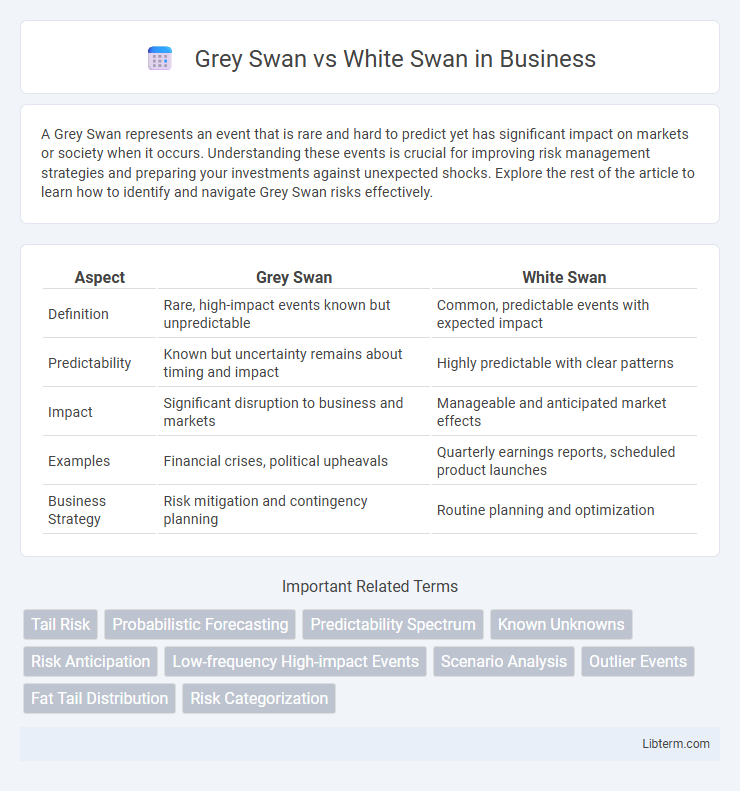

A Grey Swan represents an event that is rare and hard to predict yet has significant impact on markets or society when it occurs. Understanding these events is crucial for improving risk management strategies and preparing your investments against unexpected shocks. Explore the rest of the article to learn how to identify and navigate Grey Swan risks effectively.

Table of Comparison

| Aspect | Grey Swan | White Swan |

|---|---|---|

| Definition | Rare, high-impact events known but unpredictable | Common, predictable events with expected impact |

| Predictability | Known but uncertainty remains about timing and impact | Highly predictable with clear patterns |

| Impact | Significant disruption to business and markets | Manageable and anticipated market effects |

| Examples | Financial crises, political upheavals | Quarterly earnings reports, scheduled product launches |

| Business Strategy | Risk mitigation and contingency planning | Routine planning and optimization |

Understanding Grey Swans and White Swans

Grey Swans represent high-impact, rare events that are somewhat predictable and identifiable based on existing knowledge, often characterized by significant uncertainty but with recognizable warning signs. White Swans, by contrast, are common and expected occurrences with predictable outcomes supported by historical data and established probability models. Understanding these distinctions helps in risk management by preparing for foreseeable threats (Grey Swans) while managing routine risks (White Swans) in strategic decision-making.

Defining Grey Swan Events

Grey Swan events are unpredictable occurrences with potentially significant impact, distinguishable from White Swan events by their lower probability and greater uncertainty. Unlike White Swan events, which are rare but foreseeable and often accounted for in risk management, Grey Swans exist in a gray area of partial predictability where their occurrence is recognized but their magnitude and timing remain ambiguous. Understanding Grey Swan events involves analyzing incomplete data, ambiguous signals, and emerging trends that defy traditional forecasting models.

What Constitutes a White Swan Event

A White Swan event is characterized by its predictability and frequent occurrence, making it a known risk with well-understood possible outcomes. Unlike Grey Swan events, which are rare and partially predictable with significant uncertainty, White Swans are events easily identifiable through historical data, such as regular economic recessions or seasonal weather patterns. Their anticipated nature allows businesses and policymakers to prepare and implement strategies to mitigate potential impacts effectively.

Key Differences Between Grey Swans and White Swans

Grey Swans represent highly improbable but impactful events that are foreseeable with some level of analysis, whereas White Swans refer to regular, predictable occurrences based on historical data. Grey Swans carry an element of surprise and uncertainty, demanding risk management strategies that anticipate potential disruptions. In contrast, White Swans involve known risks that can be quantified and planned for with routine forecasting models.

Real-World Examples of Grey Swan Events

Grey swan events are rare but foreseeable occurrences with significant impacts, unlike white swan events which are predictable and expected. Real-world examples of grey swan events include the 2008 global financial crisis triggered by the collapse of the US housing market and the 2011 Fukushima nuclear disaster caused by a tsunami. These examples highlight how grey swan events blend predictability with high uncertainty, necessitating robust risk management strategies.

Notable Instances of White Swan Events

White Swan events are predictable and well-known occurrences with significant impact, such as scheduled financial crashes or seasonal natural disasters like hurricanes. Notable instances include the 2008 global financial crisis, which analysts had anticipated due to unstable mortgage securities, and annual influenza outbreaks causing widespread health emergencies. These events contrast with Grey Swans, which are less predictable but still foreseeable disruptions with considerable consequences.

Predictability and Impact: Comparing Both Swans

Grey Swans represent high-impact events that are rare but predictable through analysis of existing risks, while White Swans are common, regular occurrences with low impact and high predictability. Grey Swan events pose significant challenges due to their disproportionate consequences and uncertainty in timing despite their foreseeability. White Swan events maintain market or environmental stability by being expected and manageable, contrasting sharply with the disruptive nature of Grey Swans.

The Role of Uncertainty in Swan Events

Grey Swan events embody high-impact occurrences that are rare but perceived as plausible based on available information, while White Swan events are predictable and expected outcomes within normal risk parameters. The role of uncertainty in Grey Swan events lies in the incomplete knowledge and limited data, making them difficult to quantify yet anticipated by experts. Understanding this uncertainty helps in developing risk management strategies that acknowledge both known risks (White Swans) and plausible but uncertain threats (Grey Swans).

Strategies for Managing Grey and White Swans

Strategies for managing Grey Swans involve implementing robust risk assessment frameworks and flexible contingency plans to address unpredictable but plausible high-impact events. White Swan strategies focus on routine risk mitigation techniques, such as regular monitoring, compliance adherence, and standardized responses to well-known, anticipated risks. Combining scenario analysis with adaptive decision-making enhances resilience against both Grey Swan uncertainties and White Swan certainties.

Implications for Risk Management and Planning

Grey Swan events are rare but somewhat predictable risks with moderate to high impact, requiring risk management strategies that emphasize scenario analysis and adaptive planning to mitigate potential disruptions. White Swan events are common, well-known risks with predictable outcomes, allowing organizations to implement standardized controls and contingency plans for effective risk mitigation. Integrating both Grey and White Swan considerations enhances resilient decision-making by addressing both expected and unforeseen challenges in risk management frameworks.

Grey Swan Infographic

libterm.com

libterm.com