Mutual funds pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities, offering professional management and liquidity. Hedge funds use more aggressive strategies like leveraging, short selling, and derivatives to achieve high returns, typically available only to accredited investors. Discover how understanding the differences between mutual funds and hedge funds can help you make informed investment choices by reading the full article.

Table of Comparison

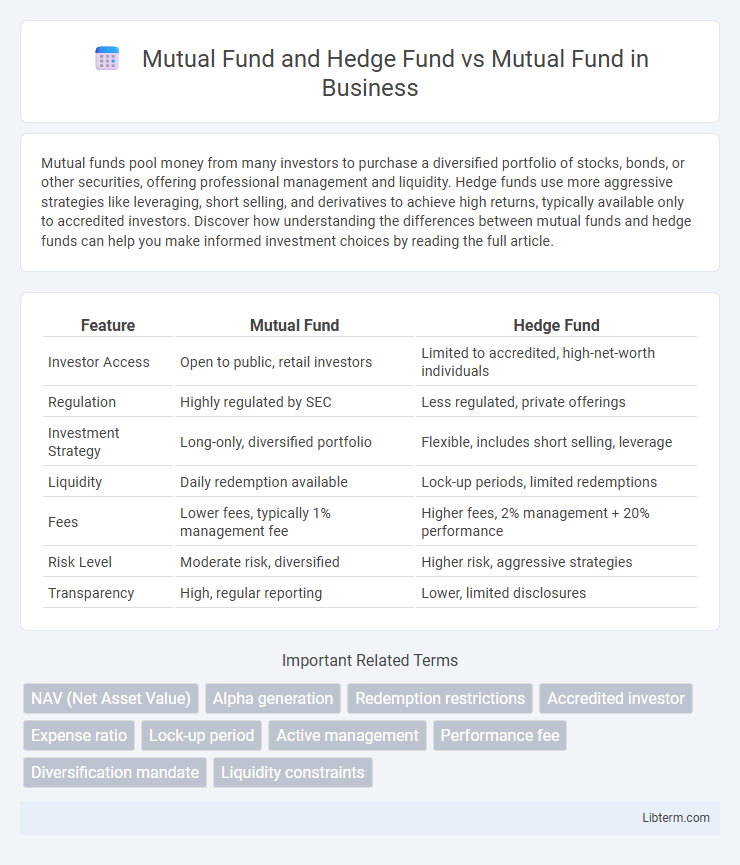

| Feature | Mutual Fund | Hedge Fund |

|---|---|---|

| Investor Access | Open to public, retail investors | Limited to accredited, high-net-worth individuals |

| Regulation | Highly regulated by SEC | Less regulated, private offerings |

| Investment Strategy | Long-only, diversified portfolio | Flexible, includes short selling, leverage |

| Liquidity | Daily redemption available | Lock-up periods, limited redemptions |

| Fees | Lower fees, typically 1% management fee | Higher fees, 2% management + 20% performance |

| Risk Level | Moderate risk, diversified | Higher risk, aggressive strategies |

| Transparency | High, regular reporting | Lower, limited disclosures |

Introduction to Mutual Funds and Hedge Funds

Mutual funds pool capital from multiple investors to invest in diversified portfolios primarily consisting of stocks, bonds, and other securities, making them accessible and regulated investment vehicles. Hedge funds also aggregate investor funds but employ advanced strategies like leverage, short selling, and derivatives trading to generate higher returns, typically targeting accredited investors with higher risk tolerance. The key differences between mutual funds and hedge funds lie in regulatory oversight, investment flexibility, risk profiles, and investor eligibility criteria.

Key Differences Between Mutual Funds and Hedge Funds

Mutual funds primarily cater to retail investors, offering diversified portfolios with regulated transparency and liquidity, while hedge funds target accredited investors using aggressive strategies like leverage and short selling for higher returns. Mutual funds are subject to strict SEC regulations ensuring lower risk and easier access, whereas hedge funds operate with fewer regulatory constraints, allowing more complex and speculative investments. Fee structures differ significantly, with mutual funds charging lower management fees compared to hedge funds' typical "2 and 20" model, including performance-based incentives.

Investment Strategies: Hedge Funds vs Mutual Funds

Hedge funds employ diverse investment strategies, including leverage, short selling, and derivatives, aiming for absolute returns regardless of market conditions. Mutual funds primarily invest in stocks, bonds, or other securities with a focus on long-term growth and diversification to reduce risk. The aggressive, flexible tactics of hedge funds contrast with the regulated, transparent, and risk-averse strategies typical of mutual funds.

Regulatory Framework: Mutual Funds and Hedge Funds

Mutual funds operate under stringent regulatory frameworks established by entities like the SEC, requiring transparency, regular reporting, and liquidity to protect retail investors. Hedge funds face lighter regulatory oversight, allowing for greater investment flexibility but higher risk, typically catering to accredited or institutional investors. These regulatory differences significantly impact the risk profiles, disclosure requirements, and investor accessibility between mutual funds and hedge funds.

Accessibility and Investor Eligibility

Mutual funds offer broad accessibility with low minimum investment requirements, allowing retail investors easy entry through brokerage accounts or retirement plans. Hedge funds typically impose high minimum investment thresholds of $100,000 or more, restricting access to accredited or institutional investors due to regulatory requirements. This exclusivity and complexity in hedge fund structures contrast with the widespread availability and simplicity of mutual fund investments.

Fee Structures: Comparing Costs

Mutual funds typically charge expense ratios averaging 0.5% to 1.5%, covering management and operational fees, while hedge funds impose higher fees with a common "2 and 20" model consisting of a 2% management fee and 20% performance fee. Mutual fund fees are transparent and regulated by the SEC, providing investors with clear cost structures, whereas hedge fund fees vary significantly based on fund strategy and negotiation. These differences in fee arrangements directly impact net returns, making cost analysis crucial when choosing between mutual funds and hedge funds.

Risk Profiles: Which Fund is Safer?

Mutual funds generally offer lower risk profiles due to their diversified portfolios and regulatory oversight by the SEC, making them safer for average investors seeking steady returns. Hedge funds involve higher risk with complex strategies such as leverage and short selling, often targeting higher returns but subjected to less regulatory scrutiny. Investors prioritizing safety typically prefer mutual funds, while those willing to accept greater volatility may consider hedge funds for potential higher rewards.

Performance Comparison: Historical Returns

Hedge funds have historically outperformed mutual funds by generating higher absolute returns through diverse, active strategies such as leverage, short-selling, and derivatives trading. Mutual funds typically offer more consistent returns with lower volatility by investing primarily in stocks and bonds, adhering to a more regulated framework. While hedge funds can deliver superior performance during bullish and bearish market cycles, their higher fees and risk levels often result in greater performance variability compared to mutual funds' steady growth over the long term.

Transparency and Reporting Requirements

Mutual funds are subject to strict transparency and reporting requirements governed by regulatory bodies like the SEC, which mandate regular disclosures of portfolio holdings and performance to investors. Hedge funds operate with less regulatory oversight, often providing limited information and delayed reporting to protect proprietary strategies and maintain competitive advantage. This difference in transparency makes mutual funds more accessible and trustworthy for retail investors seeking clarity, while hedge funds cater to sophisticated investors willing to accept higher risk and opacity.

Which Investment Suits Your Financial Goals?

Mutual funds offer diversified portfolios managed by professionals, making them ideal for long-term investors seeking steady growth and moderate risk. Hedge funds employ aggressive strategies, including leverage and short selling, aiming for higher returns but with increased risk and less liquidity, suitable for high-net-worth investors. Choosing between mutual funds and hedge funds depends on your financial goals, risk tolerance, investment horizon, and need for liquidity.

Mutual Fund and Hedge Fund Infographic

libterm.com

libterm.com