Founders' equity represents the initial ownership stake held by the company's founders, reflecting their contribution in shaping the business vision and assets. This equity is typically distributed based on each founder's involvement, investment, and role in the company's early development, impacting control and decision-making. Discover how understanding founders' equity can help you navigate startup ownership and secure your share by reading the rest of the article.

Table of Comparison

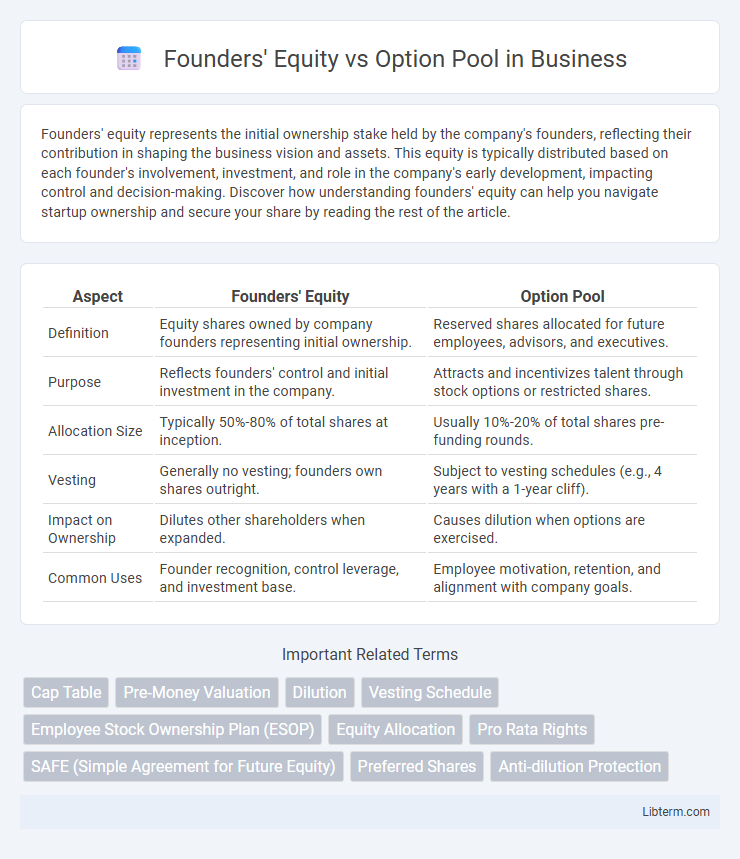

| Aspect | Founders' Equity | Option Pool |

|---|---|---|

| Definition | Equity shares owned by company founders representing initial ownership. | Reserved shares allocated for future employees, advisors, and executives. |

| Purpose | Reflects founders' control and initial investment in the company. | Attracts and incentivizes talent through stock options or restricted shares. |

| Allocation Size | Typically 50%-80% of total shares at inception. | Usually 10%-20% of total shares pre-funding rounds. |

| Vesting | Generally no vesting; founders own shares outright. | Subject to vesting schedules (e.g., 4 years with a 1-year cliff). |

| Impact on Ownership | Dilutes other shareholders when expanded. | Causes dilution when options are exercised. |

| Common Uses | Founder recognition, control leverage, and investment base. | Employee motivation, retention, and alignment with company goals. |

Understanding Founders' Equity

Founders' equity represents the initial ownership stake allocated to the startup's founders, reflecting their contributions in terms of ideas, time, and resources during the company's formation. This equity is typically divided based on roles, responsibilities, and negotiated agreements, impacting control and future dilution. Understanding founders' equity is crucial for aligning incentives and maintaining motivation as the company grows and incorporates option pools for employees.

What is an Option Pool?

An option pool is a reserved portion of a company's equity allocated to employees, advisors, and consultants as stock options to incentivize performance and retain talent. Typically comprising 10-20% of total shares, the option pool dilutes founders' equity but aligns team members with the company's growth. Understanding how the option pool impacts ownership structure is crucial for founders during fundraising and equity distribution negotiations.

Key Differences Between Founders' Equity and Option Pool

Founders' equity represents the ownership stake initially allocated to the startup's founders, reflecting their contribution and control in the company, whereas the option pool consists of shares reserved for future employees to incentivize and retain talent. Founders' equity is typically fixed at the company's inception, while the option pool can be adjusted over time to meet hiring demands. The dilution impact differs as creating or expanding an option pool reduces existing shareholders' percentages, including founders', without immediate capital infusion.

Importance of Equity Structure in Startups

A well-defined equity structure in startups balances Founders' Equity and the Option Pool to align incentives and attract talent while preserving founder control. Founders' Equity represents the ownership stake held by the startup's creators, securing their leadership role and commitment to long-term growth. The Option Pool is critical for incentivizing employees and advisors through stock options, fostering motivation and retention essential for scaling the business effectively.

How Option Pools Impact Founders’ Ownership

Option pools reduce founders' ownership percentage by allocating a portion of the company's equity for future employees, diluting the founders' shares before investment rounds. Investors often require pre-money option pools, increasing the pool size and further diluting founders' stakes but ensuring talent incentives attract growth. Managing option pool size strategically helps founders balance retaining control and providing competitive compensation.

Typical Sizes for Option Pools

Option pools typically range from 10% to 20% of a company's total equity, designed to attract and retain key employees through stock options. Founders' equity often represents the largest single portion initially but dilutes as the option pool and subsequent funding rounds expand. The size of the option pool is strategically set during early funding to ensure sufficient shares for talent incentives without overly diminishing founders' control.

Negotiating Equity: Protecting Founders’ Interests

Negotiating equity requires founders to carefully balance their ownership stake against dilution from the option pool, which is typically reserved for employees and advisors to incentivize growth. Protecting founders' interests involves structuring the option pool post-money to minimize dilution impact and negotiating clear terms on vesting schedules and repurchase rights. Ensuring transparent allocation and maintaining majority control helps founders retain decision-making power while still attracting top talent through equity incentives.

Dilution Effects: Founders’ Equity vs Option Pool

Founders' equity represents the initial ownership stake held by the company's creators, while the option pool is reserved for future employee stock options, both impacting overall shareholder dilution. Allocating a larger option pool before investment rounds dilutes founders' equity more significantly, reducing their control and value per share. Strategic management of the option pool size is essential to balance attracting talent and preserving founders' ownership percentages.

Best Practices for Allocating Option Pools

Establishing a well-structured option pool is critical for startup founders aiming to attract and retain top talent while preserving founders' equity. Best practices include allocating 10-20% of total shares to the option pool before external funding rounds to minimize dilution impact on founders. Regularly reviewing and adjusting the option pool size ensures alignment with company growth and hiring plans, maintaining a balance between incentivizing employees and protecting founders' ownership stakes.

Strategic Considerations for Early-Stage Startups

Founders' equity represents the ownership stake initially held by the startup's creators, while the option pool allocates shares reserved for future employees, advisors, and consultants. Strategic considerations for early-stage startups include balancing the dilution impact between founders and the option pool to attract top talent without significantly weakening founders' control. Optimizing the option pool size early influences fundraising negotiations, valuation, and long-term incentive alignment critical for company growth and investor confidence.

Founders' Equity Infographic

libterm.com

libterm.com