Stock Appreciation Rights (SARs) grant employees the right to receive a bonus based on the increase in a company's stock price over a set period, without requiring them to purchase shares. These rights align employee incentives with company performance, offering potential financial rewards that reflect shareholder gains. Discover how SARs can enhance your compensation strategy and what to consider before implementing them.

Table of Comparison

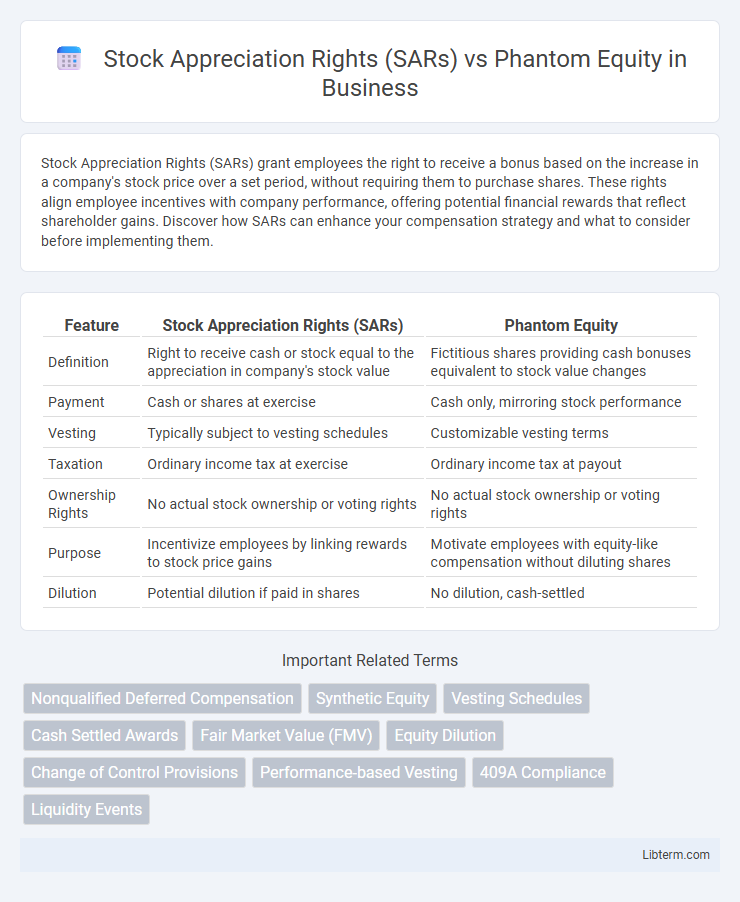

| Feature | Stock Appreciation Rights (SARs) | Phantom Equity |

|---|---|---|

| Definition | Right to receive cash or stock equal to the appreciation in company's stock value | Fictitious shares providing cash bonuses equivalent to stock value changes |

| Payment | Cash or shares at exercise | Cash only, mirroring stock performance |

| Vesting | Typically subject to vesting schedules | Customizable vesting terms |

| Taxation | Ordinary income tax at exercise | Ordinary income tax at payout |

| Ownership Rights | No actual stock ownership or voting rights | No actual stock ownership or voting rights |

| Purpose | Incentivize employees by linking rewards to stock price gains | Motivate employees with equity-like compensation without diluting shares |

| Dilution | Potential dilution if paid in shares | No dilution, cash-settled |

Introduction to Stock Appreciation Rights (SARs) and Phantom Equity

Stock Appreciation Rights (SARs) grant employees the right to receive compensation equivalent to the increase in company stock value over a specified period, often paid in cash or shares, without requiring ownership transfer. Phantom Equity mimics actual stock ownership, providing employees with the financial benefits of stock price appreciation and dividends without granting voting rights or equity stake. Both SARs and Phantom Equity serve as motivational tools in employee compensation, aligning individual performance with company growth while avoiding dilution of equity.

Key Features and Definitions

Stock Appreciation Rights (SARs) grant employees the right to receive compensation equal to the increase in the stock price over a set period, often paid in cash or shares without requiring the employee to purchase stock. Phantom Equity simulates actual stock ownership by providing cash bonuses tied to the company's valuation or stock price, without conferring legal equity or voting rights. Both are non-dilutive equity compensation tools designed to align employee incentives with company performance while avoiding issuing real shares.

How SARs Work: Mechanics and Processes

Stock Appreciation Rights (SARs) grant employees the right to receive a cash or stock payment equivalent to the increase in company stock value from a predetermined base price over a specific period. Employees do not need to purchase shares; instead, they benefit from the appreciation in stock price, typically realized at vesting or exercise dates when the company calculates the value difference. The process involves setting a base price, tracking stock performance, and providing payout either in cash or shares based on the appreciation, aligning employee incentives with company growth without diluting equity immediately.

Understanding Phantom Equity: Structure and Purpose

Phantom equity is a form of long-term incentive plan that grants employees benefits tied to the company's stock value without issuing actual shares, creating a cash or stock bonus based on stock appreciation. Unlike Stock Appreciation Rights (SARs), phantom equity often includes dividend equivalents and can mimic shareholder rights, aligning employee interests with company performance while avoiding dilution. Its structure typically involves a contractual agreement promising a payout reflective of stock value growth, designed to retain key talent and enhance motivation through equity-like rewards.

SARs vs Phantom Equity: Core Differences

Stock Appreciation Rights (SARs) grant employees the right to receive compensation based on the increase in stock price over a set period without actual stock ownership, while Phantom Equity simulates stock ownership by granting units that mimic actual shares' value. SARs typically provide cash or stock equivalent payouts tied strictly to appreciation in stock price, whereas Phantom Equity often includes dividends and may offer voting rights, making it more like real equity. The core difference lies in SARs emphasizing stock price gains as a form of bonus compensation, while Phantom Equity creates a broader, long-term equity-like incentive without transferring legal ownership.

Tax Implications for Employees and Employers

Stock Appreciation Rights (SARs) provide employees with the right to receive the monetary equivalent of stock price increases, typically taxed as ordinary income upon exercise, creating immediate tax obligations for employees, while employers can deduct the corresponding expense. Phantom Equity mimics actual stock ownership without issuing shares, offering employees cash or stock equivalent payments taxed as ordinary income when vested, allowing employers to take tax deductions at payout without upfront tax consequences. Both SARs and Phantom Equity avoid capital gains tax treatment at exercise or payout, impacting employee tax planning and employer accounting strategies.

Accounting and Compliance Considerations

Stock Appreciation Rights (SARs) require companies to record a liability reflecting the fair value of SARs at each reporting date, impacting financial statements under ASC 718 and IFRS 2 standards. Phantom Equity also generates a liability but often involves more complex valuation due to its customizable payout structures, necessitating strict compliance with local tax and securities regulations. Both instruments demand rigorous disclosure and consistent re-measurement to ensure accurate representation of compensation expense and liabilities in financial reporting.

Advantages and Disadvantages of SARs

Stock Appreciation Rights (SARs) offer employees the advantage of benefiting from the company's stock price increase without requiring them to purchase shares, providing a cashless profit opportunity and aligning employee incentives with shareholder value. However, SARs can create a cash flow burden for the company when payouts are made, and their value depends on stock price volatility, which might lead to unpredictable compensation expenses. Unlike phantom equity, SARs do not grant actual ownership or voting rights, potentially limiting employee engagement compared to true equity-based compensation plans.

Pros and Cons of Phantom Equity

Phantom Equity offers employees a share in company value growth without actual stock ownership, providing tax advantages by deferring income until payout and avoiding dilution of shareholder equity. However, Phantom Equity can create significant long-term financial liabilities for employers and may lack the motivational impact of true stock ownership since employees do not gain voting rights or dividends. Companies must carefully design Phantom Equity plans to balance retention benefits against potential cash flow challenges during payouts.

Choosing the Right Plan: Factors for Employers to Consider

Employers choosing between Stock Appreciation Rights (SARs) and Phantom Equity must evaluate factors such as tax implications, employee motivation, and plan administrative complexity. SARs provide employees with the right to receive the appreciation in stock value, typically resulting in favorable tax treatment as compensation income upon exercise. Phantom Equity mimics actual stock ownership, often aligning employee interests more closely with company performance but may involve higher administrative costs and more complex valuation processes.

Stock Appreciation Rights (SARs) Infographic

libterm.com

libterm.com