A management buyout (MBO) occurs when a company's existing management team acquires a significant portion or all of the business, often financed through debt or equity investors. This strategic move enhances managerial control and aligns ownership with operational expertise, potentially driving growth and innovation. Discover how an MBO could transform Your business strategy by exploring the detailed insights in this article.

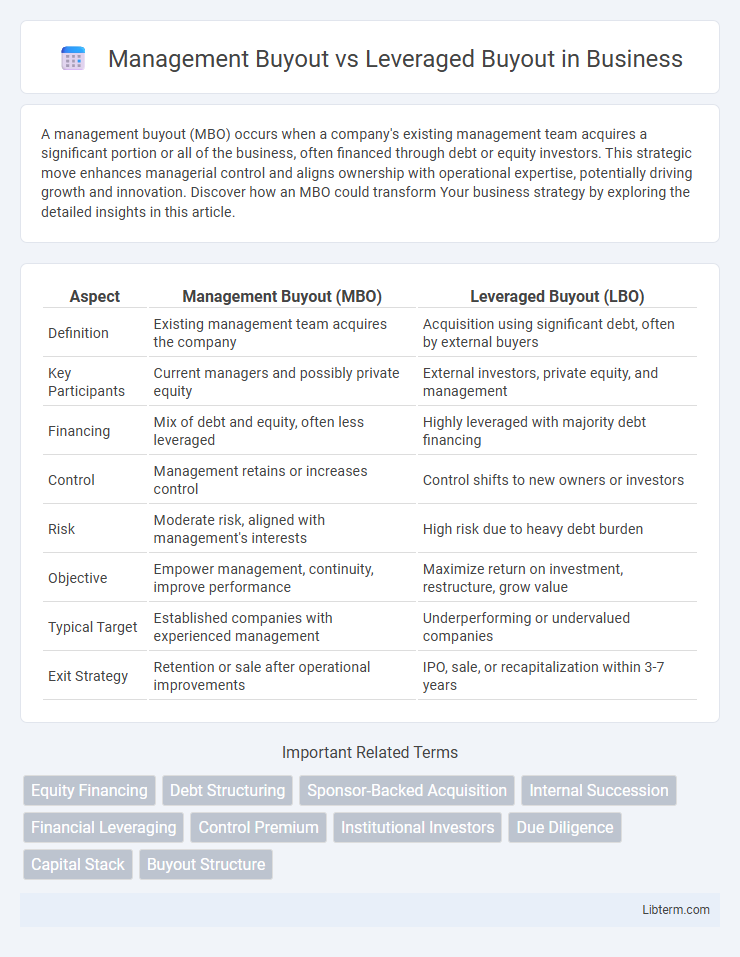

Table of Comparison

| Aspect | Management Buyout (MBO) | Leveraged Buyout (LBO) |

|---|---|---|

| Definition | Existing management team acquires the company | Acquisition using significant debt, often by external buyers |

| Key Participants | Current managers and possibly private equity | External investors, private equity, and management |

| Financing | Mix of debt and equity, often less leveraged | Highly leveraged with majority debt financing |

| Control | Management retains or increases control | Control shifts to new owners or investors |

| Risk | Moderate risk, aligned with management's interests | High risk due to heavy debt burden |

| Objective | Empower management, continuity, improve performance | Maximize return on investment, restructure, grow value |

| Typical Target | Established companies with experienced management | Underperforming or undervalued companies |

| Exit Strategy | Retention or sale after operational improvements | IPO, sale, or recapitalization within 3-7 years |

Introduction to Management Buyout (MBO) and Leveraged Buyout (LBO)

Management Buyout (MBO) involves a company's existing management team acquiring a significant portion or all of the business, utilizing their insider knowledge to drive future growth and operational improvements. Leveraged Buyout (LBO) primarily uses borrowed funds to finance the acquisition, with the target company's assets often serving as collateral for the debt, emphasizing financial structuring and risk management. Both MBO and LBO center on ownership transfer but differ in their sources of capital and strategic focus on management control versus leverage optimization.

Key Differences Between MBO and LBO

A Management Buyout (MBO) involves the existing management team purchasing the company they operate, focusing on preserving operational continuity and leveraging insider knowledge. A Leveraged Buyout (LBO) is a transaction where external investors use significant borrowed funds to acquire a company, emphasizing financial restructuring and maximizing returns. Key differences include the buyer's identity--internal management in MBOs versus typically external investors in LBOs--and the primary motivation, with MBOs aiming for control by existing leaders and LBOs targeting financial leverage and investment gains.

How Management Buyouts Work

Management Buyouts (MBOs) occur when a company's existing management team acquires a significant portion or all of the business, using a combination of personal capital and external financing, often involving private equity firms or banks. The management team leverages their deep operational knowledge and strategic vision to negotiate purchase terms, perform due diligence, and secure funding, aiming to enhance company performance post-acquisition. This process aligns the interests of management and investors, fostering motivation for growth and long-term success.

How Leveraged Buyouts Work

Leveraged buyouts (LBOs) function by acquiring a company primarily through borrowed funds, using the target's assets as collateral to secure loans that finance the purchase. The acquirers, often private equity firms, inject a small amount of equity while relying heavily on debt to maximize returns on investment. Successful LBOs depend on strong cash flows of the acquired company to service the debt and generate value through operational improvements or strategic restructuring.

Advantages of Management Buyouts

Management Buyouts offer significant advantages, including greater control and alignment of interests as existing management takes ownership, fostering commitment and motivation to drive business growth. The transition tends to be smoother, with management's deep understanding of company operations reducing integration risks and accelerating decision-making. Furthermore, Management Buyouts often facilitate better retention of key employees and customers due to continuity and stability during the ownership change.

Advantages of Leveraged Buyouts

Leveraged Buyouts (LBOs) offer distinct advantages such as the ability to acquire companies with minimal upfront equity, maximizing return on investment through the use of debt financing. LBOs enable management and investors to realize value creation by improving operational efficiency and driving strategic growth while leveraging the company's cash flow to service debt. This structure aligns incentives effectively, enhancing financial discipline and facilitating substantial equity gains upon successful exit.

Risks Associated with MBOs and LBOs

Management Buyouts (MBOs) carry risks such as conflicts of interest, overvaluation of the company by insider buyers, and potential cash flow constraints due to limited management capital. Leveraged Buyouts (LBOs) pose significant debt-related risks, including high leverage ratios that increase default probability and restrict operational flexibility due to stringent covenants. Both MBOs and LBOs face challenges in sustaining post-acquisition performance under financial and managerial pressures.

Financial Structuring in Buyouts

Management Buyouts (MBOs) involve the existing management team acquiring the company, often using a blend of personal equity and external financing to align incentives and maintain operational control. Leveraged Buyouts (LBOs) primarily rely on significant debt financing secured against the target company's assets and cash flows to maximize returns, with a focus on structuring debt tranches such as senior, mezzanine, and subordinated loans. Financial structuring in buyouts is critical to balance leverage levels, optimize cost of capital, and ensure sustainable debt service without compromising post-transaction value creation.

Factors to Consider When Choosing Between MBO and LBO

Key factors to consider when choosing between a Management Buyout (MBO) and a Leveraged Buyout (LBO) include the level of management involvement, financing structure, and risk tolerance. MBOs emphasize the existing management team's ability to run the business, often relying on their expertise and internal knowledge, whereas LBOs typically involve external buyers leveraging significant debt to acquire the company, focusing heavily on financial engineering. Evaluating company stability, market conditions, and long-term strategic goals is critical to determine the most suitable buyout approach.

Real-World Examples of MBOs and LBOs

Management Buyouts (MBOs) and Leveraged Buyouts (LBOs) serve distinct strategic purposes in business acquisitions, exemplified by different real-world instances. A notable MBO is the 2012 buyout of the UK-based business EY's consulting arm by its management team, underscoring internal leadership's confidence and commitment to the company's future growth. In contrast, the 2007 LBO of TXU Energy by private equity firms Kohlberg Kravis Roberts and TPG Capital highlights how LBOs utilize significant debt financing to acquire substantial stakes in companies, aiming for operational improvements and eventual profitable exits.

Management Buyout Infographic

libterm.com

libterm.com