An Executive Director plays a crucial role in steering an organization's strategic direction and operational management to achieve its mission and goals effectively. This leadership position requires strong decision-making skills, financial acumen, and the ability to foster relationships with stakeholders, staff, and the board. Discover how an Executive Director's expertise can transform your organization and drive sustainable success by reading the full article.

Table of Comparison

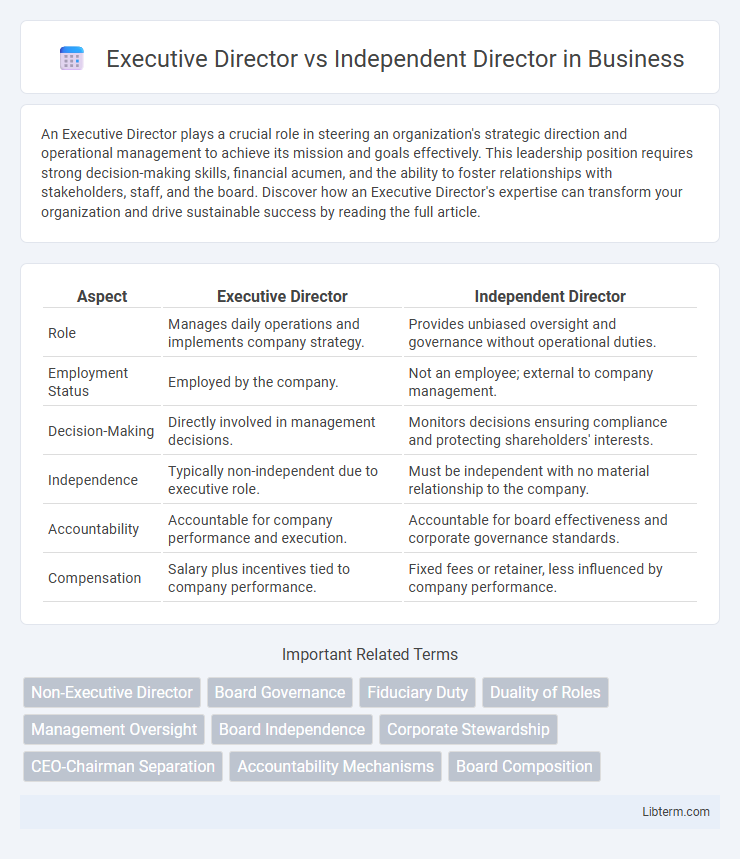

| Aspect | Executive Director | Independent Director |

|---|---|---|

| Role | Manages daily operations and implements company strategy. | Provides unbiased oversight and governance without operational duties. |

| Employment Status | Employed by the company. | Not an employee; external to company management. |

| Decision-Making | Directly involved in management decisions. | Monitors decisions ensuring compliance and protecting shareholders' interests. |

| Independence | Typically non-independent due to executive role. | Must be independent with no material relationship to the company. |

| Accountability | Accountable for company performance and execution. | Accountable for board effectiveness and corporate governance standards. |

| Compensation | Salary plus incentives tied to company performance. | Fixed fees or retainer, less influenced by company performance. |

Understanding the Roles: Executive Director vs Independent Director

Executive Directors are senior executives involved in the day-to-day management and operations of a company, responsible for implementing board decisions and achieving corporate objectives. Independent Directors are non-executive members who provide unbiased oversight and strategic guidance, ensuring accountability and protecting shareholder interests without direct involvement in daily operations. The distinction between these roles is crucial for balancing management control and board supervision, promoting effective corporate governance.

Key Responsibilities of an Executive Director

An Executive Director is primarily responsible for the day-to-day management of a company, including implementing board decisions, overseeing operations, and driving strategic initiatives. They act as a bridge between the board and the company's management team, ensuring operational efficiency and meeting business objectives. Unlike Independent Directors, who focus on governance and oversight without involvement in daily operations, Executive Directors have a hands-on role in shaping corporate culture and executing business plans.

Core Duties of an Independent Director

Independent Directors play a crucial role in corporate governance by providing unbiased oversight and protecting shareholders' interests, ensuring transparency and accountability in board decisions. Their core duties include monitoring management performance, evaluating financial reporting, and overseeing risk management processes to prevent conflicts of interest and promote ethical conduct. Unlike Executive Directors, Independent Directors do not engage in day-to-day management but focus on strategic guidance and compliance with regulatory standards.

Appointment Process: Executive vs Independent Directors

Executive directors are appointed by the company's board or shareholders and are usually selected from within the organization due to their management experience and intimate knowledge of company operations. Independent directors are nominated based on strict regulatory criteria to ensure impartiality and are typically appointed through a formal board approval process that emphasizes their external expertise and lack of material relationships with the company. The appointment of independent directors often involves rigorous vetting by nominating committees to uphold corporate governance standards and investor confidence.

Legal and Regulatory Differences

Executive Directors are company employees involved in daily management, subject to fiduciary duties and liabilities under laws such as the Companies Act 2006 in the UK and the Sarbanes-Oxley Act in the US, while Independent Directors are non-executive, providing oversight without operational roles and must meet regulatory independence criteria defined by bodies like the SEC and stock exchanges. Independent Directors help ensure compliance with corporate governance standards, risk management, and unbiased decision-making, whereas Executive Directors have direct responsibility for business performance and regulatory filings. Legal distinctions include conflict-of-interest rules, disclosure obligations, and differing responsibilities in board committees like audit and remuneration committees to uphold transparency and accountability.

Boardroom Influence and Decision-Making

Executive Directors hold significant boardroom influence due to their operational roles and direct involvement in company management, enabling them to drive strategic decisions with firsthand insights. Independent Directors bring impartiality and objective oversight, enhancing board integrity by mitigating conflicts of interest and ensuring balanced governance. The dynamic between both roles shapes robust decision-making processes, combining insider expertise with independent scrutiny.

Compensation Structures Compared

Executive Directors typically receive a salary, performance bonuses, and benefits aligned with their management responsibilities and involvement in daily operations. Independent Directors generally earn fixed fees, meeting retainers, and stock options, reflecting their advisory role and limited engagement with company management. Compensation structures for Executive Directors emphasize incentive alignment with company performance, while Independent Directors' pay prioritizes governance oversight and impartiality.

Conflict of Interest and Independence

An Executive Director is typically involved in the day-to-day management of the company, which can create potential conflicts of interest due to their operational roles and vested interests. Independent Directors, by definition, must have no material relationship with the company, ensuring unbiased oversight and mitigating conflicts of interest effectively. This independence is critical for maintaining transparent corporate governance and protecting shareholder interests.

Impact on Corporate Governance

Executive Directors actively manage daily operations, providing detailed insights that influence strategic decisions and strengthen internal controls within corporate governance frameworks. Independent Directors offer unbiased oversight, enhancing transparency and mitigating conflicts of interest by ensuring accountability and protecting shareholder interests. The balance between Executive and Independent Directors fosters robust governance by combining operational expertise with impartial scrutiny, ultimately promoting ethical leadership and sustainable business practices.

Choosing the Right Director for Your Organization

Choosing the right director for your organization involves understanding the distinct roles of Executive Directors and Independent Directors. Executive Directors are involved in day-to-day management, providing operational expertise and strategic leadership from within the company. Independent Directors bring unbiased oversight and governance, enhancing board objectivity and protecting shareholder interests without conflicts of interest.

Executive Director Infographic

libterm.com

libterm.com