Leverage is a powerful financial tool that allows investors and businesses to amplify their potential returns by using borrowed capital. Understanding how leverage affects risk and reward is crucial for making informed decisions in trading or business expansion. Explore the rest of this article to discover how you can effectively harness leverage to achieve your financial goals.

Table of Comparison

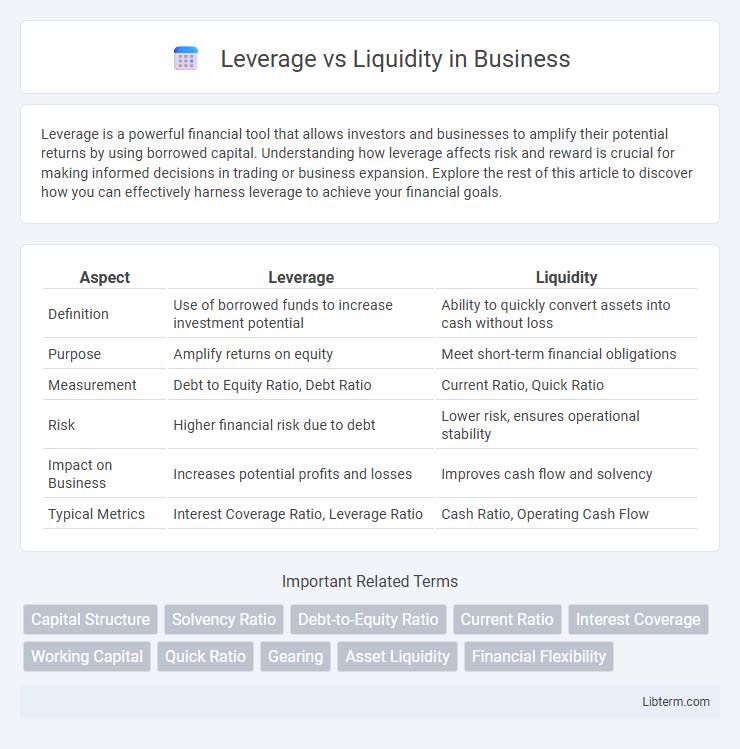

| Aspect | Leverage | Liquidity |

|---|---|---|

| Definition | Use of borrowed funds to increase investment potential | Ability to quickly convert assets into cash without loss |

| Purpose | Amplify returns on equity | Meet short-term financial obligations |

| Measurement | Debt to Equity Ratio, Debt Ratio | Current Ratio, Quick Ratio |

| Risk | Higher financial risk due to debt | Lower risk, ensures operational stability |

| Impact on Business | Increases potential profits and losses | Improves cash flow and solvency |

| Typical Metrics | Interest Coverage Ratio, Leverage Ratio | Cash Ratio, Operating Cash Flow |

Understanding Leverage: Definition and Importance

Leverage refers to the use of borrowed funds to amplify potential returns on investment, playing a critical role in financial strategy by enabling investors and companies to increase their asset base and potential profits. Understanding leverage is essential because it directly impacts risk, as higher leverage magnifies both gains and losses, influencing decision-making in investment and corporate finance. Properly managed leverage enhances liquidity by allowing access to additional capital without immediate cash outflows, which is crucial for maintaining operational flexibility and meeting short-term obligations.

What is Liquidity in Financial Markets?

Liquidity in financial markets refers to the ease with which assets can be quickly bought or sold without causing a significant impact on their price. High liquidity means there are many active buyers and sellers, allowing transactions to occur efficiently with tight bid-ask spreads. Markets with strong liquidity enable investors to enter or exit positions rapidly, reducing the risk and cost associated with trading.

The Relationship Between Leverage and Liquidity

Leverage and liquidity are interconnected financial metrics that influence a company's risk profile and operational stability. Higher leverage, indicating greater debt levels, often reduces liquidity by increasing fixed obligations, which limits a firm's ability to meet short-term liabilities. Conversely, strong liquidity enhances a company's capacity to manage leverage efficiently by providing readily available assets to cover debt repayments and unexpected expenses.

Types of Leverage: Operational, Financial, and Combined

Operational leverage measures a company's fixed versus variable costs, impacting profit sensitivity to sales volume changes, while financial leverage assesses the extent of debt used to finance assets, affecting earnings volatility due to interest obligations. Combined leverage integrates both operational and financial leverage, amplifying the overall risk and potential return by considering the interaction between fixed operational costs and fixed financial costs. Understanding these types helps investors evaluate a firm's risk profile and its ability to manage expenses and debt under varying market conditions.

Measuring Liquidity: Key Ratios and Metrics

Measuring liquidity involves key ratios such as the current ratio, quick ratio, and cash ratio, which assess a company's ability to meet short-term obligations. The current ratio compares current assets to current liabilities, while the quick ratio excludes inventory to provide a stricter liquidity measure. Cash ratio evaluates the most liquid assets, highlighting immediate payment capacity without relying on asset conversion.

The Risks of High Leverage in Illiquid Markets

High leverage in illiquid markets significantly amplifies financial risk due to limited market depth and wider bid-ask spreads, making it difficult to exit positions without substantial losses. Illiquidity restricts the ability to quickly convert assets to cash, increasing the possibility of forced asset sales at depressed prices under margin calls. These conditions exacerbate volatility, heighten the potential for rapid value erosion, and increase the likelihood of insolvency during market stress.

How Liquidity Influences Leverage Decisions

Liquidity directly impacts leverage decisions by determining a company's ability to meet short-term obligations, influencing its capacity to take on additional debt. High liquidity levels provide a safety net, allowing firms to leverage more confidently without risking solvency, while low liquidity constraints force conservative borrowing to maintain financial stability. Effective liquidity management ensures optimal leverage use, balancing risk and growth potential in capital structuring strategies.

Real-World Examples: Leverage and Liquidity in Action

Leverage amplifies potential returns but increases financial risk, as seen in companies like Tesla, which uses leverage to fuel rapid growth and innovation. Liquidity ensures assets can be quickly converted to cash without significant loss, exemplified by Apple's substantial cash reserves that enable seamless operations and investment opportunities. Balancing leverage and liquidity is critical for firms to optimize growth while maintaining financial stability in dynamic markets.

Strategies to Balance Leverage and Liquidity

Effective strategies to balance leverage and liquidity involve optimizing debt levels to maintain sufficient cash flow for operational needs without overextending financial risk. Implementing dynamic cash management, such as maintaining a liquidity buffer and using revolving credit facilities, ensures availability of funds during market volatility. Regular stress testing and scenario analysis allow businesses to adjust leverage ratios proactively while preserving liquidity to support growth and withstand economic downturns.

Best Practices: Managing Leverage and Maintaining Liquidity

Effective management of leverage involves maintaining an optimal debt-to-equity ratio that balances growth opportunities with financial stability, ensuring companies avoid excessive borrowing that triggers solvency risks. Best practices for liquidity management focus on preserving ample cash reserves and maintaining access to credit lines, facilitating smooth operations during market fluctuations and unexpected expenses. Regular stress testing and scenario analysis help firms anticipate cash flow challenges, promoting proactive adjustments in both leverage and liquidity strategies.

Leverage Infographic

libterm.com

libterm.com