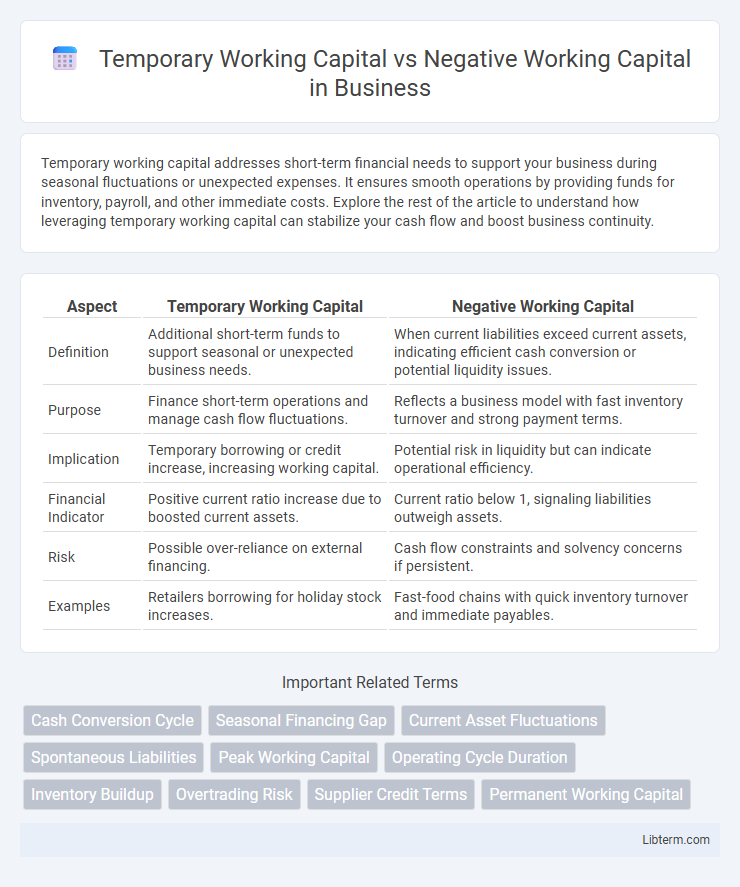

Temporary working capital addresses short-term financial needs to support your business during seasonal fluctuations or unexpected expenses. It ensures smooth operations by providing funds for inventory, payroll, and other immediate costs. Explore the rest of the article to understand how leveraging temporary working capital can stabilize your cash flow and boost business continuity.

Table of Comparison

| Aspect | Temporary Working Capital | Negative Working Capital |

|---|---|---|

| Definition | Additional short-term funds to support seasonal or unexpected business needs. | When current liabilities exceed current assets, indicating efficient cash conversion or potential liquidity issues. |

| Purpose | Finance short-term operations and manage cash flow fluctuations. | Reflects a business model with fast inventory turnover and strong payment terms. |

| Implication | Temporary borrowing or credit increase, increasing working capital. | Potential risk in liquidity but can indicate operational efficiency. |

| Financial Indicator | Positive current ratio increase due to boosted current assets. | Current ratio below 1, signaling liabilities outweigh assets. |

| Risk | Possible over-reliance on external financing. | Cash flow constraints and solvency concerns if persistent. |

| Examples | Retailers borrowing for holiday stock increases. | Fast-food chains with quick inventory turnover and immediate payables. |

Understanding Temporary Working Capital

Temporary working capital refers to the additional funds a company requires to manage fluctuations in its operational needs, often driven by seasonal sales increases or unexpected expenses. It differs from negative working capital, which occurs when current liabilities exceed current assets, indicating potential liquidity issues. Understanding temporary working capital enables businesses to effectively plan cash flow and maintain smooth operations during peak periods without compromising financial stability.

Defining Negative Working Capital

Negative working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity challenges. Temporary working capital refers to the short-term funding required to manage seasonal or unexpected fluctuations in operational expenses. While negative working capital may signal financial distress, some businesses operate efficiently with it by quickly turning over inventory and receivables.

Key Differences Between Temporary and Negative Working Capital

Temporary working capital refers to the additional funds a business requires to manage seasonal fluctuations in operations, often characterized by short-term borrowing or increased current assets. Negative working capital occurs when current liabilities exceed current assets, indicating that a company may face liquidity issues or efficient inventory management, depending on the industry's operating cycle. Key differences include the nature of cash flow management, with temporary working capital being a planned financial strategy to meet demand surges, while negative working capital signals potential financial distress or an aggressive approach to payable management.

Causes of Temporary Working Capital Needs

Temporary working capital needs arise primarily from seasonal fluctuations in sales, unexpected increases in production costs, or delays in accounts receivable collections. Businesses experience these short-term cash flow gaps when inventory buildup or higher operational expenses temporarily exceed current liabilities. Managing these temporary needs requires careful monitoring of cash flow cycles and strategic financing to avoid liquidity shortages.

Factors Leading to Negative Working Capital

Temporary working capital refers to the additional funds required by a business to meet short-term operational needs during peak periods or unexpected expenses. Negative working capital occurs when current liabilities exceed current assets, indicating potential liquidity challenges or efficient risk management depending on the industry. Factors leading to negative working capital include rapid inventory turnover, high accounts payable due to extended supplier credit terms, and aggressive collection of receivables, commonly seen in retail or service sectors with strong cash flow cycles.

Benefits and Risks of Temporary Working Capital

Temporary working capital provides businesses with short-term liquidity to manage seasonal fluctuations, unexpected expenses, or short-term operational needs, ensuring smooth cash flow without long-term debt commitments. Its benefits include flexibility in financing, improved operational efficiency during peak periods, and the ability to capitalize on growth opportunities. Risks involve potential dependency leading to frequent borrowing, increased interest costs, and vulnerability to cash flow disruptions when repayment is due.

Implications of Sustained Negative Working Capital

Sustained negative working capital indicates that a company consistently has current liabilities exceeding current assets, potentially signaling liquidity issues and difficulty in meeting short-term obligations. This condition can reflect efficient inventory management and rapid cash turnover in some industries, but often increases the risk of insolvency and supplier payment delays. Businesses with prolonged negative working capital must carefully manage cash flows and financing strategies to avoid operational disruptions and maintain financial stability.

Managing Temporary Working Capital Efficiently

Managing temporary working capital efficiently involves optimizing short-term assets and liabilities to meet fluctuating operational needs without incurring excessive costs. Maintaining adequate cash flow and inventory turnover ensures businesses can capitalize on growth opportunities while avoiding liquidity crunches. Strategic control of accounts receivable and payable cycles minimizes funding gaps, promoting sustained financial stability despite temporary capital demands.

How to Address Negative Working Capital Scenarios

Negative working capital occurs when a company's current liabilities exceed its current assets, signaling potential liquidity issues. To address this, businesses can improve cash flow by accelerating receivables, extending payables, and managing inventory more efficiently. Securing short-term financing or renegotiating payment terms with suppliers also helps stabilize operations during negative working capital scenarios.

Strategic Approaches to Optimize Working Capital

Temporary working capital management involves short-term adjustments to meet fluctuating operational needs, utilizing tactical measures such as accelerating receivables and managing inventory turnover to maintain liquidity. Negative working capital, characterized by current liabilities exceeding current assets, can be strategically leveraged by businesses with strong cash flows to optimize cash management and reduce financing costs. Employing data-driven cash flow forecasting, vendor negotiations, and just-in-time inventory practices enhances the strategic optimization of working capital to support operational efficiency and financial stability.

Temporary Working Capital Infographic

libterm.com

libterm.com