Permanent working capital represents the minimum amount of funds that a business must maintain to ensure smooth day-to-day operations without disruptions. This capital stays invested in current assets like inventory and receivables, providing a financial cushion against short-term fluctuations. Discover how managing your permanent working capital effectively can improve your company's liquidity and operational efficiency by reading the rest of the article.

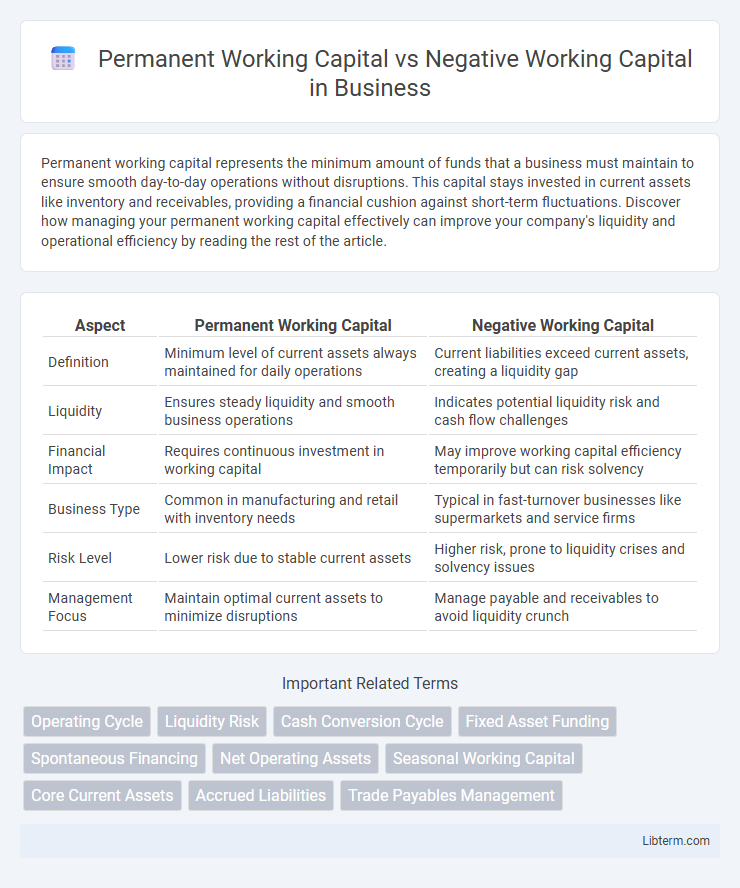

Table of Comparison

| Aspect | Permanent Working Capital | Negative Working Capital |

|---|---|---|

| Definition | Minimum level of current assets always maintained for daily operations | Current liabilities exceed current assets, creating a liquidity gap |

| Liquidity | Ensures steady liquidity and smooth business operations | Indicates potential liquidity risk and cash flow challenges |

| Financial Impact | Requires continuous investment in working capital | May improve working capital efficiency temporarily but can risk solvency |

| Business Type | Common in manufacturing and retail with inventory needs | Typical in fast-turnover businesses like supermarkets and service firms |

| Risk Level | Lower risk due to stable current assets | Higher risk, prone to liquidity crises and solvency issues |

| Management Focus | Maintain optimal current assets to minimize disruptions | Manage payable and receivables to avoid liquidity crunch |

Understanding Permanent Working Capital

Permanent working capital refers to the minimum level of current assets a company must maintain to ensure uninterrupted operations, including cash, inventory, and receivables, that remain invested indefinitely. This stable portion of working capital supports day-to-day business functions and absorbs fluctuations in short-term liabilities. Understanding permanent working capital helps businesses manage liquidity, optimize cash flow, and sustain operational stability despite market variability.

What is Negative Working Capital?

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity challenges in meeting short-term obligations. This financial state can signal efficient inventory management and faster turnover in some industries, but often raises concerns about solvency and operational risk. Understanding the difference between permanent working capital, which ensures ongoing operational needs, and negative working capital helps businesses balance liquidity management and financial stability.

Key Differences Between Permanent and Negative Working Capital

Permanent working capital refers to the minimum level of current assets that a company must maintain to ensure continuous operations, representing a stable and ongoing investment in inventory, receivables, and cash. Negative working capital occurs when current liabilities exceed current assets, indicating that a company's short-term obligations surpass its liquid assets, which may signal liquidity challenges or efficient asset management in certain industries like retail. The key differences lie in their financial implications: permanent working capital reflects sustained operational needs, while negative working capital highlights potential cash flow issues or strategic use of supplier credit.

Importance of Permanent Working Capital for Businesses

Permanent working capital ensures that businesses maintain a minimum level of current assets to support uninterrupted operations and meet short-term liabilities, fostering financial stability. It enables companies to manage unforeseen expenses and seasonal fluctuations, reducing the risk of liquidity crises. Reliance on permanent working capital enhances creditworthiness and operational efficiency, essential for sustaining long-term growth.

Risks Associated with Negative Working Capital

Negative working capital indicates that a company's current liabilities exceed its current assets, creating liquidity risks that may hinder timely payment of short-term obligations and disrupt operations. Companies with negative working capital face increased insolvency risks during economic downturns or revenue fluctuations, as they lack sufficient assets to cover debts. In contrast, maintaining permanent working capital ensures consistent operational funding and reduces the probability of cash flow shortages, enhancing financial stability.

Industries Commonly Using Negative Working Capital

Industries commonly using negative working capital include retail, fast food, and technology sectors where companies such as Walmart, McDonald's, and Apple generate cash quickly from customers but pay suppliers on extended terms. Negative working capital indicates these firms efficiently manage cash flow by minimizing inventory and speeding up receivables, relying on supplier credit for operational funding. This practice contrasts with permanent working capital requirements in manufacturing or heavy industries where large inventories and longer receivable cycles demand sustained investment.

Managing and Optimizing Permanent Working Capital

Permanent working capital represents the minimum level of current assets a company must maintain to ensure smooth operations, while negative working capital occurs when current liabilities exceed current assets, indicating potential liquidity issues. Managing permanent working capital involves optimizing cash, inventory, and receivables levels to avoid excess idle resources and minimize financing costs. Effective strategies include accurate forecasting, just-in-time inventory systems, and efficient credit policies to sustain operations without overburdening the balance sheet.

When Negative Working Capital Can Be Advantageous

Negative working capital can be advantageous when a company operates with high inventory turnover and strong supplier relationships that allow for extended payment terms. This scenario enables businesses to finance operations through accounts payable without tying up cash in inventory or receivables, improving liquidity. Retailers and service companies often leverage negative working capital to fund growth efficiently without additional borrowing.

Financial Implications: Cash Flow and Liquidity

Permanent working capital ensures consistent liquidity to cover ongoing operational expenses, stabilizing cash flow and reducing the risk of solvency issues. Negative working capital occurs when current liabilities exceed current assets, potentially signaling cash flow challenges and strained liquidity that can disrupt daily operations. Efficient management of permanent working capital supports sustained cash inflows, while persistent negative working capital requires careful financial strategies to avoid liquidity crises.

Permanent vs Negative Working Capital: Strategic Considerations

Permanent working capital represents the minimum level of current assets a company must maintain to ensure uninterrupted operations, reflecting a long-term investment in inventory, receivables, and cash reserves. Negative working capital occurs when current liabilities exceed current assets, which can indicate efficient cash management in sectors like retail but may pose liquidity risks in capital-intense industries. Strategic considerations involve balancing permanent working capital to support growth without tying up excessive resources, while managing negative working capital demands careful monitoring to avoid solvency challenges and sustain operational stability.

Permanent Working Capital Infographic

libterm.com

libterm.com