Sustainability bonds are financial instruments designed to fund projects that deliver positive environmental and social outcomes, helping organizations meet ESG (Environmental, Social, and Governance) goals effectively. These bonds attract socially conscious investors aiming to support green infrastructure, clean energy, and community development initiatives. Discover how sustainability bonds can boost your investment strategy and drive meaningful change by reading the full article.

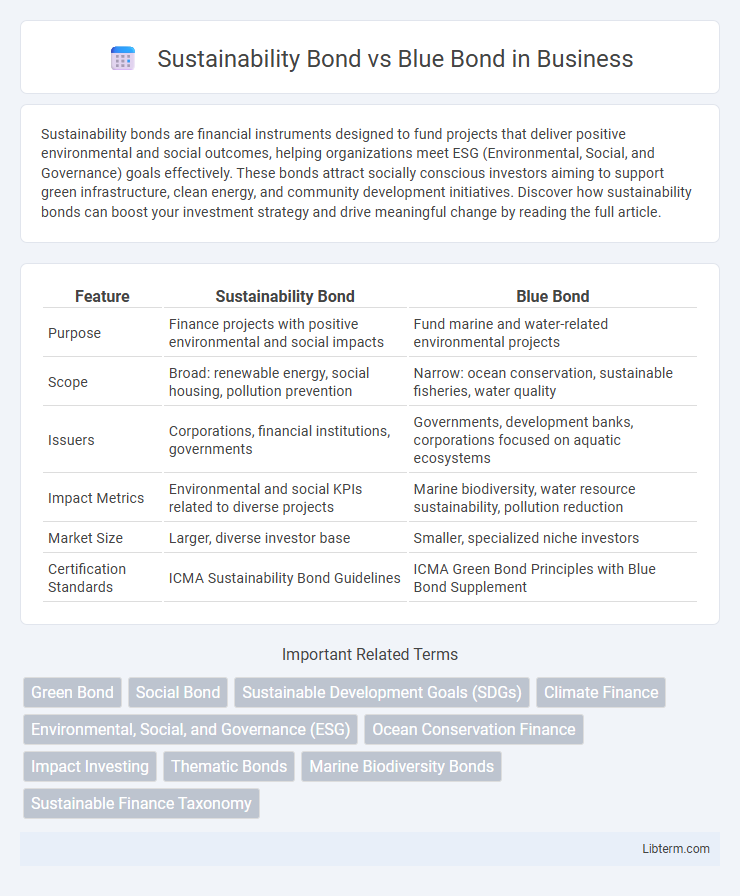

Table of Comparison

| Feature | Sustainability Bond | Blue Bond |

|---|---|---|

| Purpose | Finance projects with positive environmental and social impacts | Fund marine and water-related environmental projects |

| Scope | Broad: renewable energy, social housing, pollution prevention | Narrow: ocean conservation, sustainable fisheries, water quality |

| Issuers | Corporations, financial institutions, governments | Governments, development banks, corporations focused on aquatic ecosystems |

| Impact Metrics | Environmental and social KPIs related to diverse projects | Marine biodiversity, water resource sustainability, pollution reduction |

| Market Size | Larger, diverse investor base | Smaller, specialized niche investors |

| Certification Standards | ICMA Sustainability Bond Guidelines | ICMA Green Bond Principles with Blue Bond Supplement |

Introduction to Sustainability Bonds and Blue Bonds

Sustainability bonds finance projects addressing environmental and social challenges, blending green and social bond features to support diverse sustainable development goals (SDGs). Blue bonds specifically target marine and freshwater conservation initiatives, such as ocean health, sustainable fisheries, and water quality improvement. Both bond types mobilize private capital to drive sustainable investments aligned with global environmental priorities.

Defining Sustainability Bonds

Sustainability bonds are debt instruments issued to finance projects that generate positive environmental and social impacts, targeting a broad range of sustainable initiatives such as renewable energy, affordable housing, and clean water. They differ from blue bonds, which specifically fund marine and ocean-related environmental projects like coral reef restoration and sustainable fisheries. The broad scope of sustainability bonds allows issuers to address multiple sustainable development goals (SDGs) simultaneously.

What Are Blue Bonds?

Blue bonds are debt instruments specifically designed to finance projects that protect ocean and water resources, such as marine conservation, sustainable fisheries, and wastewater management. Unlike general sustainability bonds, which fund a broad range of environmental and social initiatives, blue bonds target investments that address marine biodiversity, coastal resilience, and ocean health. Issued by governments or institutions, blue bonds support sustainable blue economy objectives aligned with United Nations Sustainable Development Goal 14 (Life Below Water).

Key Differences Between Sustainability Bonds and Blue Bonds

Sustainability bonds finance projects with broader environmental and social benefits, such as renewable energy, affordable housing, and education, while blue bonds specifically target marine and water-related initiatives like ocean conservation, fisheries management, and coastal resilience. Both bonds aim to attract investors seeking impact investments, but blue bonds are a subset of sustainability bonds with a narrower focus on aquatic ecosystems. Key differences lie in their target sectors, impact measurement criteria, and stakeholder engagement strategies, with blue bonds emphasizing marine sustainability metrics.

Global Market Trends in Sustainability and Blue Bonds

Sustainability bonds and blue bonds are gaining significant traction in the global financial markets, with sustainability bonds offering broader environmental and social impact funding, while blue bonds specifically target ocean and water-related projects. The global issuance of sustainability bonds reached over $150 billion in 2023, reflecting growing investor demand for responsible investments, whereas the blue bond market, though smaller, is rapidly expanding as governments and corporations address marine conservation and climate resilience. Major markets such as Europe, Asia, and the Americas are leading the adoption, driven by regulatory frameworks and increasing awareness of environmental, social, and governance (ESG) criteria.

Environmental Impact: Comparing Outcomes

Sustainability bonds finance projects addressing both environmental and social challenges, promoting broad sustainable development goals, while blue bonds specifically target marine and water-related conservation efforts. Environmental impact from sustainability bonds includes reducing carbon emissions, enhancing renewable energy, and supporting social welfare, whereas blue bonds primarily focus on protecting ocean ecosystems, combating overfishing, and restoring marine biodiversity. The measurable outcomes of blue bonds often show significant improvements in marine health indicators, while sustainability bonds yield diverse benefits across climate, social equity, and resource efficiency.

Issuers and Investors: Who Participates?

Sustainability bonds are issued by corporations, municipalities, and financial institutions seeking to fund a broad range of environmental and social projects, attracting diverse investors focused on sustainable development. Blue bonds specifically target marine and ocean-related projects and are typically issued by governments and development banks, drawing investors committed to ocean conservation and sustainable fisheries. Both bond types appeal to impact investors but differ in project focus and issuer profiles, shaping their unique market participation.

Regulatory Frameworks and Standards

Sustainability Bonds comply with broad regulatory frameworks such as the Green Bond Principles (GBP) and Social Bond Principles (SBP) established by the International Capital Market Association (ICMA), which emphasize transparency, impact reporting, and use of proceeds for environmental or social projects. Blue Bonds, a subset of Sustainability Bonds, adhere to specific standards like the Blue Bond Principles (BBP) that focus exclusively on ocean and water-related projects, incorporating stricter criteria to ensure maritime ecosystem preservation and sustainable ocean economy financing. Regulatory bodies increasingly require independent third-party verification and impact audits to maintain compliance and credibility in both bond types, supporting investor confidence and market growth.

Challenges and Risks in Both Bond Types

Sustainability bonds and blue bonds face challenges related to impact measurement, transparency, and greenwashing risks, which can undermine investor confidence. Both bond types often encounter difficulties in verifying the environmental outcomes due to lack of standardized metrics and third-party evaluation. Market risks also include regulatory uncertainty and evolving investor expectations that may affect liquidity and pricing.

Future Outlook for Sustainability Bonds and Blue Bonds

Sustainability bonds and blue bonds are poised for significant growth as global investors increasingly prioritize environmental, social, and governance (ESG) criteria to meet ambitious climate targets. Future outlook for sustainability bonds includes expanding frameworks that encompass broader social and environmental outcomes, driving innovation in green finance and attracting diverse sectors. Blue bonds, with their specialized focus on ocean conservation and sustainable marine activities, are expected to gain prominence as coastal economies and investors recognize the critical role of healthy marine ecosystems in climate resilience and economic stability.

Sustainability Bond Infographic

libterm.com

libterm.com