Passive interest refers to earnings generated from investments like savings accounts, bonds, or rental properties without active involvement in daily operations. This type of interest allows your money to grow steadily over time, providing a reliable income stream with minimal effort. Explore the article to discover how passive interest can enhance your financial strategy.

Table of Comparison

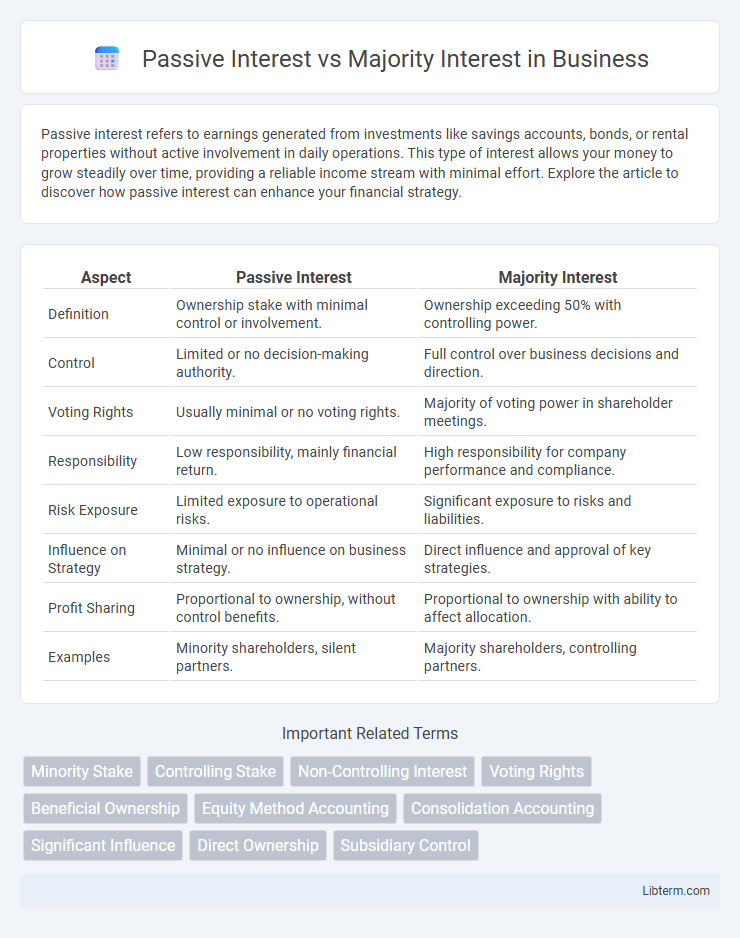

| Aspect | Passive Interest | Majority Interest |

|---|---|---|

| Definition | Ownership stake with minimal control or involvement. | Ownership exceeding 50% with controlling power. |

| Control | Limited or no decision-making authority. | Full control over business decisions and direction. |

| Voting Rights | Usually minimal or no voting rights. | Majority of voting power in shareholder meetings. |

| Responsibility | Low responsibility, mainly financial return. | High responsibility for company performance and compliance. |

| Risk Exposure | Limited exposure to operational risks. | Significant exposure to risks and liabilities. |

| Influence on Strategy | Minimal or no influence on business strategy. | Direct influence and approval of key strategies. |

| Profit Sharing | Proportional to ownership, without control benefits. | Proportional to ownership with ability to affect allocation. |

| Examples | Minority shareholders, silent partners. | Majority shareholders, controlling partners. |

Understanding Passive Interest vs Majority Interest

Passive interest refers to a shareholder's stake in a company where they do not have significant control or decision-making power, typically holding less than 50% ownership. Majority interest exists when an investor or group holds more than 50% of a company's shares, granting control over corporate decisions and governance. Understanding the distinction between passive interest and majority interest is crucial for evaluating control rights, influence in strategic direction, and potential financial benefits.

Definitions: What is Passive Interest?

Passive interest refers to a stakeholder's ownership share in a business or investment without active involvement in daily management or decision-making processes. Typically held by investors who provide capital but do not participate in operational control, passive interest generates returns primarily through dividends, profit sharing, or appreciation. This contrasts with majority interest, where the owner has controlling authority and significant influence over company decisions.

Definitions: What is Majority Interest?

Majority interest refers to owning more than 50% of a company's voting shares, granting control over corporate decisions and influence on management policies. This ownership stake enables the majority shareholder to dictate major business strategies, board composition, and mergers or acquisitions. In contrast, minority shareholders hold less than 50% and typically lack decisive control over company direction.

Key Differences Between Passive and Majority Interests

Passive interest typically refers to a non-controlling stake in a business where the investor has limited influence over management decisions and operational control, often characterized by dividends or profit shares without voting power. Majority interest implies ownership of more than 50% of a company's stock, granting significant control over corporate decisions, board composition, and strategic direction. Key differences include levels of control, voting rights, and regulatory implications, where majority interest holders can dictate business policies, while passive investors generally remain financially involved without operational authority.

Rights and Responsibilities of Passive Interest Holders

Passive interest holders possess limited rights in company decisions, primarily receiving financial returns without voting power or management influence. Their responsibilities are minimal, generally restricted to fulfilling initial investment commitments and complying with contract terms. Unlike majority interest holders, passive investors do not engage in operational control or bear liabilities for company management.

Rights and Powers of Majority Interest Holders

Majority interest holders possess significant decision-making rights, including voting power to elect board members, approve mergers, and influence corporate policies. Their authority often enables control over dividend distributions, corporate governance, and strategic direction of the company. Passive interest holders typically lack such control, receiving returns without participating in management decisions.

Financial Implications: Earnings and Control

Passive interest holders receive earnings primarily through dividends or distributions without influence over corporate decisions, limiting their control but ensuring steady income streams. Majority interest holders possess significant control over management and strategic directions, enabling them to impact earnings policy and reinvestment strategies directly. This control facilitates potential growth in earnings but introduces risks tied to decision-making and operational performance.

Legal Considerations for Both Interests

Passive interest holders typically have limited legal rights and minimal control over company decisions, focusing mainly on financial returns without involvement in day-to-day management. Majority interest holders possess significant legal authority, including voting rights that influence corporate governance, decision-making, and strategic direction. Legal considerations for majority interests include fiduciary duties and liability exposure, while passive investors primarily navigate contractual protections and securities regulations.

Impact on Business Decision-Making

Passive interest holders typically have limited influence on business decisions, as their stake does not grant them control or voting power, which can slow strategic initiatives requiring broad consensus. Majority interest owners possess significant control and can steer company policies, financial choices, and operational strategies, directly impacting the direction and growth of the business. This concentration of decision-making power in majority interest holders often leads to more streamlined and decisive management compared to the often-inactive input of passive investors.

Choosing Between Passive and Majority Interests

Choosing between passive interest and majority interest depends on the desired level of control and involvement in a business. A majority interest provides decision-making power and control over operations, typically requiring active participation, while a passive interest limits exposure to management responsibilities but offers a share of profits with reduced influence. Investors seeking influence should opt for majority interest, whereas those prioritizing limited liability and minimal engagement prefer passive interest.

Passive Interest Infographic

libterm.com

libterm.com