Indirect tax applies to goods and services rather than income or profits, including value-added tax (VAT), sales tax, and excise duties. Businesses often pass the tax burden to consumers, impacting the final price you pay. Explore this article to understand how indirect taxes affect your everyday purchases and financial decisions.

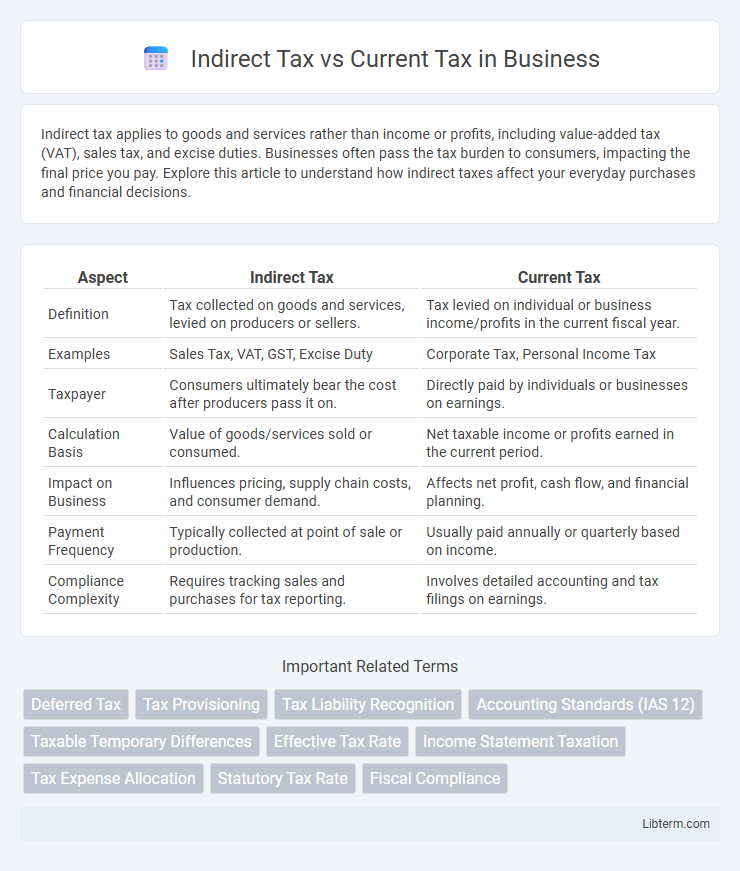

Table of Comparison

| Aspect | Indirect Tax | Current Tax |

|---|---|---|

| Definition | Tax collected on goods and services, levied on producers or sellers. | Tax levied on individual or business income/profits in the current fiscal year. |

| Examples | Sales Tax, VAT, GST, Excise Duty | Corporate Tax, Personal Income Tax |

| Taxpayer | Consumers ultimately bear the cost after producers pass it on. | Directly paid by individuals or businesses on earnings. |

| Calculation Basis | Value of goods/services sold or consumed. | Net taxable income or profits earned in the current period. |

| Impact on Business | Influences pricing, supply chain costs, and consumer demand. | Affects net profit, cash flow, and financial planning. |

| Payment Frequency | Typically collected at point of sale or production. | Usually paid annually or quarterly based on income. |

| Compliance Complexity | Requires tracking sales and purchases for tax reporting. | Involves detailed accounting and tax filings on earnings. |

Introduction to Indirect Tax and Current Tax

Indirect tax is a type of tax collected by an intermediary from the person who bears the ultimate economic burden of the tax, typically imposed on goods and services such as sales tax, VAT, and excise duty. Current tax refers to the income tax computed on taxable income for a particular accounting period, reflecting the amount payable to tax authorities based on profit or loss for that period. Both taxes serve distinct roles in fiscal policy, with indirect tax influencing consumption patterns and current tax affecting corporate profitability.

Definition of Indirect Tax

Indirect tax is a type of tax collected by an intermediary from the person who bears the ultimate economic burden of the tax, such as sales tax or value-added tax (VAT). It is included in the price of goods and services, making it less visible to the consumer compared to current tax, which refers to taxes on income or profits payable within a specific period. Indirect taxes are crucial for governments as they generate significant revenue and influence consumer behavior through tax-inclusive pricing.

Definition of Current Tax

Current tax is the amount of income tax payable or recoverable for a given financial year, calculated based on taxable income determined under tax laws and regulations. It represents the liability or asset recognized in the financial statements arising from the current period's taxable profits or losses. Unlike indirect tax, which is levied on goods and services, current tax directly impacts a company's net income and tax expense reporting.

Key Differences Between Indirect and Current Tax

Indirect tax is levied on goods and services, paid by consumers but collected by businesses, while current tax refers to the income tax liability of individuals or corporations for a specific period. Indirect tax includes VAT, GST, and excise duties, whereas current tax is assessed based on taxable income reported in financial statements. The key difference lies in the tax incidence: indirect tax affects consumption, and current tax impacts reported earnings and taxable profits.

Examples of Indirect Taxes

Indirect taxes include value-added tax (VAT), excise duty, customs duty, and sales tax, which are levied on goods and services rather than directly on income or profits. Current taxes refer to taxes payable for the current period, typically including income tax and corporate tax, assessed on earnings or profits within a fiscal year. Examples of indirect taxes like VAT and customs duty affect consumer prices and are collected by intermediaries before reaching the government.

Examples of Current Taxes

Current taxes include income tax, corporate tax, and property tax, which are directly imposed on individuals and businesses based on their earnings or asset ownership. These taxes are payable within a short period, typically within the fiscal year they are assessed, reflecting the current obligation owed to tax authorities. Examples of current taxes also encompass payroll taxes and capital gains tax, highlighting their role in immediate government revenue collection.

Impact on Consumers and Businesses

Indirect tax, such as sales tax or VAT, directly affects consumers by increasing the final price of goods and services, often leading to reduced purchasing power and altered consumption patterns. Current tax, typically referring to income tax paid by businesses, impacts company profitability and cash flow, influencing investment decisions and operational costs. The combined effect of both taxes shapes market dynamics, with indirect taxes burdening consumers and current taxes affecting business sustainability.

Administration and Collection Process

Indirect tax administration involves collection at the point of sale or production, typically handled by businesses and remitted periodically to tax authorities, ensuring seamless integration with commercial transactions. Current tax, often referring to income or corporate tax, requires taxpayers to calculate liabilities based on annual financial outcomes and submit returns directly to tax agencies, involving detailed assessments and potential audits. Efficient indirect tax collection relies on automated systems and third-party enforcement, while current tax depends heavily on accurate self-reporting and administrative scrutiny.

Advantages and Disadvantages

Indirect tax, such as sales tax and VAT, offers the advantage of easy collection at points of sale, ensuring a steady revenue stream without direct burden on income declarations, but it tends to be regressive, disproportionately affecting lower-income groups. Current tax, primarily income tax, is progressive and aligns tax liability with the taxpayer's ability to pay, promoting equity, yet it requires complex administration and may encourage tax evasion. Both tax types play crucial roles in fiscal policy, but balancing efficiency and fairness remains a challenge for governments.

Conclusion: Choosing the Right Tax Instrument

Indirect tax offers flexibility and broad revenue generation by taxing consumption, while current tax directly targets income and profits, ensuring equity and progressivity. Selecting the appropriate tax instrument depends on economic goals, administrative capacity, and the desired balance between efficiency and fairness. Policymakers must align tax choices with fiscal policy objectives to optimize revenue without stifling economic growth.

Indirect Tax Infographic

libterm.com

libterm.com