Institutional investors play a crucial role in global financial markets by managing large pools of capital on behalf of clients such as pension funds, insurance companies, and mutual funds. Their investment decisions influence market trends, corporate governance, and economic growth worldwide. Explore the full article to understand how institutional investors impact your financial landscape and investment opportunities.

Table of Comparison

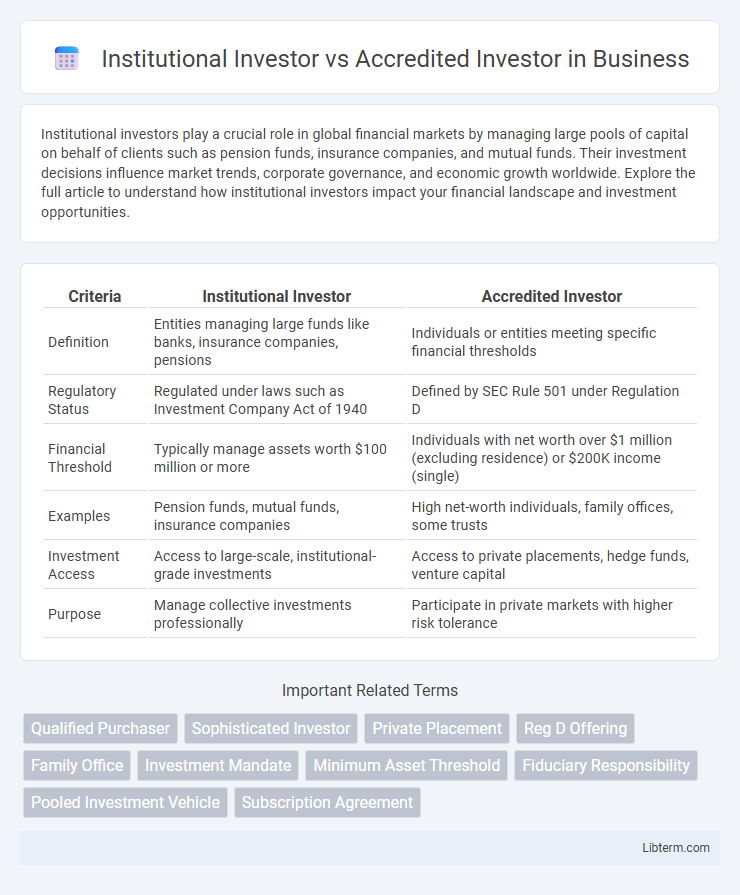

| Criteria | Institutional Investor | Accredited Investor |

|---|---|---|

| Definition | Entities managing large funds like banks, insurance companies, pensions | Individuals or entities meeting specific financial thresholds |

| Regulatory Status | Regulated under laws such as Investment Company Act of 1940 | Defined by SEC Rule 501 under Regulation D |

| Financial Threshold | Typically manage assets worth $100 million or more | Individuals with net worth over $1 million (excluding residence) or $200K income (single) |

| Examples | Pension funds, mutual funds, insurance companies | High net-worth individuals, family offices, some trusts |

| Investment Access | Access to large-scale, institutional-grade investments | Access to private placements, hedge funds, venture capital |

| Purpose | Manage collective investments professionally | Participate in private markets with higher risk tolerance |

Understanding Institutional Investors

Institutional investors are organizations such as pension funds, insurance companies, and mutual funds that pool large sums of money to invest in securities, real estate, and other assets, providing significant market influence. They typically have more stringent regulatory standards and greater access to complex investment opportunities compared to accredited investors, who are high-net-worth individuals meeting specific income or net worth thresholds. Understanding institutional investors is crucial because their investment strategies and decisions can impact market liquidity, asset prices, and overall economic stability.

Defining Accredited Investors

Accredited investors are individuals or entities that meet specific financial criteria set by regulatory authorities, such as having a net worth exceeding $1 million (excluding primary residence) or earning an annual income above $200,000 for individuals ($300,000 for joint income) in the past two years. Unlike institutional investors, accredited investors qualify for access to private securities offerings that are exempt from certain SEC registration requirements. This classification allows accredited investors to participate in higher-risk, potentially higher-reward investment opportunities typically restricted to sophisticated market participants.

Key Differences Between Institutional and Accredited Investors

Institutional investors are organizations such as mutual funds, pension funds, and insurance companies that invest large sums of money on behalf of their clients or members, while accredited investors are high-net-worth individuals or entities who meet specific income or net worth criteria set by regulatory bodies like the SEC. Institutional investors typically have greater access to a wider range of investment opportunities, including private placements and large-scale deals, due to their substantial financial resources and professional expertise. Accredited investors qualify for certain private market investments but usually invest smaller amounts independently, relying on their meeting of income thresholds (e.g., $200,000 annual income) or net worth (e.g., $1 million excluding primary residence).

Regulatory Framework and Requirements

Institutional investors are entities such as banks, insurance companies, pensions, and mutual funds regulated under specific financial laws like the Investment Company Act of 1940, requiring rigorous compliance and disclosure standards. Accredited investors, primarily high-net-worth individuals or entities meeting criteria set by the SEC under Regulation D, qualify for private capital offerings due to their financial sophistication and ability to bear investment risks. The regulatory framework differentiates these groups to balance investor protection with capital market efficiency, imposing stricter scrutiny on institutional investors and threshold-based qualification for accredited investors.

Investment Capabilities and Capital Strength

Institutional investors typically manage large pools of capital, often exceeding billions of dollars, enabling diversified investment strategies across multiple asset classes and markets. Accredited investors have substantial personal or joint net worth or income, allowing them access to private investment opportunities but with comparatively limited capital and resources. The capital strength of institutional investors provides greater leverage and risk tolerance, whereas accredited investors often rely on personal wealth and may face constraints in scaling investments.

Types of Investment Opportunities Available

Institutional investors typically access a broader range of investment opportunities, including private equity, hedge funds, syndicated loans, and large-scale real estate projects, often with higher minimum investment thresholds. Accredited investors, defined by specific income or net worth criteria, can participate in private placements, venture capital funds, and certain private debt offerings, but their options are generally more limited compared to institutional counterparts. Both categories benefit from exemptions under securities regulations, granting access to exclusive investment vehicles not open to non-accredited retail investors.

Risk Profiles and Management Strategies

Institutional investors, such as pension funds and insurance companies, typically manage large pools of capital with diversified portfolios designed to mitigate risk through professional asset management and sophisticated strategies. Accredited investors, often high-net-worth individuals, assume higher risk by investing in less regulated markets like private equity or venture capital, relying on personal financial acumen or advisors to manage volatility. The risk profile for institutional investors leans toward stability and long-term growth, whereas accredited investors often pursue aggressive strategies seeking higher returns despite increased exposure to market fluctuations.

Impact on Financial Markets

Institutional investors, such as pension funds and mutual funds, manage large pools of capital, driving market liquidity and price stability through substantial trading volumes. Accredited investors, typically high-net-worth individuals, contribute to market diversity by accessing private offerings and early-stage investments, fostering innovation and capital formation. The combined participation of both investor types enhances market efficiency, risk distribution, and capital allocation across public and private financial markets.

Advantages and Limitations for Each Investor Type

Institutional investors benefit from access to large-scale investment opportunities and preferential terms due to their substantial financial resources and market influence, yet they face complex regulatory scrutiny and limited flexibility in investment strategies. Accredited investors enjoy access to exclusive private market deals and potentially higher returns with fewer regulatory constraints, but their investment scope is generally smaller, and they bear higher risks without guaranteed protections. Both investor types contribute significantly to capital markets, balancing opportunities for growth with inherent limitations tied to their regulatory and financial capacities.

Choosing the Right Path: Which Investor Category Fits You?

Institutional investors manage large pools of capital, such as pension funds, insurance companies, and mutual funds, offering access to high-value, diversified investment opportunities with regulatory advantages but requiring significant capital and expertise. Accredited investors are individuals or entities meeting specific income or net worth thresholds, allowing access to private placements and alternative investments with fewer regulatory protections but greater flexibility. Choosing the right path depends on your capital size, investment experience, risk tolerance, and regulatory eligibility, ensuring alignment with your financial goals and compliance requirements.

Institutional Investor Infographic

libterm.com

libterm.com