ICE Mortgage Technology streamlines lending processes with advanced digital solutions tailored for mortgage professionals and borrowers. Its innovative platform enhances efficiency, reduces errors, and accelerates loan delivery from application to closing. Discover how ICE Mortgage Technology can transform your mortgage experience by exploring the full article.

Table of Comparison

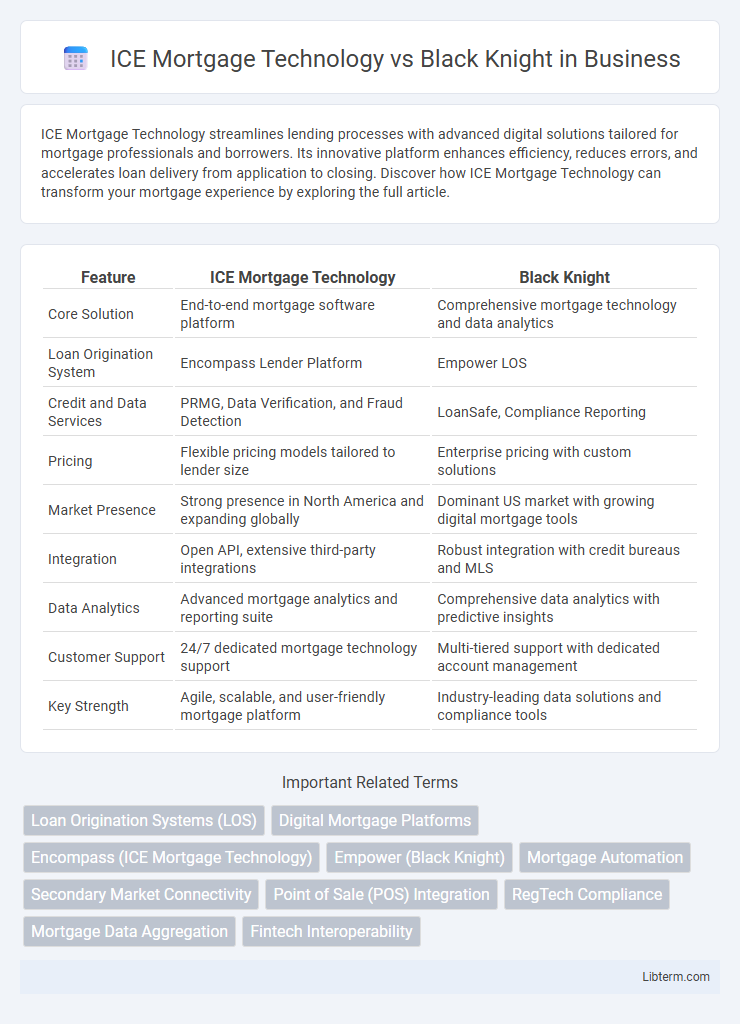

| Feature | ICE Mortgage Technology | Black Knight |

|---|---|---|

| Core Solution | End-to-end mortgage software platform | Comprehensive mortgage technology and data analytics |

| Loan Origination System | Encompass Lender Platform | Empower LOS |

| Credit and Data Services | PRMG, Data Verification, and Fraud Detection | LoanSafe, Compliance Reporting |

| Pricing | Flexible pricing models tailored to lender size | Enterprise pricing with custom solutions |

| Market Presence | Strong presence in North America and expanding globally | Dominant US market with growing digital mortgage tools |

| Integration | Open API, extensive third-party integrations | Robust integration with credit bureaus and MLS |

| Data Analytics | Advanced mortgage analytics and reporting suite | Comprehensive data analytics with predictive insights |

| Customer Support | 24/7 dedicated mortgage technology support | Multi-tiered support with dedicated account management |

| Key Strength | Agile, scalable, and user-friendly mortgage platform | Industry-leading data solutions and compliance tools |

Overview of ICE Mortgage Technology and Black Knight

ICE Mortgage Technology offers a comprehensive digital mortgage platform designed to streamline loan origination, processing, and underwriting with advanced automation and data integration. Black Knight provides end-to-end mortgage solutions including servicing, loan origination, and analytics, leveraging robust software and data services to enhance operational efficiency. Both companies lead the mortgage technology sector, emphasizing innovation to optimize lending workflows and improve borrower experience.

Key Features Comparison

ICE Mortgage Technology offers comprehensive loan origination systems with robust automation capabilities, cloud-based integration, and advanced analytics for streamlined mortgage processing. Black Knight provides extensive end-to-end mortgage software solutions featuring powerful servicing platforms, risk management tools, and data analytics designed for scalability and regulatory compliance. Both platforms emphasize digital transformation but differ in their specialized tools: ICE focuses on accelerating loan processing efficiency, while Black Knight excels in servicing and portfolio management functions.

User Interface and Experience

ICE Mortgage Technology offers a modern, intuitive user interface designed for seamless navigation and enhanced efficiency, featuring customizable dashboards and real-time analytics that support quick decision-making. Black Knight provides a robust platform with comprehensive mortgage servicing capabilities, but its interface is often considered more complex, requiring steeper learning curves and longer onboarding. User experience in ICE Mortgage Technology prioritizes streamlined workflows and user-centric design, whereas Black Knight emphasizes depth of functionality over simplicity.

Integration Capabilities

ICE Mortgage Technology offers robust integration capabilities through its end-to-end mortgage processing platform, enabling seamless data exchange across loan origination, underwriting, and closing. Black Knight specializes in comprehensive integration solutions with its Empower platform, supporting interoperability among multiple third-party systems and enhancing workflow automation. Both companies prioritize open APIs and scalable architecture to streamline mortgage operations and improve efficiency for lenders and servicers.

Compliance and Security Measures

ICE Mortgage Technology and Black Knight both implement robust compliance frameworks tailored to meet stringent regulatory standards such as CFPB, RESPA, and GDPR. ICE Mortgage Technology emphasizes advanced encryption protocols, multi-factor authentication, and continuous threat monitoring to safeguard sensitive data throughout the mortgage lifecycle. Black Knight integrates AI-driven compliance checks and automated audit trails, enhancing real-time risk management and ensuring comprehensive security governance across its platforms.

Pricing Structures

ICE Mortgage Technology offers subscription-based pricing models tailored for scalability, enabling lenders to select modules based on volume and service needs. Black Knight utilizes a flexible fee structure combining licensing fees, transactional charges, and maintenance costs to accommodate diverse enterprise sizes. Both firms emphasize customizable pricing to align with varying loan volumes and technology integration requirements.

Customer Support and Training

ICE Mortgage Technology offers comprehensive customer support with tailored training programs designed to enhance user onboarding and system proficiency, leveraging advanced digital tools for seamless assistance. Black Knight provides robust customer service with extensive training resources, including live webinars and on-demand tutorials, prioritizing responsiveness and personalized support. Both companies emphasize proactive client engagement to ensure efficient adoption and utilization of their mortgage technology platforms.

Scalability and Customization Options

ICE Mortgage Technology offers highly scalable cloud-based solutions designed to support large-volume mortgage operations with flexible APIs for seamless integration and extensive customization options tailored to lender-specific workflows. Black Knight provides robust scalability through its enterprise-level software platforms capable of handling substantial loan volumes, coupled with configurable modules that allow lenders to customize features and streamline business processes. Both companies emphasize adaptability and scalability, yet ICE Mortgage Technology's API-driven framework typically offers greater real-time customization flexibility compared to Black Knight's modular approach.

Industry Adoption and Market Share

ICE Mortgage Technology and Black Knight are leading providers in the mortgage technology sector, each commanding significant industry adoption and market share. ICE Mortgage Technology's innovative digital mortgage solutions have been rapidly adopted by top lenders, contributing to its expanding footprint in the loan origination software market. Black Knight maintains a strong presence with its comprehensive suite of mortgage servicing and analytics platforms widely used by banks and mortgage servicers, securing a dominant share in the servicing solutions segment.

Pros and Cons of Each Platform

ICE Mortgage Technology offers an intuitive user interface with robust automation tools that streamline the loan origination process, enhancing productivity and reducing errors; however, its implementation can be costly for smaller lenders and might require extensive training. Black Knight provides a comprehensive suite of mortgage and servicing solutions with strong integration capabilities and regulatory compliance features but may present challenges with system complexity and slower customization options. Both platforms provide powerful data analytics and support services, yet choosing between them depends on specific lender size, budget, and workflow preferences.

ICE Mortgage Technology Infographic

libterm.com

libterm.com