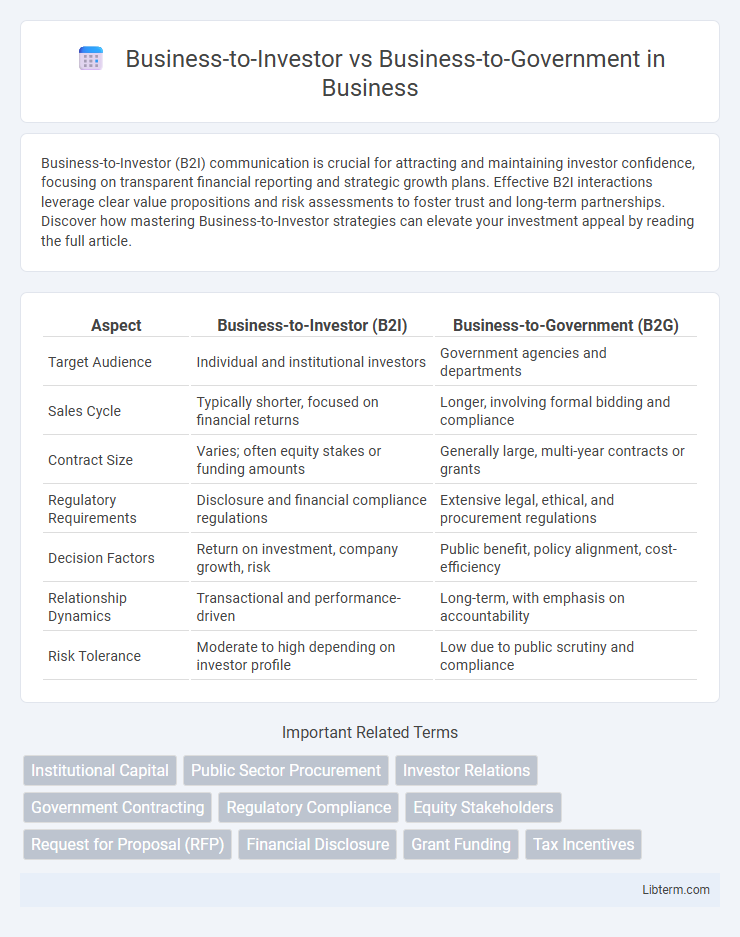

Business-to-Investor (B2I) communication is crucial for attracting and maintaining investor confidence, focusing on transparent financial reporting and strategic growth plans. Effective B2I interactions leverage clear value propositions and risk assessments to foster trust and long-term partnerships. Discover how mastering Business-to-Investor strategies can elevate your investment appeal by reading the full article.

Table of Comparison

| Aspect | Business-to-Investor (B2I) | Business-to-Government (B2G) |

|---|---|---|

| Target Audience | Individual and institutional investors | Government agencies and departments |

| Sales Cycle | Typically shorter, focused on financial returns | Longer, involving formal bidding and compliance |

| Contract Size | Varies; often equity stakes or funding amounts | Generally large, multi-year contracts or grants |

| Regulatory Requirements | Disclosure and financial compliance regulations | Extensive legal, ethical, and procurement regulations |

| Decision Factors | Return on investment, company growth, risk | Public benefit, policy alignment, cost-efficiency |

| Relationship Dynamics | Transactional and performance-driven | Long-term, with emphasis on accountability |

| Risk Tolerance | Moderate to high depending on investor profile | Low due to public scrutiny and compliance |

Understanding Business-to-Investor (B2I) and Business-to-Government (B2G)

Business-to-Investor (B2I) involves companies engaging directly with investors to secure funding, emphasizing tailored financial reporting, investor relations strategies, and compliance with securities regulations. Business-to-Government (B2G) focuses on supplying products or services to government entities, requiring navigation of public procurement processes, adherence to regulatory standards, and often bidding through formal tenders or contracts. Understanding the distinct frameworks and communication protocols in B2I and B2G is crucial for businesses aiming to optimize stakeholder engagement and secure strategic partnerships.

Key Differences Between B2I and B2G Models

Business-to-Investor (B2I) models primarily focus on attracting capital through investor relations, emphasizing shareholder value, financial performance, and market growth potential. Business-to-Government (B2G) models, on the other hand, center around compliance, procurement processes, regulatory requirements, and long-term contracts with public sector entities. The key differences include target audience, decision-making timelines, contract complexity, and the nature of engagement, with B2I being driven by market dynamics and B2G governed by policy and public sector protocols.

Target Audiences: Investors vs. Government Entities

Business-to-Investor (B2I) targets individual and institutional investors seeking financial returns, emphasizing transparent financial performance, growth potential, and market trends. Business-to-Government (B2G) engagement focuses on meeting regulatory requirements, compliance standards, and government procurement processes tailored to public sector needs. Understanding the distinct priorities of investors versus government entities enables businesses to customize communication strategies and service offerings effectively.

Sales Cycles and Decision-Making Processes

Business-to-Investor (B2I) sales cycles typically involve shorter timelines with decisions driven by financial metrics, growth potential, and return on investment, requiring clear value propositions and performance data. Business-to-Government (B2G) sales cycles are generally longer due to stringent regulatory compliance, formal procurement procedures, and multiple stakeholder approvals, demanding comprehensive documentation and adherence to legal frameworks. Decision-making in B2I centers on investors' risk tolerance and market trends, while B2G relies on policy alignment, budget constraints, and public accountability.

Regulatory and Compliance Challenges

Business-to-Investor (B2I) interactions prioritize transparency in financial reporting and adherence to securities regulations, requiring firms to comply with frameworks such as the SEC rules and Sarbanes-Oxley Act. Business-to-Government (B2G) engagements involve stricter regulatory scrutiny, including compliance with government procurement laws, FAR (Federal Acquisition Regulation), and various compliance certifications like ISO or NIST standards. The complexity of B2G compliance often exceeds B2I due to layers of legal, ethical, and operational requirements mandated by government contracts and public accountability.

Relationship Management Strategies

Business-to-Investor (B2I) relationship management prioritizes transparent communication, consistent financial reporting, and investor confidence-building through tailored engagement strategies that emphasize ROI and market trends. Business-to-Government (B2G) relationship management focuses on compliance, regulatory alignment, and strategic partnerships, leveraging detailed contract negotiations and public sector procurement processes to foster trust and long-term collaboration. Both strategies require a nuanced understanding of stakeholder expectations and proactive communication to maintain sustained, mutually beneficial relationships.

Funding and Financial Considerations

Business-to-Investor (B2I) transactions typically involve securing capital through equity financing, venture capital, or angel investors, emphasizing return on investment and growth potential. In contrast, Business-to-Government (B2G) funding often revolves around contracts, grants, or subsidies, requiring compliance with stringent regulatory and financial reporting standards. Financial considerations in B2G emphasize risk mitigation and long-term project viability, while B2I focuses on scalability and market competitiveness.

Marketing Approaches for B2I and B2G

Business-to-Investor (B2I) marketing emphasizes transparent financial reporting, investor relations, and targeted communication through earnings calls, annual reports, and investor presentations to build trust and attract capital. Business-to-Government (B2G) marketing focuses on regulatory compliance, procurement processes, and relationship-building with government officials, often leveraging formal bids, proposals, and public sector networking events. B2I campaigns highlight return on investment and growth potential, while B2G strategies prioritize policy alignment, contract fulfillment, and long-term partnership stability.

Risk Factors and Mitigation Tactics

Business-to-Investor (B2I) engagements primarily face financial risk factors such as market volatility, investor confidence fluctuations, and regulatory compliance challenges, mitigated through transparent reporting, diversified investment portfolios, and proactive stakeholder communication. Business-to-Government (B2G) interactions encounter risks including bureaucratic delays, policy changes, and contract compliance issues, addressed by establishing strong government relationships, thorough contract management, and adaptive regulatory compliance strategies. Both B2I and B2G models require tailored risk management frameworks focusing on respective regulatory environments and stakeholder expectations for sustainable success.

Future Trends in B2I and B2G Engagements

Future trends in Business-to-Investor (B2I) engagements emphasize increased use of artificial intelligence and blockchain technology to enhance transparency and trust in investment processes. Business-to-Government (B2G) interactions are moving toward digital government platforms and automated compliance systems to streamline procurement and regulatory adherence. Both B2I and B2G sectors are expected to leverage data analytics and secure communication channels to optimize decision-making and strengthen stakeholder relationships.

Business-to-Investor Infographic

libterm.com

libterm.com