Option contracts grant the right, but not the obligation, to buy or sell an asset at a predetermined price before a specific date, providing flexibility and risk management for investors. These contracts play a crucial role in financial markets by enabling hedging strategies and speculative opportunities, tailoring investment to your risk tolerance and market expectations. Explore the rest of the article to understand how option contracts can enhance your trading strategy and financial decisions.

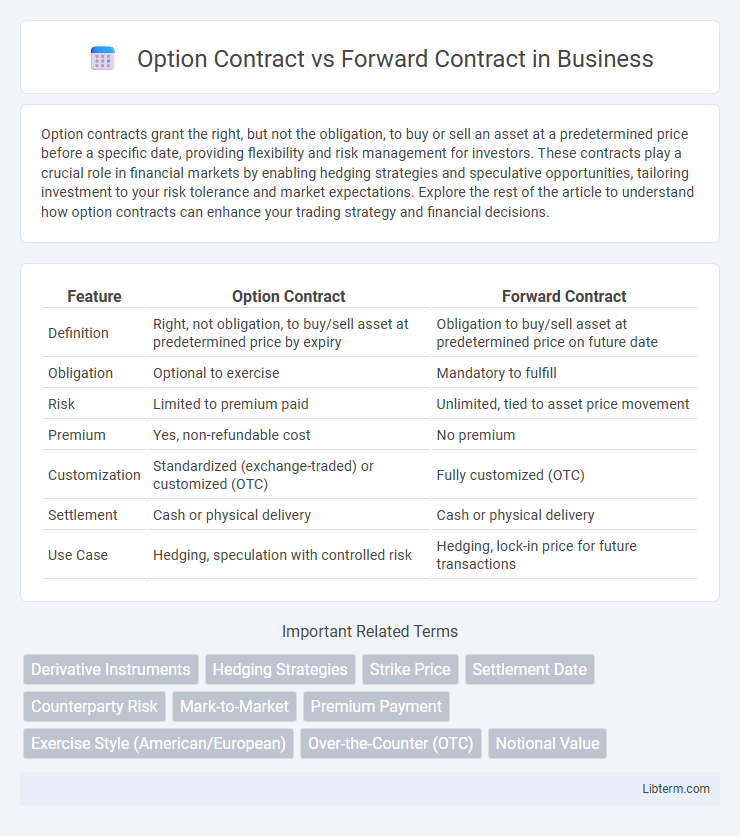

Table of Comparison

| Feature | Option Contract | Forward Contract |

|---|---|---|

| Definition | Right, not obligation, to buy/sell asset at predetermined price by expiry | Obligation to buy/sell asset at predetermined price on future date |

| Obligation | Optional to exercise | Mandatory to fulfill |

| Risk | Limited to premium paid | Unlimited, tied to asset price movement |

| Premium | Yes, non-refundable cost | No premium |

| Customization | Standardized (exchange-traded) or customized (OTC) | Fully customized (OTC) |

| Settlement | Cash or physical delivery | Cash or physical delivery |

| Use Case | Hedging, speculation with controlled risk | Hedging, lock-in price for future transactions |

Introduction to Option and Forward Contracts

Option contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specified expiration date, providing flexibility and risk management. Forward contracts are binding agreements to buy or sell an asset at a fixed price on a future date, primarily used for hedging against price volatility in commodities, currencies, and securities. Both instruments serve as essential derivatives in financial markets, offering tailored risk exposure and price certainty.

Key Definitions: Option Contract Explained

An option contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe, distinguishing it from forward contracts which impose an obligation for both parties. Option contracts include call options, allowing purchase, and put options, allowing sale, with the contract's value influenced by factors such as volatility, time to expiration, and strike price. These contracts serve as risk management tools in financial markets, enabling investors to hedge positions or speculate on asset price movements with limited downside risk.

Key Definitions: Forward Contract Explained

A forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date, typically used to hedge against price fluctuations. Unlike standardized futures contracts, forwards are traded over-the-counter (OTC), offering flexibility in terms, underlying assets, and settlement dates. This contract obligates both buyer and seller to execute the transaction at maturity, making it a binding financial instrument for managing risk.

Structural Differences Between Option and Forward Contracts

Option contracts grant the buyer the right, without obligation, to buy or sell an asset at a predetermined price before or on a specific date, while forward contracts obligate both parties to transact the asset at a fixed price on a set future date. Options involve a premium paid upfront for this right, creating asymmetric risk exposure, whereas forward contracts establish a binding agreement with symmetrical risk for both buyer and seller. The structural differences also include option contracts being standardized and often traded on exchanges, while forward contracts are typically customized OTC agreements between counterparties.

Comparative Risk Analysis: Options vs Forwards

Option contracts limit risk for buyers by providing the right, but not the obligation, to execute the transaction, minimizing potential losses to the premium paid, whereas forward contracts obligate both parties to transact at a predetermined price, exposing them to unlimited downside risk if market prices move unfavorably. Forward contracts carry higher counterparty risk and market risk due to locked-in prices and mandatory settlement, while options offer greater flexibility and risk management through time value and strike price selection. The non-linear payoff structure of options contrasts with the linear, binary risk profile of forwards, making options preferable for hedgers seeking controlled exposure and forwards suitable for entities with specific price certainty needs.

Flexibility and Customization in Contracts

Option contracts offer greater flexibility by granting the buyer the right, but not the obligation, to execute the contract, allowing for strategic decision-making based on market conditions. Forward contracts are customized agreements obligating both parties to transact at a predetermined price and date, providing certainty but less adaptability. The tailored nature of forward contracts suits parties needing fixed terms, whereas options enable participants to hedge risks while retaining optionality.

Pricing Mechanisms and Valuation

Option contracts use pricing mechanisms based on models like Black-Scholes or binomial trees, which factor in variables such as underlying asset price, strike price, volatility, time to expiration, risk-free rate, and dividends to calculate a premium representing the option's fair value. Forward contracts are priced by discounting the difference between the agreed-upon forward price and the spot price, considering the cost of carry, which includes factors like interest rates, storage costs, and dividends, ensuring the contract's value at inception is zero. Valuation of options dynamically adjusts with market volatility and time decay, while forward contracts have linear payoffs that directly reflect changes in the underlying asset price until settlement.

Settlement Processes: Physical vs Cash

Option contracts typically involve a choice for the holder to either settle physically by delivering the underlying asset or settle in cash based on the asset's market value at expiration. Forward contracts primarily require physical settlement, obligating both parties to exchange the underlying asset at a predetermined price on the contract's maturity date. Cash settlement in forwards is less common and usually specified when the underlying asset is difficult to deliver or for financial instruments where physical delivery is impractical.

Real-World Applications: When to Use Each Contract

Option contracts are ideal for businesses seeking flexibility to benefit from favorable price movements without the obligation to execute the contract, commonly used in hedging currency risk or commodity price fluctuations. Forward contracts suit companies requiring a guaranteed price and certainty of execution, often utilized in supply chain management and international trade to lock in costs and revenues. Firms typically choose options when managing uncertain market conditions, while forwards are preferred for budget stability and precise financial planning.

Summary: Choosing Between Option and Forward Contracts

Option contracts offer the right, but not the obligation, to buy or sell an asset at a predetermined price, providing flexibility and limited risk exposure. Forward contracts impose a binding obligation to transact at a specified price and date, suitable for firms seeking certainty and hedging against price fluctuations. Selecting between option and forward contracts depends on risk tolerance, cost considerations, and the need for flexibility versus guaranteed execution in financial or commodity markets.

Option Contract Infographic

libterm.com

libterm.com