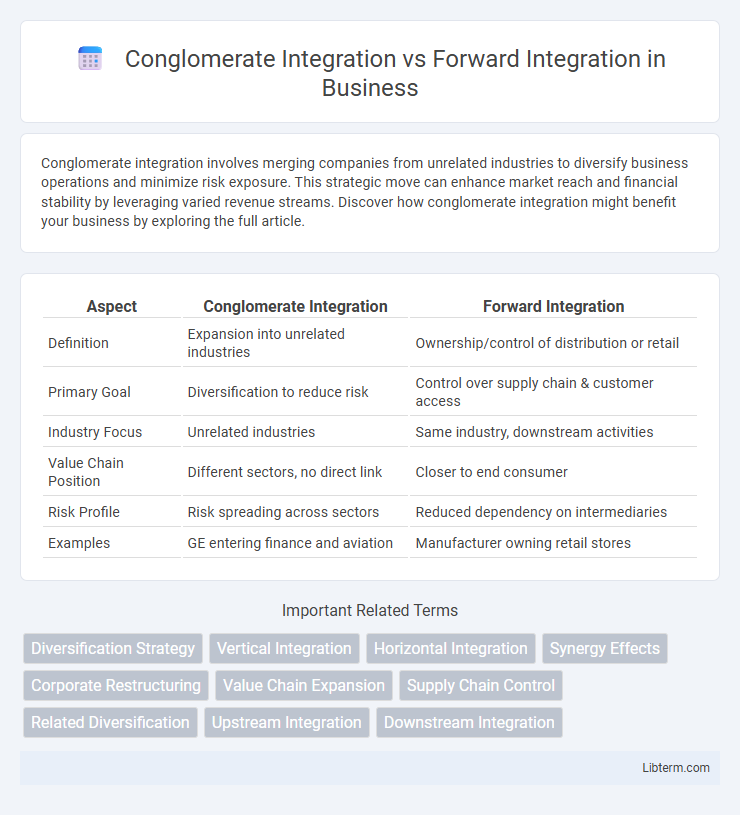

Conglomerate integration involves merging companies from unrelated industries to diversify business operations and minimize risk exposure. This strategic move can enhance market reach and financial stability by leveraging varied revenue streams. Discover how conglomerate integration might benefit your business by exploring the full article.

Table of Comparison

| Aspect | Conglomerate Integration | Forward Integration |

|---|---|---|

| Definition | Expansion into unrelated industries | Ownership/control of distribution or retail |

| Primary Goal | Diversification to reduce risk | Control over supply chain & customer access |

| Industry Focus | Unrelated industries | Same industry, downstream activities |

| Value Chain Position | Different sectors, no direct link | Closer to end consumer |

| Risk Profile | Risk spreading across sectors | Reduced dependency on intermediaries |

| Examples | GE entering finance and aviation | Manufacturer owning retail stores |

Understanding Conglomerate Integration

Conglomerate integration involves combining businesses from unrelated industry sectors, aiming to diversify risk and expand market reach without relying on existing product lines or customer bases. This strategy contrasts with forward integration, which focuses on gaining control over distribution channels or direct access to end consumers within the same industry supply chain. Understanding conglomerate integration requires analyzing its benefits in achieving portfolio diversification and reducing dependence on a single market, thereby enhancing overall corporate resilience.

Defining Forward Integration

Forward integration involves a company expanding its operations by acquiring or merging with entities that are closer to the final consumer, such as distributors or retailers, to control the distribution pipeline. This strategy enhances market control, reduces reliance on intermediaries, and improves profit margins through direct access to customers. Conglomerate integration, in contrast, refers to merging with or acquiring businesses in unrelated industries to diversify risks and capitalize on new market opportunities.

Key Differences Between Conglomerate and Forward Integration

Conglomerate integration involves merging with or acquiring companies in unrelated industries to diversify business operations and reduce risk, while forward integration focuses on gaining control over the distribution or sales channels by acquiring companies closer to the end consumer in the supply chain. The key difference lies in their strategic objectives: conglomerate integration aims at diversification across different markets, whereas forward integration seeks to improve market control and increase profit margins by moving closer to the final product sale. Forward integration typically enhances supply chain efficiency, while conglomerate integration spreads business risks across varied industries.

Strategic Objectives Behind Each Integration

Conglomerate integration aims to diversify a company's portfolio by entering unrelated markets to reduce risk and capitalize on new growth opportunities. Forward integration focuses on gaining control over distribution channels or customer access to enhance market power, improve supply chain efficiency, and increase profit margins. Strategic objectives behind conglomerate integration prioritize risk mitigation and market expansion, while forward integration targets value chain control and competitive advantage.

Market Impact of Conglomerate Integration

Conglomerate integration significantly diversifies a company's market presence by entering unrelated industries, reducing risk through portfolio variety and creating new revenue streams beyond the core business. This strategy often leads to enhanced market power and competitive advantage by leveraging financial synergies and cross-industry opportunities. Unlike forward integration, which strengthens control over the supply chain and directly impacts the market positioning within the same industry, conglomerate integration influences the broader market landscape by expanding into multiple sectors and mitigating sector-specific uncertainties.

Market Impact of Forward Integration

Forward integration, as a strategic move where a company expands its operations into the distribution or retail aspects of its supply chain, directly influences market dynamics by increasing control over the customer experience and reducing reliance on intermediaries. This heightened control often leads to improved profit margins and competitive advantage, enabling companies to respond swiftly to market demands and trends. In contrast to conglomerate integration, which diversifies business activities into unrelated markets, forward integration consolidates a company's presence within its existing industry, thereby intensifying market competition and potentially creating barriers for new entrants.

Advantages of Conglomerate Integration

Conglomerate integration offers significant advantages by diversifying business risks across unrelated industries, enhancing overall corporate stability and reducing dependency on a single market. It enables access to new markets and customer bases, fostering growth through innovation and various revenue streams. This strategy also facilitates resource allocation optimization and financial synergies, improving overall profitability and resilience against industry-specific downturns.

Benefits of Forward Integration

Forward integration enables companies to gain greater control over distribution channels, reducing dependency on intermediaries and increasing profit margins. This strategy enhances customer relationships by providing direct access to end-users, improving responsiveness and service quality. It also streamlines supply chains, allowing for more efficient inventory management and faster market feedback.

Risks and Challenges: Conglomerate vs Forward Integration

Conglomerate integration risks include cultural clashes, management complexity, and lack of synergies, often resulting in diluted focus and inefficient resource allocation. Forward integration challenges involve increased operational costs, potential channel conflicts with existing distributors, and the need for new expertise in the distribution or retail space. Both strategies require careful risk assessment, but conglomerate integration generally poses higher strategic and managerial complexity compared to the more operational and market-facing risks of forward integration.

Choosing the Right Integration Strategy for Business Growth

Choosing the right integration strategy is crucial for business growth, with conglomerate integration expanding into unrelated industries to diversify risk and forward integration focusing on controlling the supply chain to enhance efficiency and market control. Conglomerate integration suits companies seeking diversification and reduced dependency on a single market, while forward integration benefits firms aiming to improve profit margins and strengthen customer reach by taking over distribution or retail functions. Analyzing industry conditions, core competencies, and long-term goals guides businesses in selecting between these strategies for sustainable expansion.

Conglomerate Integration Infographic

libterm.com

libterm.com