A term deposit is a secure investment option where you lock your money for a fixed period to earn guaranteed interest. This financial product offers predictable returns and protects your capital from market fluctuations, making it ideal for conservative savers. Discover how a term deposit can fit into your overall savings strategy by reading the rest of the article.

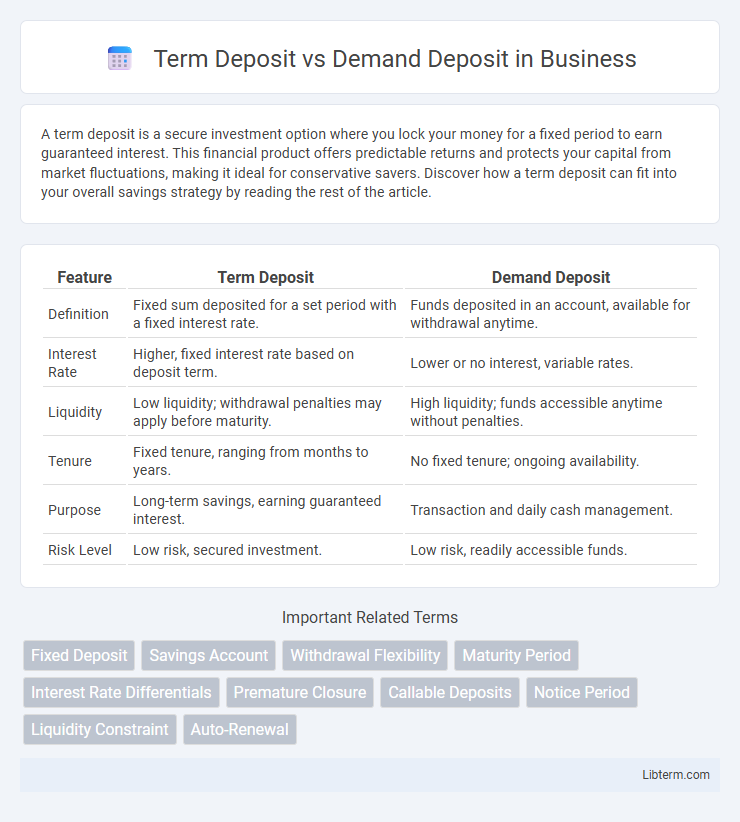

Table of Comparison

| Feature | Term Deposit | Demand Deposit |

|---|---|---|

| Definition | Fixed sum deposited for a set period with a fixed interest rate. | Funds deposited in an account, available for withdrawal anytime. |

| Interest Rate | Higher, fixed interest rate based on deposit term. | Lower or no interest, variable rates. |

| Liquidity | Low liquidity; withdrawal penalties may apply before maturity. | High liquidity; funds accessible anytime without penalties. |

| Tenure | Fixed tenure, ranging from months to years. | No fixed tenure; ongoing availability. |

| Purpose | Long-term savings, earning guaranteed interest. | Transaction and daily cash management. |

| Risk Level | Low risk, secured investment. | Low risk, readily accessible funds. |

Understanding Term Deposits: Definition and Features

Term deposits are fixed-income financial instruments where a specified amount of money is invested for a predetermined period at a guaranteed interest rate, offering higher returns than demand deposits. Unlike demand deposits, funds in term deposits are locked in until maturity, ensuring stability and minimizing withdrawal risks. Key features include fixed tenure options, predictable interest earnings, and penalties for premature withdrawal, making them suitable for risk-averse investors seeking capital preservation and steady income.

What Are Demand Deposits? Key Characteristics

Demand deposits refer to bank account funds that can be withdrawn at any time without prior notice, making them highly liquid assets. These accounts typically include checking and savings accounts, offering immediate access through checks, ATMs, or electronic transfers. Key characteristics include no maturity date, daily interest accrual (if applicable), and minimal or no withdrawal restrictions, contrasting with term deposits that lock funds for a fixed period.

Interest Rates: Term Deposit vs Demand Deposit

Term deposits typically offer higher interest rates compared to demand deposits due to the fixed investment period, providing predictable returns over time. Demand deposits, such as checking or savings accounts, generally feature lower or variable interest rates to maintain liquidity and immediate access to funds. Investors seeking stable and higher returns often prefer term deposits, while those prioritizing flexibility choose demand deposits despite lower interest earnings.

Liquidity and Accessibility Compared

Term deposits offer lower liquidity as funds are locked for a fixed period, typically ranging from a month to several years, with penalties imposed for early withdrawal. Demand deposits provide high liquidity and immediate accessibility, allowing account holders to withdraw or transfer funds at any time without restrictions. The choice between the two depends on balancing the need for stable interest earnings in term deposits against the flexible access to cash offered by demand deposits.

Safety and Risk Factors in Term and Demand Deposits

Term deposits offer higher safety due to fixed interest rates and guaranteed principal protection over a specified period, minimizing market risk exposure. Demand deposits provide liquidity with low risk but typically yield lower returns, making them less vulnerable to interest rate fluctuations but susceptible to inflation risk. The key risk factor in term deposits is early withdrawal penalties, while demand deposits face risks mainly from potential bank insolvency, although both are generally insured by deposit insurance schemes.

Withdrawal Flexibility: Pros and Cons

Term deposits offer limited withdrawal flexibility since funds are locked for a fixed period, often incurring penalties for early withdrawal, making them suitable for long-term saving goals. Demand deposits provide high withdrawal flexibility with instant access to funds anytime without penalties, ideal for everyday expenses and emergency needs. The trade-off lies in higher interest rates for term deposits versus the liquidity convenience of demand deposits.

Suitability: Who Should Choose Term Deposits?

Term deposits are ideal for risk-averse investors seeking stable returns through fixed interest rates over a predetermined period, making them suitable for individuals with a clear financial goal and a defined time horizon. Those who do not require immediate access to their funds and prefer guaranteed principal protection benefit from term deposits, unlike demand deposits that offer high liquidity but typically lower interest earnings. Retirees, conservative savers, and individuals planning for future expenses such as education or home purchases often choose term deposits to maximize interest income while minimizing risk.

Suitability: Who Should Choose Demand Deposits?

Demand deposits are ideal for individuals and businesses requiring immediate access to their funds for daily transactions, such as paying bills or managing operating expenses. They suit those prioritizing liquidity and flexibility over earning interest, given the lack of withdrawal restrictions and instant fund availability. Customers with unpredictable cash flow needs or frequent transfers benefit most from demand deposit accounts.

Tax Implications for Term and Demand Deposits

Interest earned on term deposits is subject to tax deducted at source (TDS) if the interest exceeds a specified threshold, and this income must be reported in the investor's return under the applicable income tax slab. Demand deposits, such as savings accounts, generally offer lower interest rates, and the interest earned is also taxable, requiring declaration under income from other sources. Understanding the tax treatment for both deposit types is crucial for effective financial planning and minimizing tax liability.

Making the Right Choice: Term Deposit or Demand Deposit?

Choosing between a term deposit and a demand deposit depends on your financial goals and liquidity needs. Term deposits offer higher interest rates by locking funds for a fixed period, ideal for savings growth without frequent access. Demand deposits provide immediate access to funds with lower interest, suitable for daily transactions and emergency expenses.

Term Deposit Infographic

libterm.com

libterm.com