An investor plays a crucial role in fueling business growth by providing capital in exchange for equity or debt. Understanding different investment types, risk tolerance, and market trends can significantly enhance your financial success. Explore the full article to learn how to make informed investment decisions that align with your financial goals.

Table of Comparison

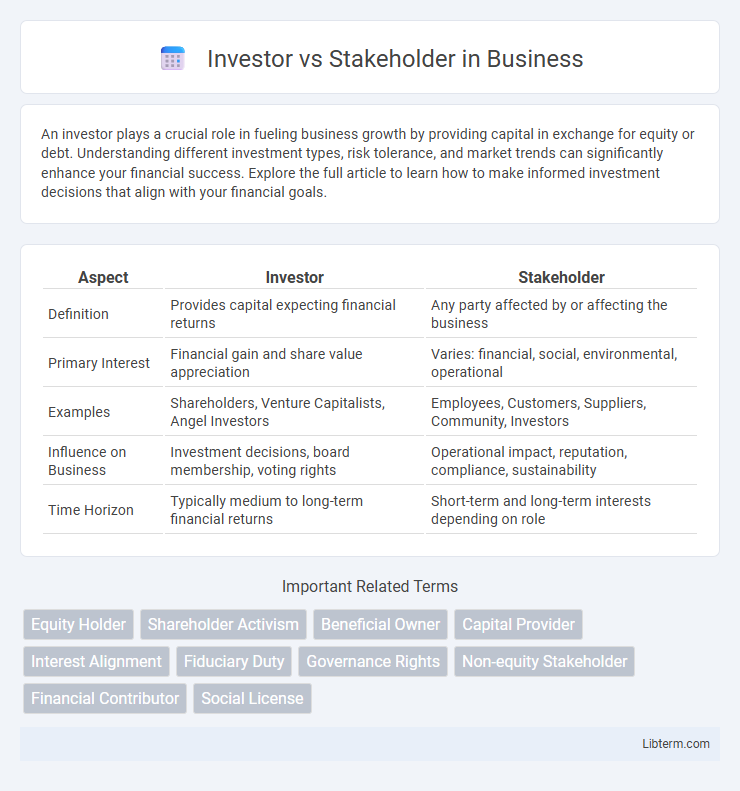

| Aspect | Investor | Stakeholder |

|---|---|---|

| Definition | Provides capital expecting financial returns | Any party affected by or affecting the business |

| Primary Interest | Financial gain and share value appreciation | Varies: financial, social, environmental, operational |

| Examples | Shareholders, Venture Capitalists, Angel Investors | Employees, Customers, Suppliers, Community, Investors |

| Influence on Business | Investment decisions, board membership, voting rights | Operational impact, reputation, compliance, sustainability |

| Time Horizon | Typically medium to long-term financial returns | Short-term and long-term interests depending on role |

Defining Investors and Stakeholders

Investors are individuals or entities that provide capital to a business with the expectation of financial returns through dividends, interest, or capital gains. Stakeholders encompass a broader group including investors, employees, customers, suppliers, and community members who are affected by or can affect the organization's operations and success. Understanding the distinction between investors and stakeholders is crucial for effective corporate governance and strategic decision-making.

Key Roles in Business Ecosystems

Investors provide capital and expect financial returns, influencing strategic decisions through ownership stakes, while stakeholders encompass a broader group including employees, customers, suppliers, and communities who impact and are impacted by the business's operations. Key roles in business ecosystems involve investors driving growth and innovation via funding, whereas stakeholders contribute to sustainability, operational success, and reputation management. Effective collaboration among investors and stakeholders ensures balanced value creation and long-term business resilience.

Primary Objectives: Profit vs. Broader Interests

Investors primarily seek financial returns and profit maximization from their investments, focusing on short- to medium-term gains. Stakeholders encompass a broader group, including employees, customers, suppliers, and communities, prioritizing sustainable growth, social responsibility, and long-term value creation. Balancing profit objectives with stakeholder interests fosters corporate resilience and ethical business practices.

Types of Investors and Stakeholders

Investors primarily include individual investors, institutional investors, venture capitalists, and angel investors, each playing distinct roles in funding and influencing a company's growth. Stakeholders encompass a broader group such as employees, customers, suppliers, creditors, community members, and regulatory bodies, all affected by the organization's operations and decisions. Understanding these types helps in aligning business strategies to meet diverse interests and ensure sustainable value creation.

Decision-Making Influence and Power

Investors primarily influence decision-making through financial leverage, using their capital contributions to sway company strategy and governance. Stakeholders encompass a broader group, including employees, customers, suppliers, and community members, whose collective interests can impact decisions indirectly through reputational effects, operational continuity, and social license. The power dynamic varies as investors hold formal voting rights and control over resource allocation, while stakeholders exert informal pressure that shapes corporate policies and ethical considerations.

Impact on Corporate Governance

Investors primarily influence corporate governance through financial oversight, demanding transparency, accountability, and return on investment, which drives board decisions and strategic priorities. Stakeholders, including employees, customers, and communities, affect governance by advocating for ethical practices, sustainability, and social responsibility, leading companies to adopt broader accountability frameworks. Balancing investor pressures with stakeholder interests shapes governance policies that promote long-term value creation and corporate resilience.

Risk Tolerance and Expectations

Investors primarily focus on financial risk tolerance and expect quantifiable returns within defined timeframes, often analyzing market volatility and portfolio diversification to mitigate losses. Stakeholders encompass a broader group including employees, customers, and community members, with risk tolerance linked to non-financial factors such as job security, brand reputation, and social impact. Balancing investor expectations with stakeholder risk sensitivities is critical for sustainable business strategies and long-term value creation.

Long-term vs. Short-term Focus

Investors typically prioritize short-term financial returns by focusing on quarterly profits and stock price performance, aiming to maximize their immediate gains. In contrast, stakeholders--including employees, customers, and communities--emphasize long-term value creation, sustainability, and corporate social responsibility to ensure ongoing business success and ethical impact. Balancing these perspectives involves integrating robust governance frameworks that align investor interests with sustainable stakeholder benefits over extended time horizons.

Ethical Considerations and Social Responsibilities

Investors prioritize financial returns, often focusing on maximizing profits, sometimes at the expense of broader social and environmental implications. Stakeholders encompass a wider group--including employees, customers, communities, and regulators--whose interests emphasize ethical considerations like fair labor practices, environmental sustainability, and corporate social responsibility. Balancing investor demands with stakeholder expectations requires transparent governance, ethical decision-making, and sustainable business strategies that promote long-term social value alongside economic growth.

Achieving Balance: Aligning Investor and Stakeholder Interests

Achieving balance between investor and stakeholder interests requires aligning financial returns with long-term social and environmental impact, ensuring sustainable business growth. Companies that integrate stakeholder engagement strategies, such as ESG (Environmental, Social, Governance) criteria, can attract responsible investors while meeting community and employee expectations. This alignment fosters trust and resilience, enhancing overall corporate value and reducing risks associated with conflicting priorities.

Investor Infographic

libterm.com

libterm.com