An options contract grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. This financial instrument is essential for hedging risk or speculating on price movements in markets such as stocks, commodities, or currencies. Discover how options contracts can enhance your investment strategy by reading the rest of this article.

Table of Comparison

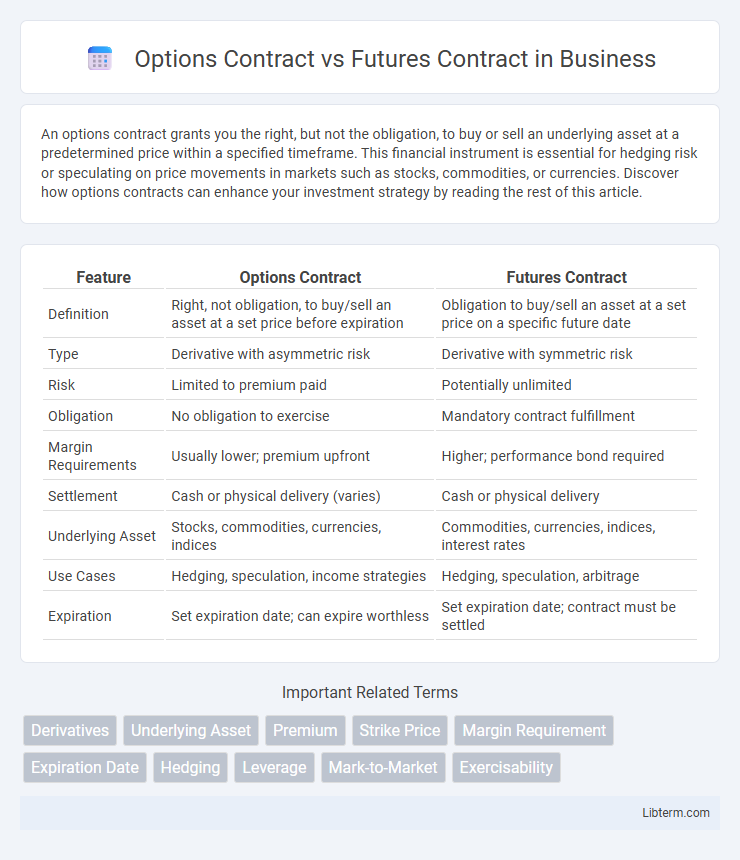

| Feature | Options Contract | Futures Contract |

|---|---|---|

| Definition | Right, not obligation, to buy/sell an asset at a set price before expiration | Obligation to buy/sell an asset at a set price on a specific future date |

| Type | Derivative with asymmetric risk | Derivative with symmetric risk |

| Risk | Limited to premium paid | Potentially unlimited |

| Obligation | No obligation to exercise | Mandatory contract fulfillment |

| Margin Requirements | Usually lower; premium upfront | Higher; performance bond required |

| Settlement | Cash or physical delivery (varies) | Cash or physical delivery |

| Underlying Asset | Stocks, commodities, currencies, indices | Commodities, currencies, indices, interest rates |

| Use Cases | Hedging, speculation, income strategies | Hedging, speculation, arbitrage |

| Expiration | Set expiration date; can expire worthless | Set expiration date; contract must be settled |

Introduction to Derivatives

Options contracts grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specific expiration date, offering flexibility and limited risk. Futures contracts obligate both parties to buy or sell the asset at a set price and date, providing standardized agreements often used for hedging and speculation in commodities, currencies, and financial instruments. Both derivatives serve as essential tools in risk management and price discovery within financial markets.

What is an Options Contract?

An options contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame, providing strategic flexibility in trading. This derivative instrument is used for hedging, speculation, or income generation through premium collection. Unlike futures contracts, options involve a premium cost and limit potential losses to this premium while allowing unlimited profit potential.

What is a Futures Contract?

A futures contract is a standardized legal agreement to buy or sell a specific quantity of an asset, such as commodities, currencies, or financial instruments, at a predetermined price on a specified future date. Unlike options contracts, futures impose an obligation on both buyer and seller to execute the trade at contract maturity, eliminating the choice to opt out. Futures contracts are commonly used for hedging risk or speculative purposes in markets like commodities, stock indices, and foreign exchange.

Key Differences Between Options and Futures

Options contracts grant the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price before expiration, while futures contracts oblige both parties to buy or sell the asset at a set price on a specified date. Options require payment of a premium, providing limited risk to the buyer, whereas futures involve margin requirements and expose both parties to potentially unlimited risk. In terms of flexibility, options allow strategic hedging with various strike prices and expiration dates, unlike futures, which have standardized terms and settlement dates.

Risk and Reward Profiles

Options contracts offer asymmetric risk and reward profiles, allowing buyers to limit losses to the premium paid while maintaining unlimited upside potential, whereas sellers face potentially unlimited losses. Futures contracts, on the other hand, involve symmetrical risk and reward where both parties are obligated to buy or sell the asset at a predetermined price, exposing them to potentially substantial gains or losses. The inherent leverage in futures amplifies both risk and reward, demanding careful margin management to avoid significant financial exposure.

Margin Requirements and Leverage

Options contracts require margin deposits typically lower than futures due to limited risk exposure, primarily involving the option premium. Futures contracts mandate higher margin requirements, reflecting their obligation to buy or sell the underlying asset at a set price, increasing leverage and potential risk. Leverage in futures amplifies gains and losses as traders must maintain margin levels, while options offer controlled risk with leverage tied to premium payments.

Use Cases: Hedging and Speculation

Options contracts offer flexibility in hedging by allowing investors to limit potential losses while maintaining upside potential, making them ideal for managing risk in volatile markets. Futures contracts provide standardized agreements to buy or sell assets at predetermined prices, commonly used by producers and consumers to lock in prices and avoid adverse price movements. Speculators prefer futures for their leverage and liquidity, whereas options attract those seeking asymmetric risk-reward profiles.

Settlement Mechanisms

Options contracts settle by granting the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price before or at expiration, with settlement either in cash or via physical delivery. Futures contracts require the buyer and seller to execute the trade at contract maturity, typically settled daily through mark-to-market adjustments and finalized by either cash settlement or physical delivery. The distinct settlement mechanisms impact risk exposure and liquidity, with futures imposing mandatory settlement obligations while options provide asymmetric payoff profiles.

Pros and Cons of Options vs Futures

Options contracts provide the buyer with the right, but not the obligation, to buy or sell an asset at a predetermined price, offering limited risk to the premium paid, while futures contracts bind both parties to execute the trade on a specified date, which can lead to unlimited risk or reward. Options offer greater flexibility and risk management with potential for hedging and speculative strategies, but generally come with higher premiums and lower liquidity compared to futures contracts. Futures contracts are typically more standardized and liquid, allowing for easier market entry and exit, though they require significant margin investment and expose traders to potentially unlimited losses.

Choosing the Right Contract for Your Strategy

Choosing the right contract depends on your risk tolerance and market outlook; options contracts offer flexibility with the right, but not the obligation, to buy or sell an asset at a set price, ideal for hedging and speculative strategies with limited loss potential. Futures contracts involve a binding agreement to buy or sell an asset at a predetermined price and date, suitable for traders seeking certainty and leveraging market movements with higher risk exposure. Understanding the distinct payoff structures and margin requirements of options and futures is essential for aligning contract selection with your financial goals and risk management approach.

Options Contract Infographic

libterm.com

libterm.com