Greenmail involves purchasing a significant stake in a company to pressure its management into buying back shares at a premium, thereby profiting without pursuing a takeover. This tactic often creates tension within the business and can impact shareholder value negatively. Explore the rest of the article to understand how greenmail operates and its effects on corporate strategy.

Table of Comparison

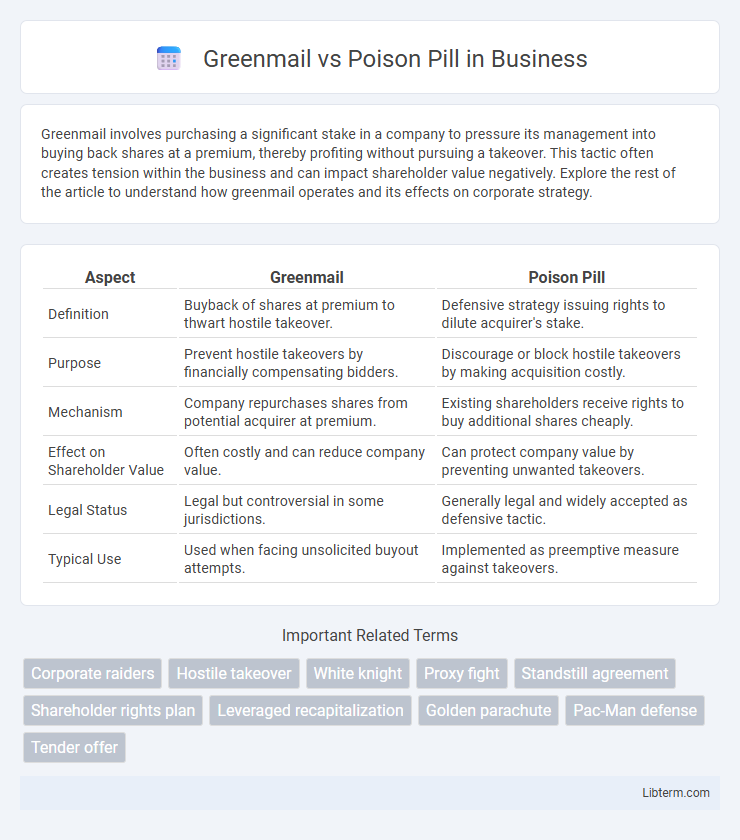

| Aspect | Greenmail | Poison Pill |

|---|---|---|

| Definition | Buyback of shares at premium to thwart hostile takeover. | Defensive strategy issuing rights to dilute acquirer's stake. |

| Purpose | Prevent hostile takeovers by financially compensating bidders. | Discourage or block hostile takeovers by making acquisition costly. |

| Mechanism | Company repurchases shares from potential acquirer at premium. | Existing shareholders receive rights to buy additional shares cheaply. |

| Effect on Shareholder Value | Often costly and can reduce company value. | Can protect company value by preventing unwanted takeovers. |

| Legal Status | Legal but controversial in some jurisdictions. | Generally legal and widely accepted as defensive tactic. |

| Typical Use | Used when facing unsolicited buyout attempts. | Implemented as preemptive measure against takeovers. |

Understanding Greenmail: Definition and History

Greenmail refers to the practice where a company repurchases its own shares at a premium from a potential hostile bidder to prevent a takeover, effectively paying the bidder to back off. This strategy emerged prominently in the 1980s during a wave of corporate takeovers, with companies using greenmail as a defense mechanism to maintain control. The practice attracted criticism for rewarding greenmailers and leading to shareholder value dilution, prompting regulatory scrutiny and the adoption of alternative defense tactics like the poison pill.

What is a Poison Pill? Key Concepts Explained

A poison pill is a defensive strategy used by companies to prevent hostile takeovers by making the acquisition prohibitively expensive or complicated for the potential acquirer. It typically involves issuing new shares or rights to existing shareholders, diluting the ownership interest of the bidder and discouraging further accumulation of shares. This tactic contrasts with greenmail, where companies buy back shares at a premium to thwart takeover attempts without altering capital structure.

Greenmail vs Poison Pill: Core Differences

Greenmail involves purchasing a significant block of a company's shares to threaten a hostile takeover, prompting the target to buy back the shares at a premium to prevent the takeover. Poison Pill is a defensive tactic that allows existing shareholders to purchase additional shares at a discount, diluting the potential acquirer's stake and making a takeover more expensive. The core difference lies in Greenmail's transactional nature aimed at forcing a buyback, while Poison Pill is a structural defense embedded in company policy to deter hostile acquisitions.

Key Strategies Used in Greenmail

Greenmail involves a target company repurchasing its shares at a premium to prevent a hostile takeover, leveraging financial incentives to deter the acquirer. Key strategies in greenmail include offering a buyback price above market value, negotiating directly with the threatening shareholder, and using legal maneuvering to delay hostile bids. This contrasts with poison pill tactics, which dilute stock value to make acquisition costlier, emphasizing defensive financial and shareholder rights strategies.

Poison Pill Mechanisms: Types and Examples

Poison pill mechanisms are defensive strategies used by companies to deter hostile takeovers by making the acquisition financially unattractive. Common types include the flip-in, which allows existing shareholders to buy additional shares at a discount, diluting the acquirer's stake, and the flip-over, enabling shareholders to purchase the acquirer's shares post-merger at a reduced price. Notable examples of poison pills include Netflix's 2012 adoption of a flip-in plan to prevent unwanted takeovers and Papa John's 2018 poison pill strategy triggered by activist investor pressure.

Impact on Corporate Governance

Greenmail pressures corporate governance by incentivizing boards to engage in costly share buybacks that may divert resources from strategic growth, potentially undermining shareholder value. Poison Pills strengthen governance by deterring hostile takeovers, ensuring management can pursue long-term strategies without abrupt interference from aggressors. Both mechanisms influence board decision-making but Poison Pills generally enhance managerial control, while Greenmail often benefits specific shareholders at the governance expense.

Legal and Regulatory Perspectives

Greenmail involves a targeted shareholder purchasing a significant stake in a company and threatening a takeover, prompting the company to repurchase shares at a premium to prevent acquisition, which often raises concerns under securities laws related to market manipulation and fiduciary duties. Poison pill strategies, typically implemented through shareholder rights plans, are designed to dilute the value of shares or make takeovers prohibitively expensive, generally complying with corporate governance regulations but scrutinized for potentially infringing on shareholder rights and board responsibilities. Regulatory bodies like the SEC closely monitor both tactics to ensure transparency, prevent abusive practices, and protect shareholder interests under laws such as the Williams Act and state corporate statutes.

Case Studies: Real-World Examples

Greenmail tactics were famously employed during the 1980s by investor Sir James Goldsmith, who amassed significant greenmail profits by threatening hostile takeovers and forcing companies to buy back shares at a premium. Poison pill strategies gained prominence with the case of Netflix in 2004, where the company adopted a shareholder rights plan to deter Carl Icahn's aggressive acquisition attempts, effectively diluting his stake and preserving corporate control. These case studies highlight strategic defenses corporations use to prevent hostile takeovers, with greenmail benefiting the raider through premium buybacks and poison pills protecting the target company's autonomy.

Pros and Cons of Each Defense Strategy

Greenmail offers a quick financial gain by buying back shares at a premium, deterring hostile takeovers but often at the cost of company funds and shareholder value. Poison pill strategies enhance shareholder control by diluting the stock and making takeovers prohibitively expensive, though they can frustrate potential beneficial mergers and result in complex legal battles. Both defenses serve to protect management but differ in financial impact and shareholder reception, requiring careful evaluation based on company goals and takeover risks.

Choosing the Right Strategy for Your Company

Choosing between greenmail and poison pill strategies depends on your company's specific circumstances and shareholder composition. Greenmail involves buying back shares at a premium to thwart hostile takeovers, which can be costly and may damage shareholder trust. Poison pills, such as shareholder rights plans, dilute the acquirer's stake and are more effective for deterring unwelcome bids while preserving long-term corporate control.

Greenmail Infographic

libterm.com

libterm.com