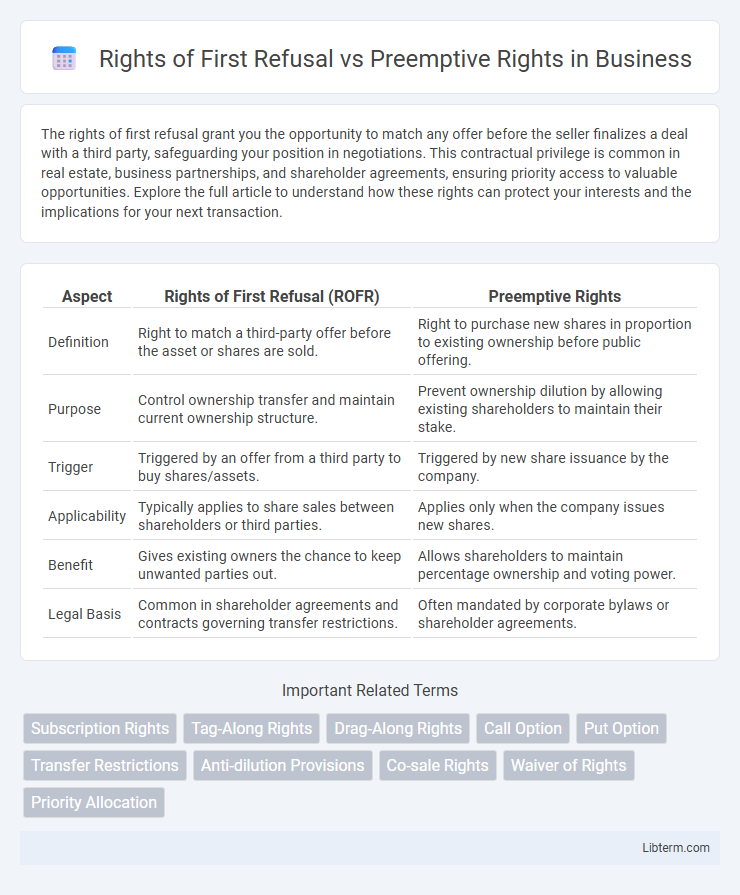

The rights of first refusal grant you the opportunity to match any offer before the seller finalizes a deal with a third party, safeguarding your position in negotiations. This contractual privilege is common in real estate, business partnerships, and shareholder agreements, ensuring priority access to valuable opportunities. Explore the full article to understand how these rights can protect your interests and the implications for your next transaction.

Table of Comparison

| Aspect | Rights of First Refusal (ROFR) | Preemptive Rights |

|---|---|---|

| Definition | Right to match a third-party offer before the asset or shares are sold. | Right to purchase new shares in proportion to existing ownership before public offering. |

| Purpose | Control ownership transfer and maintain current ownership structure. | Prevent ownership dilution by allowing existing shareholders to maintain their stake. |

| Trigger | Triggered by an offer from a third party to buy shares/assets. | Triggered by new share issuance by the company. |

| Applicability | Typically applies to share sales between shareholders or third parties. | Applies only when the company issues new shares. |

| Benefit | Gives existing owners the chance to keep unwanted parties out. | Allows shareholders to maintain percentage ownership and voting power. |

| Legal Basis | Common in shareholder agreements and contracts governing transfer restrictions. | Often mandated by corporate bylaws or shareholder agreements. |

Understanding Rights of First Refusal

Rights of First Refusal grant a party the option to purchase an asset before the owner sells it to a third party, ensuring priority in acquisition. This right differs from Preemptive Rights, which typically allow existing shareholders to maintain their ownership percentage by purchasing new shares before they are offered publicly. Understanding Rights of First Refusal is crucial for investors and businesses to control transfer restrictions and protect ownership interests in contracts and agreements.

Defining Preemptive Rights

Preemptive rights grant existing shareholders the opportunity to purchase additional shares before the company offers them to new investors, maintaining their proportional ownership and preventing dilution. These rights are typically outlined in corporate charters or shareholder agreements and are essential for protecting equity stakes during new stock issuances. Unlike rights of first refusal, which apply to transfers of existing shares, preemptive rights specifically address the purchase of newly issued shares.

Key Differences Between Rights of First Refusal and Preemptive Rights

Rights of First Refusal grant existing shareholders the opportunity to purchase shares before the seller offers them to external buyers, emphasizing control over transfer of ownership. Preemptive Rights focus on maintaining proportional ownership by allowing shareholders to buy additional shares during new issuances before the company offers them to the public. The key difference lies in the timing and purpose: Rights of First Refusal apply to secondary sales, while Preemptive Rights apply to primary share issuances.

Legal Framework and Enforceability

Rights of First Refusal (ROFR) grant a party the option to purchase an asset before the owner can sell it to a third party, typically governed by contract law and enforceable through specific performance or damages. Preemptive Rights, primarily found in corporate law, protect existing shareholders by allowing them to maintain proportional ownership during new equity issuances, enforceable under securities regulations and shareholder agreements. Legal frameworks differ significantly, with ROFRs relying on private contracts and state property laws, while preemptive rights are embedded in corporate charters and securities law, affecting their scope and remedy options.

Common Use Cases in Business Transactions

Rights of First Refusal (ROFR) often appear in real estate and shareholder agreements, allowing existing parties to match third-party offers before a sale occurs, preventing unwanted changes in ownership or partnership. Preemptive Rights primarily feature in corporate finance, enabling existing shareholders to purchase new shares proportionally during capital raises, thereby avoiding equity dilution. Both rights protect stakeholders' control and investment, but ROFR usually governs secondary sales, while Preemptive Rights apply to primary issuances of stock.

Advantages of Rights of First Refusal

Rights of First Refusal (ROFR) offer shareholders the advantage of controlling ownership changes by granting the option to match any third-party purchase offers, thereby preventing unwanted dilution or transfer of shares. This mechanism is less restrictive than preemptive rights, as ROFR only activates upon a third-party offer, allowing shareholders flexibility without mandatory participation in every new issue. ROFR also simplifies negotiation processes and enhances strategic decision-making by giving existing shareholders priority access to shares under market conditions.

Benefits of Preemptive Rights for Shareholders

Preemptive rights provide shareholders with the benefit of maintaining their proportional ownership in a company by allowing them to purchase additional shares before new stock is offered to outside investors. This mechanism helps prevent dilution of voting power and economic interest, preserving shareholders' control and investment value. By securing the opportunity to increase their stake, shareholders can exercise greater influence over corporate decisions and potential future growth.

Potential Drawbacks and Limitations

Rights of First Refusal (ROFR) may limit a seller's ability to secure the best market price, as the holder can match any third-party offer, potentially discouraging outside buyers. Preemptive Rights often dilute existing shareholders' influence by allowing new shares issuance at a discount, which can reduce the value of their current holdings. Both rights can create complexities in transaction timing and negotiation, potentially slowing down sales or capital raising efforts.

How to Draft Effective Contract Clauses

Drafting effective contract clauses for Rights of First Refusal (ROFR) and Preemptive Rights requires precise definitions of trigger events and clear timelines for the seller's notification to existing stakeholders. Incorporate unambiguous terms specifying the scope of the rights, including the exact assets or shares covered, purchase price conditions, and the duration of the rights to minimize disputes. Ensure alignment with governing law provisions and include dispute resolution mechanisms to enforce these rights efficiently.

Best Practices for Choosing Between ROFR and Preemptive Rights

Choosing between Rights of First Refusal (ROFR) and Preemptive Rights depends on the desired level of control and timing in equity transactions. ROFR grants existing shareholders the option to purchase shares before they are offered to outsiders, best suited for companies aiming to manage ownership changes with flexibility and minimal disruption. Preemptive Rights provide shareholders the ability to maintain proportional ownership during new equity issuances, ideal for protecting investors against dilution in fundraising rounds.

Rights of First Refusal Infographic

libterm.com

libterm.com