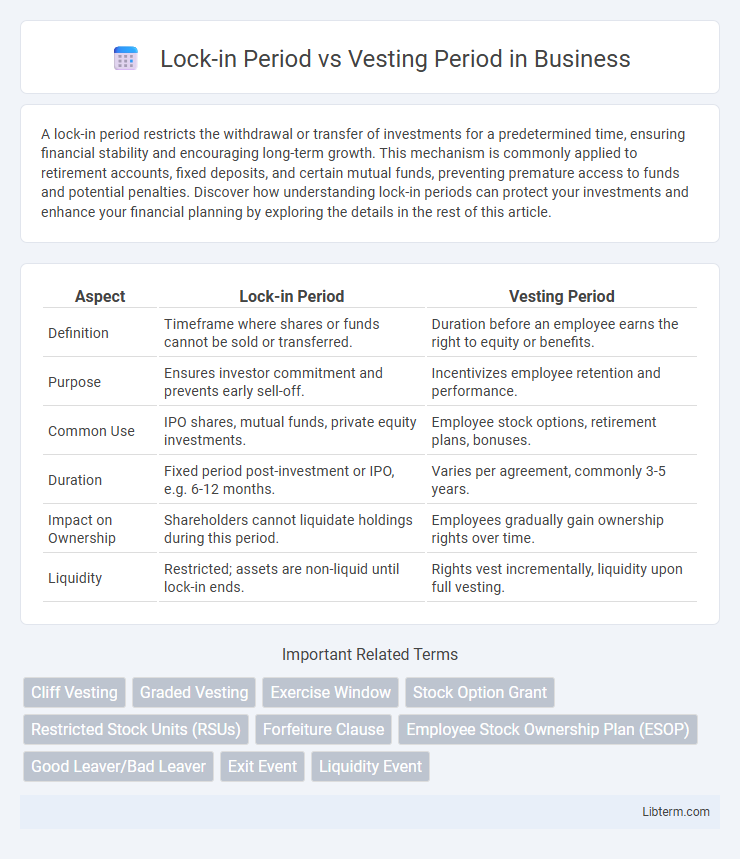

| Aspect | Lock-in Period | Vesting Period |

|---|---|---|

| Definition | Timeframe where shares or funds cannot be sold or transferred. | Duration before an employee earns the right to equity or benefits. |

| Purpose | Ensures investor commitment and prevents early sell-off. | Incentivizes employee retention and performance. |

| Common Use | IPO shares, mutual funds, private equity investments. | Employee stock options, retirement plans, bonuses. |

| Duration | Fixed period post-investment or IPO, e.g. 6-12 months. | Varies per agreement, commonly 3-5 years. |

| Impact on Ownership | Shareholders cannot liquidate holdings during this period. | Employees gradually gain ownership rights over time. |

| Liquidity | Restricted; assets are non-liquid until lock-in ends. | Rights vest incrementally, liquidity upon full vesting. |

Introduction to Lock-in and Vesting Periods

Lock-in periods refer to a fixed duration during which investors cannot sell or transfer their shares, ensuring stability and preventing market volatility. Vesting periods denote the time frame over which employees earn rights to stock options or equity incentives, aligning their interests with long-term company performance. Distinguishing between lock-in and vesting periods is crucial for understanding share liquidity restrictions and the timeline of equity ownership rights.

Definition of Lock-in Period

The lock-in period refers to a predefined timeframe during which investors or shareholders are restricted from selling or transferring their assets, typically found in mutual funds, IPOs, and employee stock options. This period aims to maintain market stability and prevent premature liquidation, ensuring commitment from stakeholders. Unlike the vesting period, which determines when employees earn ownership rights to shares, the lock-in period strictly limits the selling or transferability of securities for a specified duration.

Definition of Vesting Period

The vesting period refers to the timeframe during which an employee earns the right to receive full ownership of granted benefits, such as stock options or retirement plans, typically in incremental stages. Unlike the lock-in period, which restricts the sale or transfer of assets for a specified duration, the vesting period ensures commitment by gradually transferring ownership rights over time. Understanding vesting is crucial for employees to realize when their entitlements become fully accessible and for companies to structure effective incentive plans.

Key Differences Between Lock-in and Vesting Periods

The lock-in period refers to a fixed duration during which investors are restricted from selling or transferring their shares, primarily designed to maintain market stability after an initial public offering (IPO). In contrast, the vesting period is the timeframe over which employees earn ownership rights to stock options or equity grants, often used as an incentive to retain talent. Unlike the lock-in period that applies to external investors, the vesting period specifically governs internal stakeholder equity access.

Importance of Lock-in Periods in Investments

Lock-in periods are crucial in investments as they prevent premature withdrawal of funds, ensuring stability and encouraging long-term commitment from investors. Unlike vesting periods that define when employees earn rights to benefits or shares, lock-in periods restrict the sale or transfer of assets for a specified time, protecting investment value and supporting market confidence. This mechanism is especially important in mutual funds, IPOs, and startup funding to maintain liquidity and reduce volatility.

Role of Vesting Periods in Employee Stock Options

Vesting periods play a crucial role in employee stock options by defining the timeline over which employees earn the right to exercise their shares, aligning incentives with long-term company performance. Unlike lock-in periods that restrict the sale of shares after issuance, vesting schedules ensure employees remain committed to the company before gaining full ownership of their stock options. This gradual acquisition fosters retention and motivates sustained contribution to corporate growth.

Legal Implications of Lock-in vs. Vesting Periods

Lock-in periods legally restrict the sale or transfer of securities, ensuring regulatory compliance and preventing market manipulation, often enforced by securities laws and insider trading regulations. Vesting periods govern the legal ownership rights of employees or founders over stock options or shares, determining when they gain full ownership and control, which impacts contract enforceability and tax obligations. Failure to adhere to lock-in constraints can lead to penalties or invalidated transactions, while vesting violations may result in forfeiture of shares or breach of employment agreements.

Impact on Employee and Investor Decisions

Lock-in periods restrict employees and investors from selling shares immediately, enhancing market stability and signaling long-term commitment, which boosts investor confidence. Vesting periods require employees to earn share ownership over time, motivating retention and performance aligned with company goals. Both periods influence financial planning and risk assessment, affecting decisions on job tenure and investment timing.

Examples of Lock-in and Vesting Period Scenarios

A lock-in period example is when a mutual fund investor cannot redeem shares for a fixed time, such as three years, ensuring capital commitment and strategy adherence. In contrast, a vesting period scenario occurs in employee stock options where shares granted fully belong to the employee only after four years of continuous service, with partial vesting usually happening annually. These periods serve distinct purposes: lock-in restricts asset liquidity, while vesting aligns employee incentives with company performance over time.

Conclusion: Choosing Between Lock-in and Vesting Periods

Choosing between lock-in and vesting periods depends on the specific goals of investment or employee retention strategies. Lock-in periods restrict asset liquidation to maintain market stability or compliance, while vesting periods ensure gradual ownership transfer to align employee incentives with long-term company performance. Evaluating factors such as liquidity needs, regulatory requirements, and talent retention priorities helps determine the optimal period for maximizing financial and strategic benefits.

Lock-in Period Infographic

libterm.com

libterm.com