Modified Cash Basis Accounting blends cash and accrual accounting methods to provide a more comprehensive financial picture by recording income and expenses when cash changes hands and recognizing certain assets and liabilities. This approach offers flexibility and improved accuracy over pure cash basis while remaining simpler than full accrual accounting. Discover how Modified Cash Basis Accounting can enhance Your financial reporting and why it might be the best fit for Your business by reading the rest of the article.

Table of Comparison

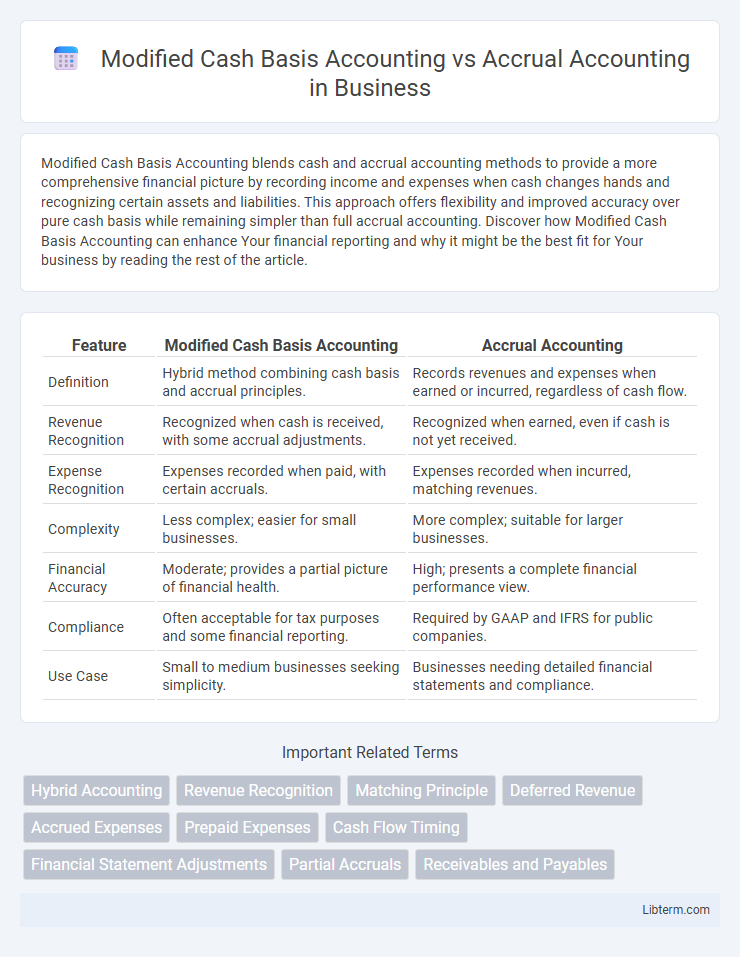

| Feature | Modified Cash Basis Accounting | Accrual Accounting |

|---|---|---|

| Definition | Hybrid method combining cash basis and accrual principles. | Records revenues and expenses when earned or incurred, regardless of cash flow. |

| Revenue Recognition | Recognized when cash is received, with some accrual adjustments. | Recognized when earned, even if cash is not yet received. |

| Expense Recognition | Expenses recorded when paid, with certain accruals. | Expenses recorded when incurred, matching revenues. |

| Complexity | Less complex; easier for small businesses. | More complex; suitable for larger businesses. |

| Financial Accuracy | Moderate; provides a partial picture of financial health. | High; presents a complete financial performance view. |

| Compliance | Often acceptable for tax purposes and some financial reporting. | Required by GAAP and IFRS for public companies. |

| Use Case | Small to medium businesses seeking simplicity. | Businesses needing detailed financial statements and compliance. |

Introduction to Modified Cash Basis and Accrual Accounting

Modified cash basis accounting combines elements of cash and accrual methods, recognizing revenues when received and expenses when paid, but also recording certain assets and liabilities. Accrual accounting records revenues when earned and expenses when incurred, regardless of cash flow timing, providing a comprehensive view of financial performance. Businesses choose between these methods based on the desired balance between simplicity and accuracy in financial reporting.

Key Principles of Modified Cash Basis Accounting

Modified Cash Basis Accounting combines elements of cash and accrual accounting by recording revenues when cash is received and expenses when they are incurred, but only for certain transactions. It maintains simplicity by recognizing income and expenses on a cash basis while incorporating specific accrual principles for long-term assets and liabilities. This approach allows better matching of revenues and expenses without the complexity of full accrual accounting, making it useful for small to medium-sized businesses seeking balanced financial reporting.

Core Concepts of Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring a more accurate financial picture. This method recognizes accounts receivable and payable, reflecting obligations and resources in real-time, unlike Modified Cash Basis which combines cash basis simplicity with some accrual adjustments. Core concepts include revenue recognition, matching principle, and the use of adjusting entries to align income and expenses with the periods they relate to.

Major Differences Between the Two Methods

Modified Cash Basis Accounting combines elements of cash and accrual methods by recognizing revenues when received and expenses when paid, but capitalizing fixed assets and liabilities. Accrual Accounting records revenues when earned and expenses when incurred, regardless of cash flow, providing a more accurate financial position over time. The major differences lie in timing of revenue and expense recognition, treatment of assets and liabilities, and overall impact on financial statements and tax reporting.

Advantages of Modified Cash Basis Accounting

Modified cash basis accounting combines the simplicity of cash basis with select accrual elements, allowing businesses to recognize revenues when received and expenses when paid while recording certain liabilities and receivables. This method offers improved financial accuracy over pure cash basis accounting by capturing key financial obligations without the complexity of full accrual accounting. It provides a practical approach for small to mid-sized businesses seeking enhanced financial insight and compliance with regulatory requirements without extensive accounting resources.

Benefits of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording revenues and expenses when they are earned or incurred, regardless of cash flow timing. This method enhances financial decision-making and forecasting by matching income with related expenses, ensuring compliance with Generally Accepted Accounting Principles (GAAP). It is particularly beneficial for businesses seeking external financing or investors, as it offers a comprehensive view of profitability and financial health.

Limitations and Drawbacks of Each Approach

Modified Cash Basis Accounting limits financial insights by recognizing revenues and expenses only when cash transactions occur, potentially distorting the true economic condition of a business. This approach lacks the ability to track accounts receivable and payable comprehensively, leading to incomplete financial statements. Accrual Accounting, while providing a more accurate picture by recording revenues and expenses when earned or incurred, can be complex to implement and maintain, increasing the risk of errors and requiring detailed adjustments that may overwhelm small businesses.

Suitability for Different Types of Businesses

Modified cash basis accounting is ideal for small to midsize businesses seeking a simplified approach that combines elements of both cash and accrual methods, allowing them to record revenues and expenses when cash is received or paid while also recognizing some accrued items like inventory. Accrual accounting suits larger businesses and those with complex financial transactions by providing a more accurate financial picture through recording revenues and expenses when they are earned or incurred, regardless of cash flow timing. Businesses with significant inventory, long-term contracts, or regulatory reporting requirements generally prefer accrual accounting for compliance and detailed financial analysis.

Tax Implications: Modified Cash vs Accrual Accounting

Modified cash basis accounting combines elements of both cash and accrual methods, resulting in tax reporting that recognizes income when received and expenses when paid, but also accounts for certain accrued items, affecting timing for tax liabilities. Accrual accounting reports income when earned and expenses when incurred, potentially accelerating taxable income recognition compared to modified cash basis, impacting quarterly tax estimates and deferred tax liabilities. Understanding the timing differences between these methods is crucial for optimizing tax planning, compliance, and cash flow management for businesses.

Choosing the Right Accounting Method for Your Business

Choosing between Modified Cash Basis Accounting and Accrual Accounting depends on the size and complexity of your business. Modified Cash Basis merges cash and accrual methods, tracking income when received and expenses when incurred, suitable for small to mid-sized businesses seeking simplicity with some accrual features. Accrual Accounting records revenues and expenses when they are earned or incurred, providing a more accurate financial picture required by larger businesses or those seeking detailed financial analysis and compliance.

Modified Cash Basis Accounting Infographic

libterm.com

libterm.com