CoreLogic provides comprehensive property data and analytics that empower businesses and individuals to make informed real estate decisions. Their advanced technology delivers insights into market trends, property values, and risk assessments, helping you plan investments with confidence. Explore the full article to discover how CoreLogic's solutions can enhance your real estate strategies.

Table of Comparison

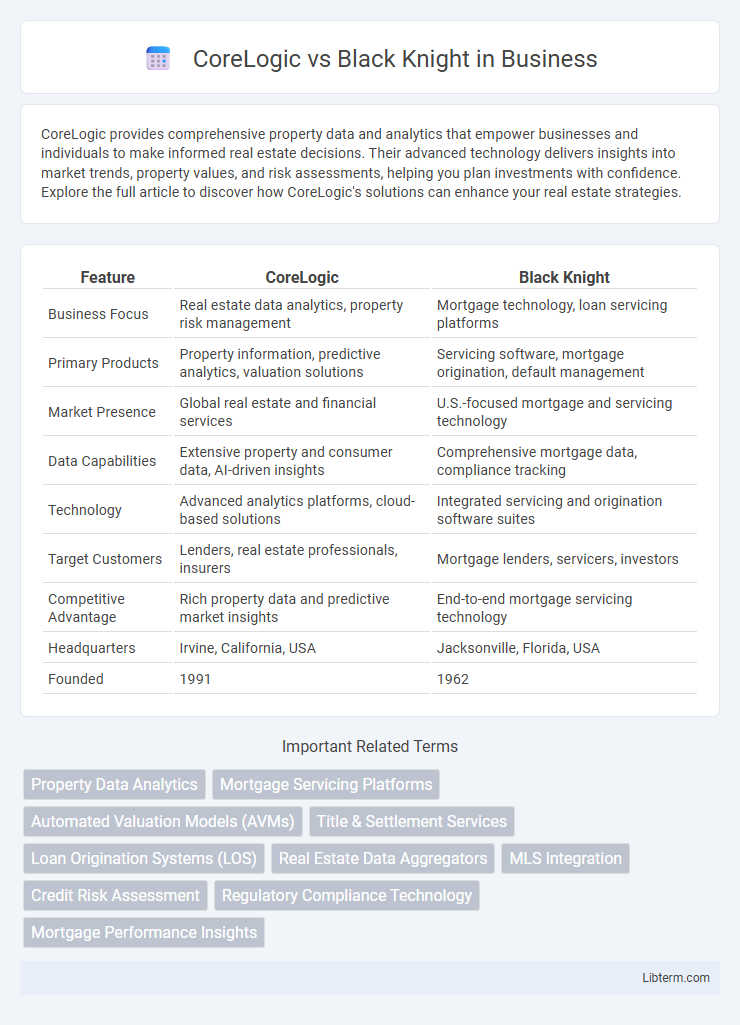

| Feature | CoreLogic | Black Knight |

|---|---|---|

| Business Focus | Real estate data analytics, property risk management | Mortgage technology, loan servicing platforms |

| Primary Products | Property information, predictive analytics, valuation solutions | Servicing software, mortgage origination, default management |

| Market Presence | Global real estate and financial services | U.S.-focused mortgage and servicing technology |

| Data Capabilities | Extensive property and consumer data, AI-driven insights | Comprehensive mortgage data, compliance tracking |

| Technology | Advanced analytics platforms, cloud-based solutions | Integrated servicing and origination software suites |

| Target Customers | Lenders, real estate professionals, insurers | Mortgage lenders, servicers, investors |

| Competitive Advantage | Rich property data and predictive market insights | End-to-end mortgage servicing technology |

| Headquarters | Irvine, California, USA | Jacksonville, Florida, USA |

| Founded | 1991 | 1962 |

Overview of CoreLogic and Black Knight

CoreLogic and Black Knight are leading providers of real estate data, analytics, and technology solutions, serving mortgage lenders, real estate professionals, and financial institutions. CoreLogic specializes in property information, mortgage analytics, and risk management, with a strong emphasis on predictive analytics and property valuation models. Black Knight offers comprehensive software platforms for mortgage origination, servicing, and default management, supported by extensive property data and customer relationship management tools.

Key Services and Offerings

CoreLogic specializes in comprehensive property data analytics, mortgage risk management, and real estate information services, enabling lenders, insurers, and government agencies to make informed decisions. Black Knight offers advanced loan servicing technology, mortgage origination solutions, and default management services, supporting financial institutions with end-to-end mortgage lifecycle platforms. Both companies leverage extensive data repositories and analytics but differ in their primary service focus, with CoreLogic emphasizing property and real estate insights, and Black Knight focusing on mortgage technology and servicing solutions.

Market Position and Reputation

CoreLogic holds a strong market position as a leading provider of property data and analytics, widely recognized for its comprehensive real estate insights and risk management solutions. Black Knight is a key competitor known for its innovative technology platforms and mortgage servicing software, serving financial institutions and lenders with robust data integration capabilities. Both companies maintain solid reputations for reliability and industry expertise, with CoreLogic excelling in property intelligence and Black Knight dominating mortgage technology services.

Data Accuracy and Coverage

CoreLogic offers extensive property data coverage with robust data accuracy through advanced analytics and multiple data sources, enhancing reliability for real estate and mortgage industries. Black Knight provides comprehensive mortgage and property data with a strong emphasis on real-time updates and high-precision verification processes to ensure data integrity. Both companies prioritize data accuracy, but CoreLogic excels in diverse property data depth, while Black Knight leads in mortgage-specific real-time coverage.

Technology and Platform Capabilities

CoreLogic excels in advanced data analytics and predictive modeling platforms, leveraging artificial intelligence and machine learning to enhance property insights and risk assessment. Black Knight offers a comprehensive suite of mortgage servicing and origination technologies, integrating cloud-based platforms that streamline workflow automation and data management. Both companies prioritize scalable, secure technology infrastructures, with CoreLogic emphasizing real estate data intelligence and Black Knight focusing on end-to-end mortgage technology solutions.

Integration and Usability

CoreLogic offers robust integration capabilities with extensive API support, enabling seamless data exchange across mortgage servicing and real estate platforms. Black Knight excels in usability through its user-friendly interfaces and customizable dashboards, streamlining workflows for loan origination and servicing teams. Both companies prioritize interoperability, but CoreLogic leans towards data depth, while Black Knight emphasizes intuitive user experience in platform design.

Pricing and Cost Structure

CoreLogic offers flexible pricing models tailored to specific real estate data and analytics services, often based on subscription tiers or usage volume, addressing diverse client needs across property information and risk management. Black Knight typically employs a modular pricing structure with fees determined by the suite of mortgage servicing and loan origination software solutions selected, allowing customization according to scale and service complexity. Both companies emphasize value-based pricing, but CoreLogic's approach leans more toward data subscription services, whereas Black Knight focuses on software licensing and transaction-based fees.

Security and Compliance Standards

CoreLogic and Black Knight both prioritize stringent security and compliance standards to protect sensitive real estate and mortgage data. CoreLogic implements advanced encryption protocols and adheres to GDPR and CCPA regulations, ensuring robust data privacy and risk management. Black Knight follows SOC 2 Type II certification and FISMA compliance, reinforcing its commitment to secure data handling and regulatory adherence in the financial services industry.

Customer Support and Resources

CoreLogic offers dedicated customer support with 24/7 availability through multiple channels, including phone, email, and live chat, ensuring prompt assistance for clients. Their extensive resource library features webinars, industry reports, and training materials designed to enhance user expertise and streamline real estate, mortgage, and risk management processes. Black Knight provides robust customer service via personalized account managers and a comprehensive knowledge base, facilitating efficient problem resolution and continuous product education.

Industry Impact and Future Outlook

CoreLogic and Black Knight both play pivotal roles in the real estate and mortgage technology sectors, with CoreLogic specializing in property data analytics and Black Knight leading in mortgage servicing software and digital lending solutions. Their ongoing innovations significantly influence industry workflows, risk assessment, and regulatory compliance, driving increased efficiency and transparency. As technology adoption accelerates, both companies are poised to expand their integration of AI and machine learning, shaping the future of real estate analytics and mortgage servicing platforms.

CoreLogic Infographic

libterm.com

libterm.com