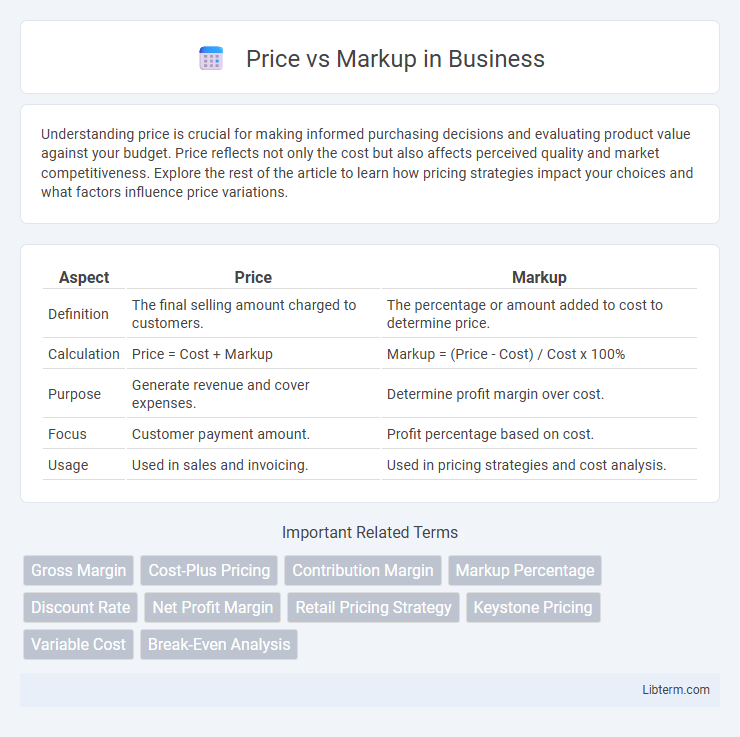

Understanding price is crucial for making informed purchasing decisions and evaluating product value against your budget. Price reflects not only the cost but also affects perceived quality and market competitiveness. Explore the rest of the article to learn how pricing strategies impact your choices and what factors influence price variations.

Table of Comparison

| Aspect | Price | Markup |

|---|---|---|

| Definition | The final selling amount charged to customers. | The percentage or amount added to cost to determine price. |

| Calculation | Price = Cost + Markup | Markup = (Price - Cost) / Cost x 100% |

| Purpose | Generate revenue and cover expenses. | Determine profit margin over cost. |

| Focus | Customer payment amount. | Profit percentage based on cost. |

| Usage | Used in sales and invoicing. | Used in pricing strategies and cost analysis. |

Understanding Price and Markup: Key Definitions

Price represents the amount a customer pays for a product or service, reflecting its market value and cost factors. Markup is the percentage added to the cost price to determine the selling price, ensuring profitability. Understanding both concepts is essential for accurate pricing strategies and maximizing business revenue.

The Fundamental Differences Between Price and Markup

Price represents the amount a customer pays for a product or service, reflecting market conditions and perceived value. Markup is the percentage added to the cost price to determine the selling price, calculated as (Selling Price - Cost) / Cost x 100%. Understanding the fundamental difference between price and markup is essential for accurate financial planning and effective business strategies.

Why Markup Matters in Business Strategy

Markup directly impacts a company's profit margin by determining the difference between the cost of goods sold and the selling price, enabling precise financial forecasting and budgeting. Setting the right markup ensures competitive pricing while maintaining profitability, crucial for sustainable business growth and market positioning. Effective markup strategies align with business objectives, customer value perception, and operational costs, significantly influencing overall financial health and strategic decision-making.

Common Methods for Calculating Markup

Common methods for calculating markup include the cost-plus method, where a fixed percentage is added to the cost of goods sold, and the retail method, which bases markup on the retail price rather than cost. Another frequently used approach is the gross margin method, focusing on desired profit margins to determine the appropriate markup percentage. These methods ensure businesses price products effectively to maintain profitability while remaining competitive in the market.

How Pricing Strategies Impact Profit Margins

Pricing strategies directly influence profit margins by determining the balance between product cost and selling price. A higher markup increases profit per unit but may reduce demand if prices become uncompetitive, while lower markup can boost sales volume but shrink profit margins. Understanding the relationship between price elasticity and markup helps businesses optimize pricing decisions to maximize overall profitability.

Real-World Examples: Markup vs Price in Action

Retailers often apply a 50% markup on the wholesale cost of products, pricing a $20 item at $30 to cover expenses and profit. Amazon utilizes dynamic pricing strategies, adjusting markups based on demand and competition to optimize margins in real time. Restaurants commonly use a 300% markup on food costs, turning a $5 ingredient into a $20 menu price, demonstrating how price and markup interplay in diverse industries.

Factors Influencing Price Setting and Markup Decisions

Price setting and markup decisions are influenced by factors such as production costs, competitor pricing, market demand, and target profit margins. Businesses analyze cost structures including raw materials, labor, and overhead to determine a base price, while market positioning and consumer willingness to pay guide the markup percentage. Regulatory constraints and seasonal trends also impact pricing strategies to maintain competitiveness and profitability.

Price vs Markup: Implications for Small Businesses

Price determines the amount customers pay for products, while markup is the percentage added to the cost to set the selling price. For small businesses, understanding the relationship between price and markup is crucial to ensuring profitability without alienating customers. Effective markup strategies help cover expenses, generate profit, and maintain competitive pricing in tight local markets.

Common Mistakes When Setting Prices and Markups

Common mistakes when setting prices and markups include confusing markup percentages with profit margins, leading to inflated expectations and pricing errors. Neglecting to account for all variable and fixed costs can result in setting prices too low or too high, harming profitability. Failure to research competitor pricing and market demand may cause misalignment with customer expectations and loss of market share.

Optimizing Price and Markup for Maximum Profitability

Optimizing price and markup for maximum profitability requires a precise balance between cost, market demand, and competitive positioning. Calculating markup as a percentage over cost helps ensure products cover expenses while pricing strategies aligned with customer willingness to pay maximize revenue. Dynamic price adjustments informed by market trends and cost fluctuations enable businesses to capture optimal profit margins without sacrificing sales volume.

Price Infographic

libterm.com

libterm.com