A staggered board structure divides a company's board of directors into separate classes with staggered terms, making it harder for shareholders to replace the entire board at once. This approach can provide stability and continuity in leadership but may also limit shareholder influence during proxy fights or takeovers. Explore the rest of the article to understand how a staggered board impacts corporate governance and your investment strategy.

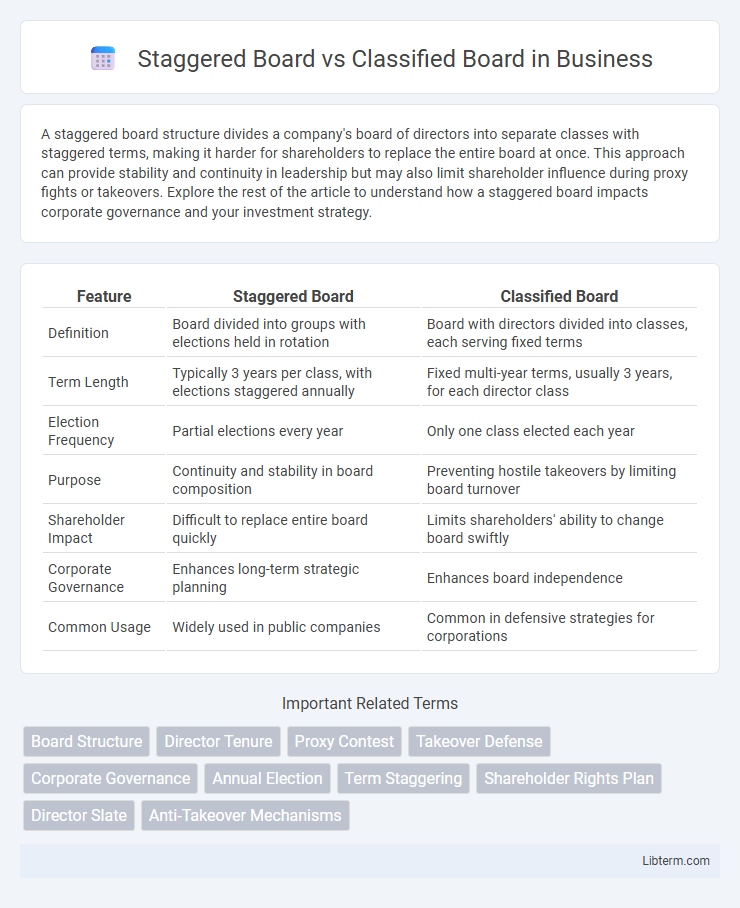

Table of Comparison

| Feature | Staggered Board | Classified Board |

|---|---|---|

| Definition | Board divided into groups with elections held in rotation | Board with directors divided into classes, each serving fixed terms |

| Term Length | Typically 3 years per class, with elections staggered annually | Fixed multi-year terms, usually 3 years, for each director class |

| Election Frequency | Partial elections every year | Only one class elected each year |

| Purpose | Continuity and stability in board composition | Preventing hostile takeovers by limiting board turnover |

| Shareholder Impact | Difficult to replace entire board quickly | Limits shareholders' ability to change board swiftly |

| Corporate Governance | Enhances long-term strategic planning | Enhances board independence |

| Common Usage | Widely used in public companies | Common in defensive strategies for corporations |

Understanding Staggered and Classified Boards

Staggered boards divide directors into classes with different election years, ensuring that only a portion of the board is elected each year, which enhances continuity and reduces the risk of hostile takeovers. Classified boards, often used interchangeably with staggered boards, specifically refer to this structure of dividing directors into separate classes with staggered terms. This board design promotes long-term decision-making and stability by preventing complete board replacement in a single election cycle.

Key Definitions: Staggered vs Classified Boards

A staggered board divides directors into separate classes with staggered terms, so only a portion of the board is elected each year, enhancing continuity and reducing the risk of hostile takeovers. A classified board is often used interchangeably with a staggered board, as it also separates directors into different classes serving multi-year terms, preventing an entire board's replacement in a single election cycle. These board structures are key in corporate governance for balancing board stability and shareholder influence.

Structural Differences Between the Two Board Types

A staggered board divides directors into multiple classes with terms expiring in different years, resulting in only a fraction of members up for election annually, enhancing board continuity and defense against hostile takeovers. In contrast, a classified board splits directors into distinct groups, each serving fixed multi-year terms, but elections occur less frequently, creating a longer-term strategic focus and greater stability. The primary structural difference lies in election timing and term length, with staggered boards emphasizing ongoing partial elections and classified boards concentrating on fixed-term, multi-year governance cycles.

Advantages of Staggered Boards

Staggered boards enhance corporate stability by preventing hostile takeovers through the gradual election of directors, limiting the ability of activists to gain immediate control. This structure encourages long-term strategic decision-making by insulating management from sudden shareholder pressures and short-term market fluctuations. Companies with staggered boards often experience improved continuity in governance, fostering consistent oversight and sustained value creation.

Benefits of Classified Boards

Classified boards enhance corporate stability by dividing directors into staggered terms, reducing the risk of hostile takeovers and promoting long-term strategic planning. This structure improves continuity in governance, as only a portion of the board is up for election in any given year, providing consistent oversight and reducing sudden leadership changes. Shareholders may benefit from sustained company vision alignment and protection against rapid shifts in control, supporting sustained value creation.

Drawbacks and Criticisms of Each Board Structure

Staggered boards often face criticism for entrenching management, reducing shareholder influence by limiting the ability to replace the entire board quickly, which can hinder responsiveness to shareholder concerns. Classified boards are criticized for potentially diminishing accountability as directors serve multi-year terms with less frequent elections, possibly allowing underperforming members to remain in power longer. Both structures may dilute shareholder democracy and create barriers to corporate governance reforms, posing challenges for investor activism and board refreshment.

Impact on Corporate Governance

Staggered boards, where only a fraction of directors are elected each year, can entrench management by reducing the likelihood of a hostile takeover and making board turnover slower, which may impair shareholder influence on corporate governance. Classified boards create longer director terms and staggered elections, potentially limiting accountability and responsiveness by diluting the power of shareholders to swiftly replace underperforming directors. Both structures influence governance dynamics by balancing management stability against shareholder rights and board accountability.

Influence on Shareholder Rights and Activism

Staggered boards divide directors into different classes with terms ending in different years, limiting the ability of shareholders to replace the entire board at once and reducing shareholder influence in board elections. Classified boards, often synonymous with staggered boards, further entrench management by making it harder for activist shareholders to gain board control quickly. This structure can deter hostile takeovers and shareholder activism by prolonging the time needed to effect significant governance changes.

Case Studies: Companies Using Staggered or Classified Boards

Major corporations like Apple and Cisco utilize staggered boards to enhance long-term strategic planning and protect against hostile takeovers, while companies such as Amazon and Google prefer classified boards to maintain a balance between stability and shareholder influence. Case studies reveal that firms with staggered boards often experience prolonged director tenure, contributing to consistent policy implementation but sometimes drawing investor criticism for decreased board accountability. Research on classified boards shows improved governance continuity, yet these structures may also face challenges in quickly adapting to shareholder demands during periods of rapid market change.

Choosing the Right Board Structure for Your Organization

Choosing the right board structure is crucial for aligning with your organization's long-term governance goals and shareholder interests. Staggered boards, which elect directors in phases, provide continuity and reduce the risk of hostile takeovers, while classified boards offer similar benefits by grouping directors into distinct classes with longer terms. Evaluating factors such as company size, industry volatility, and shareholder composition helps determine whether a staggered or classified board best supports stability and effective oversight.

Staggered Board Infographic

libterm.com

libterm.com