A sole proprietorship is the simplest business structure where one individual owns and operates the business, bearing full responsibility for its debts and liabilities. This structure offers complete control and straightforward tax reporting but lacks liability protection, putting your personal assets at risk. Explore the full article to understand the advantages, disadvantages, and key considerations before starting your sole proprietorship.

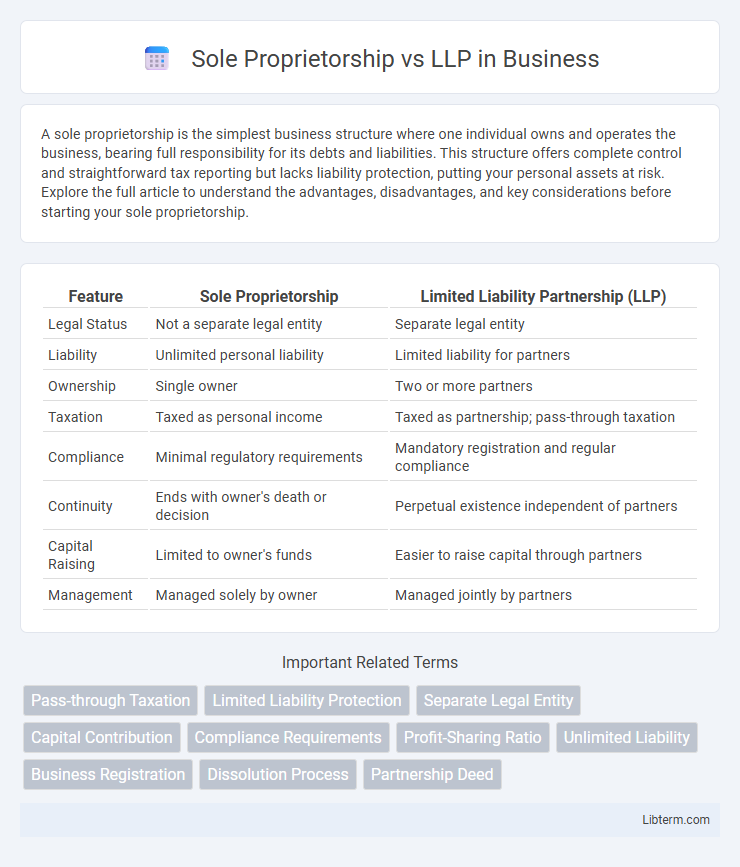

Table of Comparison

| Feature | Sole Proprietorship | Limited Liability Partnership (LLP) |

|---|---|---|

| Legal Status | Not a separate legal entity | Separate legal entity |

| Liability | Unlimited personal liability | Limited liability for partners |

| Ownership | Single owner | Two or more partners |

| Taxation | Taxed as personal income | Taxed as partnership; pass-through taxation |

| Compliance | Minimal regulatory requirements | Mandatory registration and regular compliance |

| Continuity | Ends with owner's death or decision | Perpetual existence independent of partners |

| Capital Raising | Limited to owner's funds | Easier to raise capital through partners |

| Management | Managed solely by owner | Managed jointly by partners |

Introduction to Sole Proprietorship and LLP

A sole proprietorship is the simplest business structure, owned and operated by a single individual who bears full responsibility for liabilities and retains all profits. In contrast, a Limited Liability Partnership (LLP) combines the flexibility of a partnership with limited liability protection, safeguarding personal assets of partners from business debts. LLPs require formal registration and provide an ideal structure for professionals seeking limited liability without the complexities of a corporation.

Key Definitions and Legal Structures

A sole proprietorship is a business owned and operated by a single individual, where the owner has unlimited personal liability for business debts and obligations. In contrast, a Limited Liability Partnership (LLP) combines elements of partnerships and corporations, offering partners limited liability protection while allowing flexible management structures. The legal structure of a sole proprietorship is simple with minimal regulatory requirements, whereas an LLP requires formal registration and compliance with statutory regulations, ensuring separate legal identity and protection for its partners.

Formation and Registration Process

Sole proprietorship formation requires minimal registration, often limited to local business licenses and permits, making it the simplest and fastest option for entrepreneurs to start operations. LLP registration demands filing incorporation documents with the relevant state authority, including partnership agreements and obtaining a certificate of incorporation, ensuring a formal legal structure. While sole proprietorships have straightforward processes with lower costs, LLPs involve more regulatory compliance but provide liability protection and a separate legal identity.

Ownership and Control

A sole proprietorship is owned and controlled by a single individual who has full authority over business decisions and bears unlimited personal liability. In contrast, a Limited Liability Partnership (LLP) involves multiple partners who share ownership and control according to the partnership agreement, with liability limited to their investment in the firm. LLPs provide a structured management framework, allowing partners to divide responsibilities while protecting personal assets from business debts.

Liability and Risk Exposure

Sole proprietorship owners bear unlimited personal liability, exposing their personal assets to business debts and legal claims. In contrast, an LLP (Limited Liability Partnership) offers limited liability protection, shielding partners' personal assets from business liabilities beyond their investment in the partnership. This structural difference significantly reduces risk exposure for LLP partners compared to sole proprietors.

Taxation Differences

A Sole Proprietorship reports business income on the owner's personal tax return using Schedule C, subjecting profits to self-employment tax and ordinary income tax rates. In contrast, a Limited Liability Partnership (LLP) is typically treated as a pass-through entity where partners report their share of income, but the LLP itself does not pay federal income tax, reducing potential double taxation. LLP partners must pay self-employment taxes on earnings, but the partnership can deduct business expenses before income distribution, which may optimize overall tax liability.

Compliance and Regulatory Requirements

Sole proprietorships face minimal compliance requirements, typically limited to local business licenses and tax filings, making them easier to manage for small-scale operations. LLPs, or Limited Liability Partnerships, require formal registration, ongoing annual filings, and adherence to statutory regulations such as maintaining partnership agreements and financial transparency. Regulatory frameworks for LLPs enhance liability protection but also demand stricter compliance with corporate governance and reporting standards set by authorities.

Pros and Cons of Sole Proprietorship

A sole proprietorship offers complete control to the owner with simplified tax filings and minimal regulatory requirements, making it ideal for small businesses seeking low startup costs. However, it carries unlimited personal liability, meaning the owner's personal assets are at risk for business debts and legal claims. Limited access to capital and challenges in scaling the business are additional drawbacks compared to structures like Limited Liability Partnerships (LLPs).

Pros and Cons of LLP

A Limited Liability Partnership (LLP) offers the advantage of limited liability protection, shielding personal assets from business debts and legal liabilities, unlike a sole proprietorship where the owner is personally liable. LLPs benefit from flexible management structures and pass-through taxation, avoiding double taxation commonly faced by corporations. However, LLPs may involve more regulatory requirements, annual compliance filings, and higher setup costs compared to the simplicity and lower administrative burden of a sole proprietorship.

Choosing the Right Business Structure

Choosing the right business structure between a Sole Proprietorship and a Limited Liability Partnership (LLP) depends on factors like liability, taxation, and management control. Sole Proprietorship offers simplicity and full control but exposes owners to unlimited personal liability, whereas LLP provides limited liability protection while allowing flexibility in management and pass-through taxation. Evaluating business scale, risk tolerance, and future growth plans ensures optimal alignment with legal and financial goals.

Sole Proprietorship Infographic

libterm.com

libterm.com