A capital lease is a type of lease agreement where the lessee assumes most of the risks and benefits of ownership for the leased asset, often reflected on the balance sheet. This lease typically includes terms that transfer ownership to the lessee by the end of the lease term or allow them to purchase the asset at a bargain price. To fully understand how a capital lease affects your financial statements and decision-making, read the rest of the article.

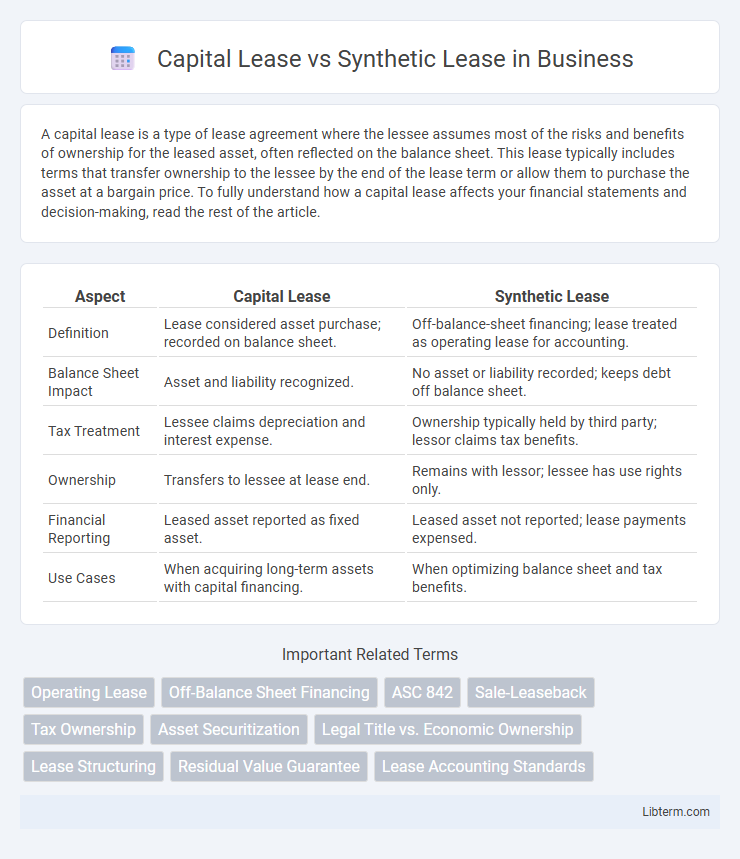

Table of Comparison

| Aspect | Capital Lease | Synthetic Lease |

|---|---|---|

| Definition | Lease considered asset purchase; recorded on balance sheet. | Off-balance-sheet financing; lease treated as operating lease for accounting. |

| Balance Sheet Impact | Asset and liability recognized. | No asset or liability recorded; keeps debt off balance sheet. |

| Tax Treatment | Lessee claims depreciation and interest expense. | Ownership typically held by third party; lessor claims tax benefits. |

| Ownership | Transfers to lessee at lease end. | Remains with lessor; lessee has use rights only. |

| Financial Reporting | Leased asset reported as fixed asset. | Leased asset not reported; lease payments expensed. |

| Use Cases | When acquiring long-term assets with capital financing. | When optimizing balance sheet and tax benefits. |

Introduction to Capital Lease vs Synthetic Lease

A capital lease is a financial arrangement where the lessee records the leased asset and corresponding liability on the balance sheet, reflecting ownership-like benefits and risks. A synthetic lease is a structured financing technique that allows the lessee to keep the leased asset and related liability off the balance sheet while still retaining operational control. Understanding the key differences between capital and synthetic leases is essential for effective financial reporting and tax strategy optimization.

Key Definitions: Capital Lease and Synthetic Lease

A capital lease is a lease agreement that transfers ownership rights and risks of the asset to the lessee, allowing the asset and related liabilities to be recorded on the lessee's balance sheet. A synthetic lease combines the tax benefits of ownership with off-balance-sheet financing, where the lessee maintains operational control but the asset and liability remain with a special purpose entity. Both lease types impact financial reporting, asset management, and tax treatment differently, influencing corporate financing strategies.

Core Differences Between Capital Lease and Synthetic Lease

A capital lease transfers ownership risks and benefits to the lessee, appearing as an asset and liability on the balance sheet, while a synthetic lease allows the lessee to keep the leased asset and related debt off the balance sheet for accounting purposes. Capital leases implement terms similar to asset purchase financing, including depreciation and interest expense recognition, whereas synthetic leases are structured to meet off-balance sheet criteria, combining operating lease accounting with ownership control. The core difference lies in balance sheet treatment and financial reporting impact, affecting key metrics such as debt-to-equity ratio and return on assets.

Accounting Treatment: Capital Lease vs Synthetic Lease

Capital leases require lessees to recognize the leased asset and corresponding liability on the balance sheet, following GAAP rules for capitalization and depreciation. Synthetic leases, structured to meet off-balance-sheet criteria, allow lessees to avoid asset and liability recognition, treating lease payments as operating expenses in the income statement. This distinction impacts financial ratios, debt covenants, and overall balance sheet presentation for lessees.

Tax Implications for Capital and Synthetic Leases

Capital leases are treated as asset purchases for tax purposes, allowing lessees to claim depreciation and interest deductions, which can reduce taxable income significantly. Synthetic leases are structured to appear as operating leases on financial statements while providing lessees with the tax benefits of ownership, including the ability to claim depreciation and interest expense deductions. The key tax implication for synthetic leases lies in their dual accounting treatment, enabling companies to optimize financial ratios without sacrificing tax advantages available under capital lease accounting.

Balance Sheet Impact: Capital vs Synthetic Leases

Capital leases are recorded as both an asset and a liability on the balance sheet, increasing reported debt and assets, which affects financial ratios such as debt-to-equity and return on assets. Synthetic leases, structured to meet off-balance-sheet criteria, keep the leased asset and corresponding liability off the balance sheet, thereby improving leverage ratios and preserving borrowing capacity. The choice between capital and synthetic leases has significant implications for financial statement presentation, investor perception, and compliance with accounting standards such as ASC 842 or IFRS 16.

Advantages of Capital Lease

Capital leases allow companies to record the leased asset and liability on their balance sheets, enhancing transparency and providing tax advantages through depreciation and interest expense deductions. They offer financial statement benefits by improving asset base representation and supporting long-term capital investment analysis. Capital leases also provide clearer ownership rights and potential purchase options at the end of the lease term, aiding asset control and strategic planning.

Benefits of Synthetic Lease Structures

Synthetic lease structures offer off-balance-sheet financing benefits, allowing companies to maintain favorable debt-to-equity ratios and improve financial statement appearance. These leases provide tax advantages by enabling lessees to retain tax ownership of the asset, thus capturing depreciation tax deductions. Enhanced flexibility in asset management and potential cost savings make synthetic leases attractive for capital-intensive industries seeking optimized capital structure and cash flow.

Factors to Consider When Choosing Lease Type

When choosing between a capital lease and a synthetic lease, companies must evaluate their impact on financial statements, including asset capitalization and liability recognition under GAAP. Tax implications and off-balance-sheet financing benefits are critical, as synthetic leases often keep liabilities off the balance sheet while capital leases require asset and liability reporting. The decision also hinges on control over the leased asset, payment structure, and long-term financial strategy aligned with regulatory compliance.

Conclusion: Selecting the Right Lease for Your Business

Choosing between a capital lease and a synthetic lease depends on the business's financial strategy and tax objectives. Capital leases offer ownership benefits and asset depreciation advantages on the balance sheet, ideal for companies seeking long-term asset control. Synthetic leases provide off-balance-sheet financing, preserving borrowing capacity and improving financial ratios without asset ownership, suitable for businesses aiming to optimize financial statements and tax treatment.

Capital Lease Infographic

libterm.com

libterm.com