Quantitative analysis uses numerical data and statistical methods to identify patterns, measure performance, and support decision-making. This approach provides objective insights across various fields, including finance, marketing, and operations. Explore the rest of the article to understand how quantitative analysis can enhance your strategic outcomes.

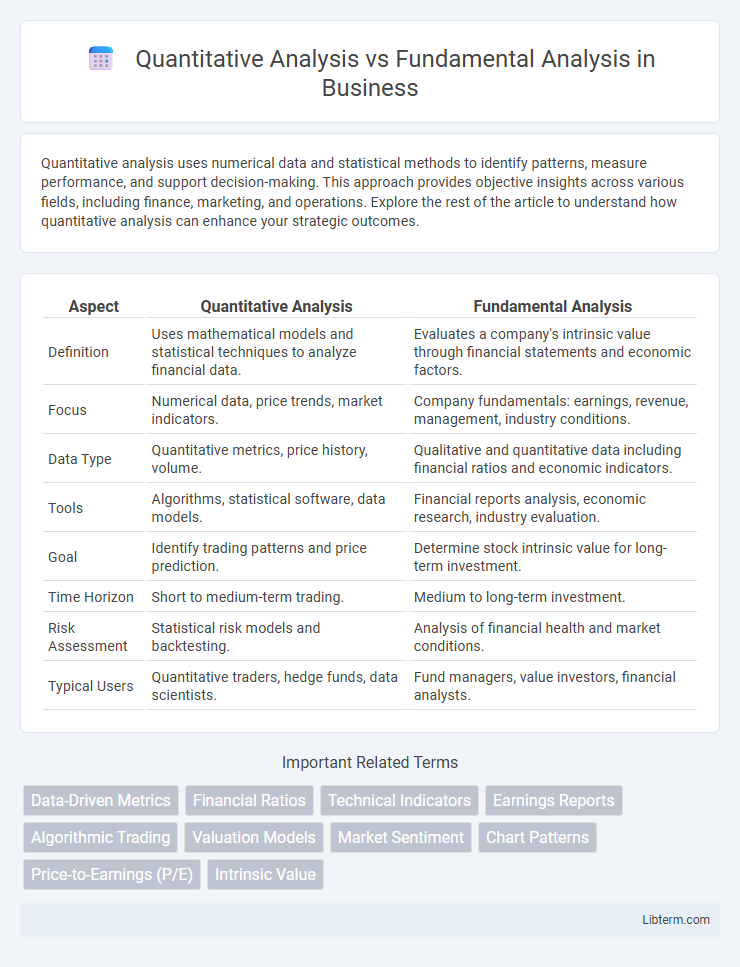

Table of Comparison

| Aspect | Quantitative Analysis | Fundamental Analysis |

|---|---|---|

| Definition | Uses mathematical models and statistical techniques to analyze financial data. | Evaluates a company's intrinsic value through financial statements and economic factors. |

| Focus | Numerical data, price trends, market indicators. | Company fundamentals: earnings, revenue, management, industry conditions. |

| Data Type | Quantitative metrics, price history, volume. | Qualitative and quantitative data including financial ratios and economic indicators. |

| Tools | Algorithms, statistical software, data models. | Financial reports analysis, economic research, industry evaluation. |

| Goal | Identify trading patterns and price prediction. | Determine stock intrinsic value for long-term investment. |

| Time Horizon | Short to medium-term trading. | Medium to long-term investment. |

| Risk Assessment | Statistical risk models and backtesting. | Analysis of financial health and market conditions. |

| Typical Users | Quantitative traders, hedge funds, data scientists. | Fund managers, value investors, financial analysts. |

Introduction to Quantitative and Fundamental Analysis

Quantitative analysis relies on mathematical models, statistical techniques, and numerical data to evaluate investment opportunities and predict market trends. Fundamental analysis examines a company's financial statements, management quality, industry conditions, and economic factors to determine its intrinsic value. Combining both approaches provides a comprehensive framework for making informed investment decisions by leveraging data-driven insights alongside qualitative business factors.

Defining Quantitative Analysis

Quantitative analysis involves the use of mathematical models, statistical techniques, and numerical data to evaluate financial securities and investment opportunities. This approach focuses on quantifiable factors such as price, volume, volatility, and financial ratios to generate objective insights and predictions. By leveraging algorithms and large datasets, quantitative analysis aims to identify patterns and trends that drive market behavior and optimize portfolio performance.

Understanding Fundamental Analysis

Fundamental analysis involves evaluating a company's financial statements, management quality, industry position, and market conditions to assess its intrinsic value. Key metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio, which help investors determine long-term growth potential. This approach aims to identify undervalued stocks by analyzing economic indicators, competitive advantages, and future cash flow projections.

Key Differences Between Quantitative and Fundamental Methods

Quantitative analysis relies on mathematical models, statistical techniques, and historical data to identify patterns and predict market movements, emphasizing numerical data and algorithmic trading strategies. Fundamental analysis evaluates a company's intrinsic value by examining financial statements, management quality, industry conditions, and macroeconomic factors, focusing on qualitative and financial health metrics. Key differences include the reliance on data types--quantitative uses structured numerical data while fundamental integrates qualitative insights--and the approach, with quantitative being systematic and automated versus fundamental's subjective and research-intensive process.

Data Sources in Quantitative vs. Fundamental Analysis

Quantitative analysis relies heavily on structured data sources such as historical price feeds, trading volumes, and financial statements processed through statistical models and algorithms. Fundamental analysis prioritizes unstructured data like company reports, industry news, economic indicators, and management discussions to evaluate intrinsic value. While quantitative analysis emphasizes large datasets for pattern recognition, fundamental analysis focuses on qualitative insights from detailed financial disclosures and market conditions.

Tools and Techniques Used in Each Approach

Quantitative analysis relies heavily on mathematical models, statistical techniques, and algorithms such as regression analysis, Monte Carlo simulations, and machine learning to evaluate financial data and identify investment opportunities. Fundamental analysis utilizes financial statements, ratio analysis, economic indicators, and industry trends to assess a company's intrinsic value and growth potential. Both approaches employ tools like Excel, Python, and specialized software platforms, but quantitative analysis emphasizes data-driven automation while fundamental analysis prioritizes qualitative assessment and expert judgment.

Pros and Cons of Quantitative Analysis

Quantitative analysis excels in processing vast datasets using mathematical models, enabling objective and data-driven investment decisions with high speed and consistency. However, it can struggle to capture qualitative factors such as management quality or market sentiment, potentially leading to overreliance on historical data and model assumptions. Limitations also include vulnerability to market anomalies and the risk of model overfitting, which may reduce effectiveness in unpredictable or rapidly changing market conditions.

Advantages and Limitations of Fundamental Analysis

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, management quality, market conditions, and economic factors, offering a comprehensive understanding of long-term investment potential. It provides advantages such as identifying undervalued stocks and assessing growth prospects, but faces limitations including subjectivity in qualitative assessments and delayed reflection of market sentiment. The reliance on historical data can also hinder responsiveness to real-time market changes, impacting decision-making speed.

When to Use Quantitative vs. Fundamental Analysis

Quantitative analysis is best used in high-frequency trading, algorithmic strategies, and situations requiring rapid data processing and pattern recognition from large datasets. Fundamental analysis is ideal for long-term investment decisions, evaluating company financial health, competitive advantages, and macroeconomic factors. Investors often combine both methods to balance data-driven insights with qualitative assessments of intrinsic value.

Integrating Quantitative and Fundamental Strategies

Integrating quantitative and fundamental analysis combines data-driven modeling with qualitative insights to enhance investment decisions. Quantitative strategies leverage statistical algorithms to identify patterns and forecast market trends, while fundamental analysis evaluates a company's financial health, management, and competitive positioning. This hybrid approach enables more robust portfolio management by capitalizing on precise data metrics and deep market understanding.

Quantitative Analysis Infographic

libterm.com

libterm.com