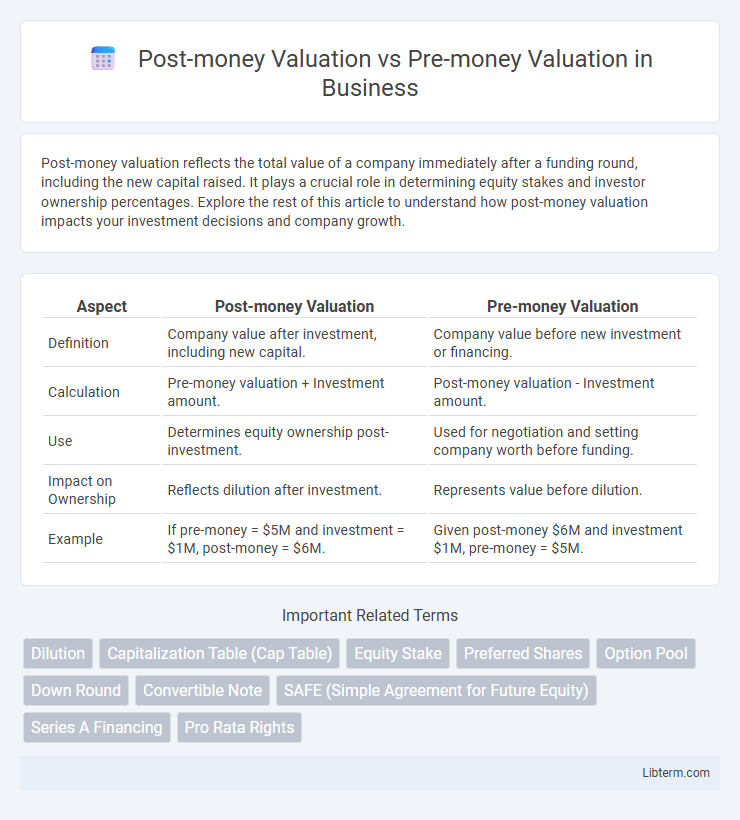

Post-money valuation reflects the total value of a company immediately after a funding round, including the new capital raised. It plays a crucial role in determining equity stakes and investor ownership percentages. Explore the rest of this article to understand how post-money valuation impacts your investment decisions and company growth.

Table of Comparison

| Aspect | Post-money Valuation | Pre-money Valuation |

|---|---|---|

| Definition | Company value after investment, including new capital. | Company value before new investment or financing. |

| Calculation | Pre-money valuation + Investment amount. | Post-money valuation - Investment amount. |

| Use | Determines equity ownership post-investment. | Used for negotiation and setting company worth before funding. |

| Impact on Ownership | Reflects dilution after investment. | Represents value before dilution. |

| Example | If pre-money = $5M and investment = $1M, post-money = $6M. | Given post-money $6M and investment $1M, pre-money = $5M. |

Introduction to Startup Valuations

Pre-money valuation represents a startup's estimated worth before receiving external funding, while post-money valuation includes the investment amount added to the pre-money value. These metrics are critical for determining equity stakes and negotiating investment terms during funding rounds. Accurate understanding of both valuations helps founders and investors assess ownership dilution and business potential effectively.

Defining Pre-money Valuation

Pre-money valuation refers to the estimated value of a company before receiving external funding or investment. This valuation is crucial for determining the ownership percentage investors will receive in exchange for their capital. Understanding pre-money valuation helps founders negotiate equity stakes and assess the impact of new funding rounds on company ownership.

Explaining Post-money Valuation

Post-money valuation refers to a company's estimated worth immediately after receiving external funding or investment, incorporating the new capital injected. This valuation is calculated by adding the amount of new equity capital raised to the pre-money valuation, reflecting the total equity value of the business at that point. Investors use post-money valuation to determine their ownership percentage and the company's value after financing rounds.

Key Differences Between Pre-money and Post-money

Pre-money valuation refers to a company's value before receiving external funding or investment, whereas post-money valuation includes the new capital injected during the funding round, representing the company's value immediately after the investment. The key difference lies in how equity ownership is calculated; post-money valuation accounts for investor shares, reducing the ownership percentage of existing shareholders compared to pre-money valuation. Understanding this distinction is crucial for founders and investors in negotiating equity stakes and assessing dilution impact during venture capital financing.

Importance of Valuation in Fundraising

Post-money valuation represents a company's value after new investments, while pre-money valuation reflects the value before receiving funding. Accurate valuation is crucial in fundraising as it determines the ownership percentage investors receive and influences investment terms. Proper valuation ensures fair equity distribution and attracts potential investors by demonstrating the company's worth and growth potential.

Calculation Methods for Valuations

Pre-money valuation calculates a startup's value before new investment by multiplying the total existing shares by the current share price. Post-money valuation adds the new investment amount to the pre-money valuation, reflecting the company's worth immediately after funding. The formula is: Post-money valuation = Pre-money valuation + New investment amount, essential for equity dilution and ownership percentage calculations.

Impact on Ownership and Equity

Post-money valuation determines the company's total value after new investment, directly influencing the ownership percentage of both existing and new shareholders. Pre-money valuation reflects the company's value before the investment, setting the baseline for equity dilution experienced by current shareholders once the funding is added. Accurate assessment of these valuations is crucial for founders and investors to negotiate ownership stakes and equity distribution effectively.

Common Misconceptions

Post-money valuation is often confused with pre-money valuation, but they represent different financial metrics crucial for startups and investors. Pre-money valuation refers to the company's value before new investment, while post-money valuation includes the new capital infusion, directly impacting equity dilution. A common misconception is that post-money valuation implies a higher company worth without accounting for ownership percentage changes that occur after the funding round.

Real-world Examples and Case Studies

Post-money valuation represents a company's worth immediately after receiving new capital from investors, while pre-money valuation reflects its value before that investment. For example, in Airbnb's 2015 funding round, a pre-money valuation of $13 billion shifted to a post-money valuation of $15 billion after raising $2 billion, illustrating how capital influx alters company worth. Case studies of startups like Uber reveal how pre-money valuations guide negotiation, but post-money figures ultimately determine ownership stakes and investor returns.

Choosing the Right Valuation Approach

Selecting the appropriate valuation method hinges on understanding post-money valuation, which reflects a company's worth after new capital infusion, versus pre-money valuation, the company's value before investment. Pre-money valuation provides a baseline for negotiating equity stakes, while post-money valuation clarifies investor ownership percentages and overall enterprise value post-funding. Accurate assessment of market conditions, growth potential, and investment terms ensures the chosen approach aligns with stakeholders' strategic goals.

Post-money Valuation Infographic

libterm.com

libterm.com