Franchise-operated businesses offer a proven model that combines brand recognition with local management expertise. This approach allows you to benefit from established operational systems while adapting to specific market needs. Explore the article to discover how franchise-operated ventures can maximize your success potential.

Table of Comparison

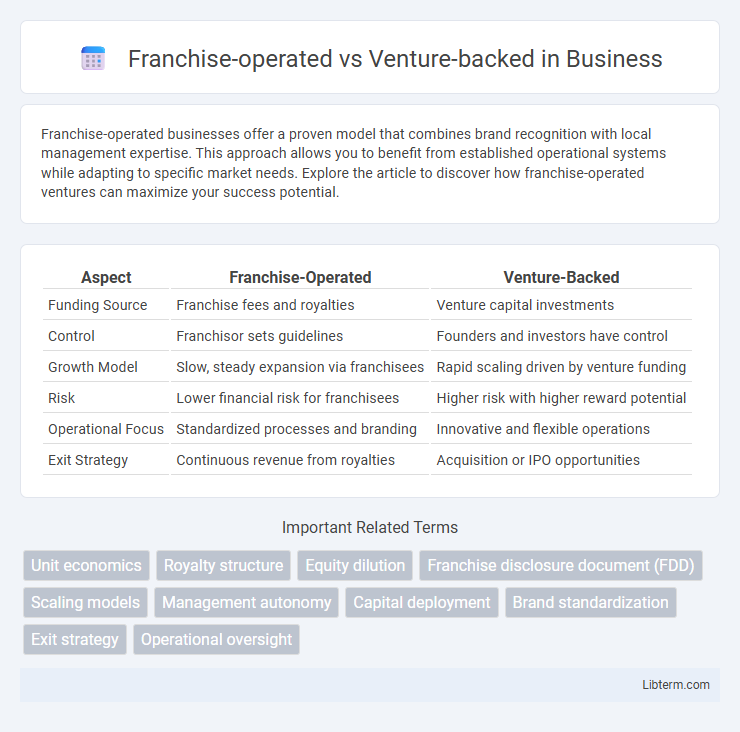

| Aspect | Franchise-Operated | Venture-Backed |

|---|---|---|

| Funding Source | Franchise fees and royalties | Venture capital investments |

| Control | Franchisor sets guidelines | Founders and investors have control |

| Growth Model | Slow, steady expansion via franchisees | Rapid scaling driven by venture funding |

| Risk | Lower financial risk for franchisees | Higher risk with higher reward potential |

| Operational Focus | Standardized processes and branding | Innovative and flexible operations |

| Exit Strategy | Continuous revenue from royalties | Acquisition or IPO opportunities |

Introduction: Franchise-Operated vs Venture-Backed Models

Franchise-operated models rely on replicating proven business concepts through individual owners who pay fees and royalties for brand use and support. Venture-backed models secure capital from investors aiming for rapid growth, often prioritizing innovation and scalability over immediate profitability. These distinct approaches influence operational control, risk distribution, and expansion strategies in the business landscape.

Defining Franchise-Operated Businesses

Franchise-operated businesses are defined by their model of licensing a brand, proven business system, and ongoing support to individual owners who operate their outlets independently. These businesses benefit from established brand recognition, standardized operating procedures, and a collective marketing strategy, reducing the risks associated with start-ups. Franchise operators typically pay initial franchise fees and ongoing royalties in exchange for training, operational support, and the right to use the franchisor's trademarks and business methods.

Understanding Venture-Backed Enterprises

Venture-backed enterprises secure funding from investors seeking high-growth potential, allowing rapid scaling and innovation compared to franchise-operated businesses that follow established models. These startups prioritize product development, market disruption, and equity growth rather than replicating proven operational systems. Understanding venture-backed firms involves analyzing venture capital trends, funding rounds, and exit strategies crucial for long-term success.

Investment Structure and Funding Sources

Franchise-operated businesses primarily rely on franchise fees and royalties from franchisees as their core funding sources, creating a decentralized investment structure that leverages individual investors for expansion. Venture-backed companies attract capital from venture capital firms and angel investors, employing an equity-based investment structure designed to fuel rapid growth and scale through successive funding rounds. The distinct funding approaches impact control dynamics, with franchisees maintaining operational autonomy versus venture investors often exerting strategic influence.

Ownership and Control Dynamics

Franchise-operated businesses maintain ownership and control through franchisors who set operational standards and brand guidelines, while franchisees retain autonomy over daily management within those parameters. Venture-backed companies experience significant influence from investors who often acquire equity stakes, leading to shared decision-making power and strategic oversight in exchange for capital infusion. This ownership dynamic directly impacts control, with franchise models emphasizing brand consistency and venture-backed startups prioritizing growth acceleration under investor guidance.

Scalability and Growth Potential

Franchise-operated businesses offer rapid expansion with lower capital risks by leveraging established brand models and local operators, enabling scalable growth through standardized systems and proven market demand. Venture-backed startups prioritize high scalability and accelerated growth by investing heavily in innovative technology and market disruption, often aiming for exponential user acquisition and market penetration. Scalability in franchise models relies on replication efficiency, whereas venture-backed growth depends on agile adaptation and substantial capital infusion for scaling operations.

Risk Factors and Mitigation Strategies

Franchise-operated businesses typically face lower financial risk due to established brand recognition, standardized operations, and ongoing franchisor support, reducing uncertainties related to market entry and customer acquisition. Venture-backed startups encounter higher risk from rapid growth demands, technology development expenses, and market volatility, requiring robust risk mitigation strategies such as scalable business models, agile management, and diversified funding sources. Effective risk management in franchise operations relies on adherence to proven systems and ongoing training, while venture-backed firms prioritize adaptive innovation, rigorous due diligence, and strategic pivot planning to mitigate operational and financial risks.

Operational Flexibility and Decision-Making

Franchise-operated businesses benefit from established operational frameworks providing consistency but often face limited flexibility due to franchisor mandates. Venture-backed startups experience higher operational flexibility, enabling rapid pivots and innovative decision-making driven by investor expectations and market demands. This dynamic shapes scalability, risk tolerance, and strategic autonomy differently across both business models.

Brand Consistency and Customer Experience

Franchise-operated businesses maintain brand consistency through standardized protocols and comprehensive training, ensuring uniform customer experiences across locations. Venture-backed companies often prioritize rapid growth and innovation, which can lead to varied customer experiences as new markets and models are tested. Consistent brand messaging and service quality are crucial in franchises to preserve customer loyalty, while venture-backed firms may leverage flexibility to tailor experiences but face challenges in maintaining uniform brand identity.

Which Model Suits Your Business Goals?

Franchise-operated models offer proven systems, brand recognition, and lower risk, making them ideal for entrepreneurs seeking steady growth and operational support. Venture-backed startups provide scalable funding, innovation-driven flexibility, and potential for rapid expansion, aligning with businesses aiming for high growth and disruptive market impact. Choosing between franchise-operated and venture-backed depends on your business goals, risk tolerance, and preference for control versus external investment.

Franchise-operated Infographic

libterm.com

libterm.com