Cash bonuses provide immediate financial rewards that boost employee motivation and enhance productivity. They serve as powerful incentives for achieving specific goals, increasing job satisfaction and loyalty. Discover how cash bonuses can transform your workplace culture by exploring the rest of this article.

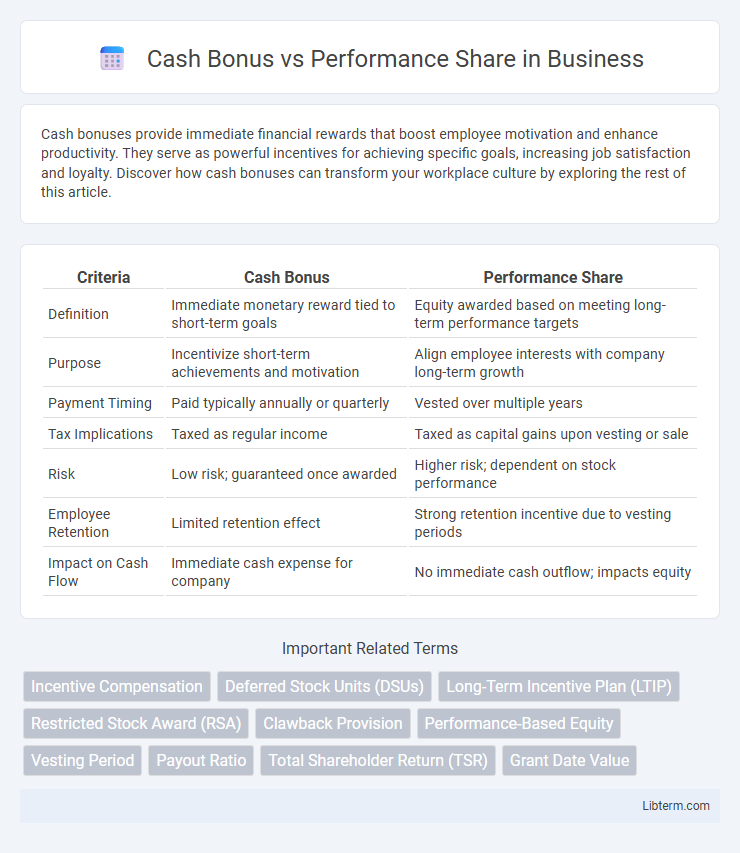

Table of Comparison

| Criteria | Cash Bonus | Performance Share |

|---|---|---|

| Definition | Immediate monetary reward tied to short-term goals | Equity awarded based on meeting long-term performance targets |

| Purpose | Incentivize short-term achievements and motivation | Align employee interests with company long-term growth |

| Payment Timing | Paid typically annually or quarterly | Vested over multiple years |

| Tax Implications | Taxed as regular income | Taxed as capital gains upon vesting or sale |

| Risk | Low risk; guaranteed once awarded | Higher risk; dependent on stock performance |

| Employee Retention | Limited retention effect | Strong retention incentive due to vesting periods |

| Impact on Cash Flow | Immediate cash expense for company | No immediate cash outflow; impacts equity |

Introduction to Cash Bonus and Performance Share

Cash bonuses are immediate financial rewards given to employees based on short-term achievements, typically reflecting individual or company performance within a fiscal year. Performance shares are equity-based incentives granted to employees, usually tied to long-term corporate goals and stock price performance over multiple years. Both forms of compensation aim to motivate and retain talent, but cash bonuses provide instant gratification while performance shares align employee interests with shareholder value growth.

Key Differences Between Cash Bonus and Performance Share

Cash bonuses provide immediate monetary rewards based on short-term achievements, often tied to annual performance metrics and company profitability. Performance shares are long-term equity incentives granted as company stock, aligning employee interests with shareholders and typically vesting over multiple years. While cash bonuses offer quick financial gains, performance shares emphasize sustained company growth and executive retention through potential stock appreciation.

How Cash Bonuses Motivate Employees

Cash bonuses provide immediate financial rewards that directly enhance employee motivation by recognizing short-term achievements and incentivizing productivity. These instant monetary incentives foster a sense of accomplishment and encourage continued high performance across sales targets, project completions, and customer service. Companies that offer significant cash bonuses often experience increased employee engagement and retention due to the tangible acknowledgment of their efforts.

Advantages of Performance Shares for Long-term Growth

Performance shares align employee incentives with company long-term growth by tying rewards to specific financial or operational milestones, fostering sustained value creation. Unlike cash bonuses, performance shares encourage retention and reduce short-term risk-taking by vesting over multiple years, promoting commitment to the company's strategic goals. This equity-based compensation also enhances shareholder alignment, motivating employees to drive stock price appreciation and overall corporate performance.

Tax Implications: Cash Bonus vs Performance Share

Cash bonuses are typically taxed as ordinary income in the year they are received, leading to immediate tax liabilities based on the employee's marginal tax rate. Performance shares, often taxed at vesting or sale, can offer tax deferral advantages and may qualify for favorable capital gains treatment if held long enough. Understanding these distinct tax implications is crucial for optimizing compensation strategies and maximizing net employee benefits.

Impact on Employee Retention and Satisfaction

Cash bonuses provide immediate financial rewards that enhance short-term motivation but may have limited long-term impact on employee retention and satisfaction. Performance shares align employee interests with company success, fostering sustained commitment and higher engagement through potential equity growth. Companies leveraging performance shares often experience improved retention rates and stronger employee satisfaction due to perceived ownership and future value.

Flexibility and Payout Structures Compared

Cash bonuses offer immediate liquidity with flexible payout options often based on short-term performance metrics, making them ideal for rewarding quick achievements and motivating employees in dynamic roles. Performance shares provide long-term incentives by linking payouts to company stock value and multi-year performance targets, aligning employee interests with shareholder value creation. The payout structure for cash bonuses is typically fixed and predictable, while performance shares vary with market conditions and vesting schedules, offering potential for greater reward but less certainty.

Financial Reporting Considerations

Cash bonuses impact financial reporting by increasing current liabilities and reducing net income due to expense recognition in the period earned. Performance shares are recorded as equity compensation and require fair value measurement at grant date, with expense recognition spread over the vesting period, affecting shareholders' equity rather than liabilities. Both forms necessitate clear disclosure in financial statements, detailing measurement methods, assumptions, and the impact on profitability and equity.

Industry Trends: Bonus vs Performance Share Adoption

Corporate compensation strategies increasingly favor performance shares over traditional cash bonuses, reflecting a shift toward aligning employee rewards with long-term company success. Industry data from 2023 shows a 25% rise in performance share adoption among Fortune 500 companies, compared to a 10% decline in cash bonus prevalence. Sectors such as technology and finance lead this trend, using equity-based incentives to drive sustained performance and shareholder value.

Choosing the Right Incentive for Your Organization

Selecting the appropriate incentive between cash bonuses and performance shares hinges on your organization's goals, financial stability, and employee motivation. Cash bonuses offer immediate rewards that drive short-term performance and enhance employee satisfaction during specific fiscal periods. Performance shares, tied to company growth and stock value, align employee interests with long-term corporate success and foster sustained engagement.

Cash Bonus Infographic

libterm.com

libterm.com