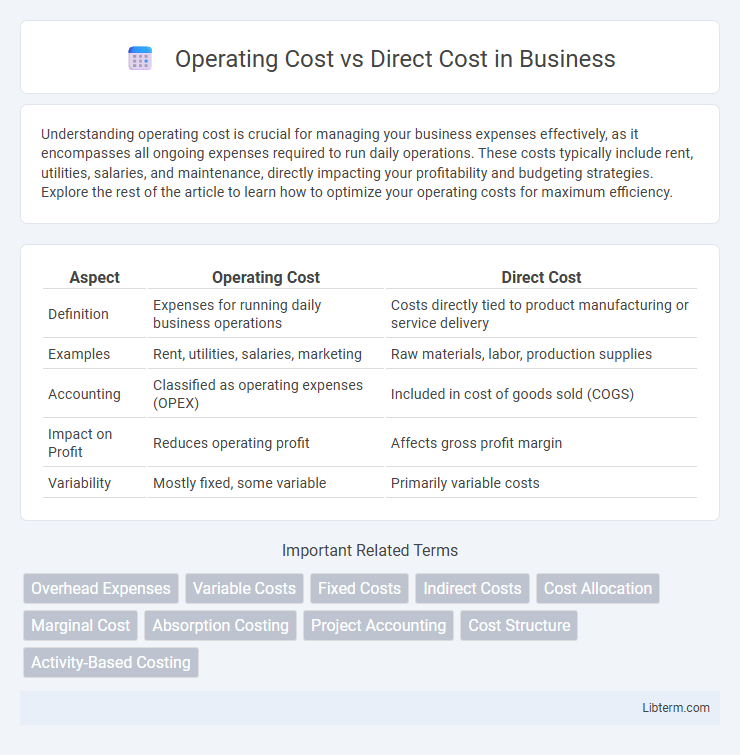

Understanding operating cost is crucial for managing your business expenses effectively, as it encompasses all ongoing expenses required to run daily operations. These costs typically include rent, utilities, salaries, and maintenance, directly impacting your profitability and budgeting strategies. Explore the rest of the article to learn how to optimize your operating costs for maximum efficiency.

Table of Comparison

| Aspect | Operating Cost | Direct Cost |

|---|---|---|

| Definition | Expenses for running daily business operations | Costs directly tied to product manufacturing or service delivery |

| Examples | Rent, utilities, salaries, marketing | Raw materials, labor, production supplies |

| Accounting | Classified as operating expenses (OPEX) | Included in cost of goods sold (COGS) |

| Impact on Profit | Reduces operating profit | Affects gross profit margin |

| Variability | Mostly fixed, some variable | Primarily variable costs |

Understanding Operating Costs

Operating costs encompass all expenses required to run a business day-to-day, including rent, utilities, salaries, and maintenance. Unlike direct costs, such as raw materials or labor directly tied to production, operating costs reflect overhead expenditures necessary for overall operations. Understanding operating costs is crucial for accurate budgeting, pricing strategies, and profitability analysis in any business model.

Defining Direct Costs

Direct costs are expenses that can be directly traced to the production of goods or services, such as raw materials, labor wages, and manufacturing supplies. These costs vary directly with the level of production output and are essential for calculating the cost of goods sold (COGS). Unlike operating costs, which include indirect expenses like rent and utilities, direct costs provide a clear measure of the expenses required to produce each unit.

Key Differences Between Operating and Direct Costs

Operating costs include all expenses required to run a business, such as rent, utilities, salaries, and maintenance, whereas direct costs are specifically tied to the production of goods or services, including raw materials and direct labor. Operating costs encompass both fixed and variable expenses that support overall operations, while direct costs vary directly with production volume. Understanding the distinction helps in accurate budgeting, cost control, and financial analysis for improved profitability and operational efficiency.

Components of Operating Costs

Operating costs encompass all expenses incurred during normal business operations, including direct costs such as raw materials and labor directly associated with production. Components of operating costs extend beyond direct costs to include indirect expenses like utilities, rent, administrative salaries, maintenance, and depreciation. Understanding these components is essential for accurate cost management and financial analysis in businesses.

Components of Direct Costs

Direct costs encompass expenses that can be directly traced to the production of goods or services, including raw materials, direct labor, and manufacturing supplies. These components are essential for calculating the total cost of production and differ from operating costs, which include both direct and indirect expenses such as rent, utilities, and administrative salaries. Understanding the breakdown of direct costs helps businesses optimize budgeting, pricing strategies, and cost control measures.

How Operating Costs Impact Profitability

Operating costs, encompassing expenses such as rent, utilities, and salaries, directly reduce a company's net profit by increasing the total expenditure needed for daily operations. Unlike direct costs, which are tied to production, high operating costs can erode profit margins even when sales are strong, making efficient cost management essential for maintaining financial health. Monitoring and controlling operating costs enables businesses to optimize profitability by maximizing the difference between revenue and overall expenses.

Importance of Direct Costs in Product Pricing

Direct costs, including raw materials, labor, and manufacturing expenses, are crucial in determining accurate product pricing since they directly impact the cost of goods sold (COGS). Understanding direct costs enables businesses to set competitive prices that cover expenses and yield profitability, ensuring financial sustainability. Unlike operating costs, which encompass indirect expenses, focusing on direct costs provides precise insights into product profitability and cost management.

Examples of Operating vs Direct Costs

Operating costs include expenses such as rent, utilities, salaries of administrative staff, and maintenance fees that keep a business running daily but do not directly create products. Direct costs specifically involve expenses like raw materials, labor directly involved in manufacturing, and production supplies used in making goods or delivering services. Examples of operating costs are office rent and utilities, while direct costs encompass raw materials for a product and wages of factory workers.

Managing and Reducing Costs Effectively

Operating cost includes all expenses required to run a business, encompassing utilities, salaries, rent, and maintenance, whereas direct cost refers specifically to expenses directly tied to production, such as raw materials and labor. Effectively managing and reducing these costs involves detailed tracking, analyzing cost drivers, and implementing strategic measures like process optimization and supplier negotiations. Leveraging technology for real-time cost monitoring and adopting lean management principles can significantly enhance cost control and profitability.

Conclusion: Choosing the Right Cost Strategy

Choosing the right cost strategy depends on accurately distinguishing operating costs, which include ongoing expenses like rent and utilities, from direct costs directly tied to production, such as raw materials and labor. Effective cost management requires aligning budget allocation with the specific nature of these expenses to enhance profitability and operational efficiency. Prioritizing direct cost control improves product pricing precision, while managing operating costs supports sustainable business growth.

Operating Cost Infographic

libterm.com

libterm.com