Auction-based methods leverage competitive bidding to determine the value or allocation of goods and services efficiently. These approaches can optimize pricing, ensure fairness, and maximize seller revenue while providing buyers with transparent opportunities. Explore the rest of the article to understand how auction-based strategies can benefit your business or personal transactions.

Table of Comparison

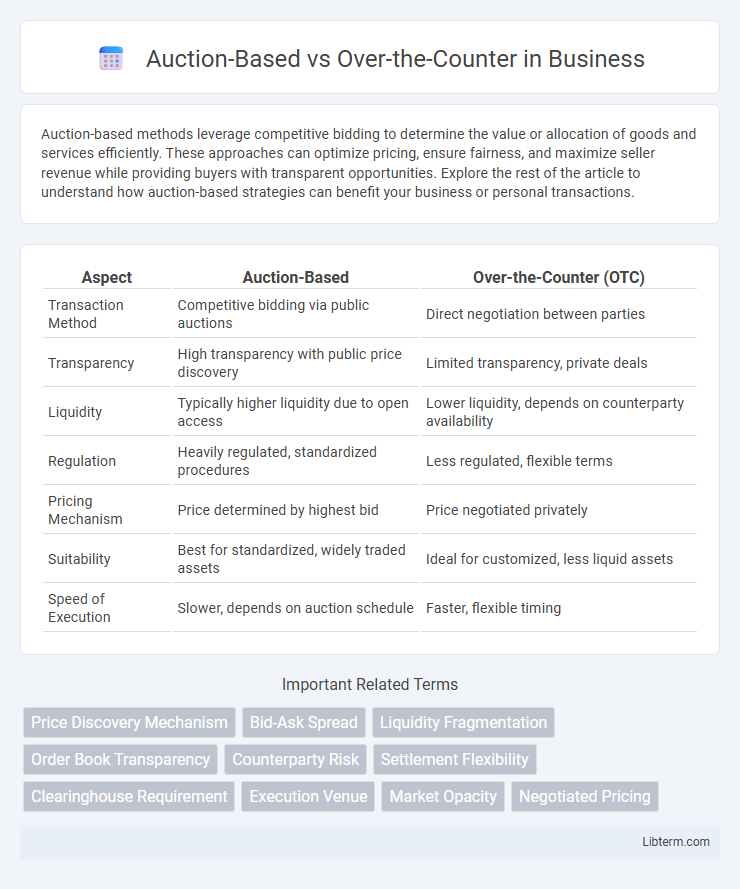

| Aspect | Auction-Based | Over-the-Counter (OTC) |

|---|---|---|

| Transaction Method | Competitive bidding via public auctions | Direct negotiation between parties |

| Transparency | High transparency with public price discovery | Limited transparency, private deals |

| Liquidity | Typically higher liquidity due to open access | Lower liquidity, depends on counterparty availability |

| Regulation | Heavily regulated, standardized procedures | Less regulated, flexible terms |

| Pricing Mechanism | Price determined by highest bid | Price negotiated privately |

| Suitability | Best for standardized, widely traded assets | Ideal for customized, less liquid assets |

| Speed of Execution | Slower, depends on auction schedule | Faster, flexible timing |

Introduction to Auction-Based and Over-the-Counter Markets

Auction-based markets facilitate the buying and selling of assets through a transparent bidding process where prices are determined by supply and demand in real-time. Over-the-Counter (OTC) markets involve direct, negotiated transactions between parties without a centralized exchange, often used for less liquid or customized financial instruments. Both market types serve distinct purposes, with auction-based markets offering price discovery and OTC markets providing flexibility and privacy for complex trades.

Key Definitions: Auction-Based vs Over-the-Counter

Auction-based trading involves the buying and selling of securities through a transparent bidding process on organized exchanges, where prices are determined by supply and demand dynamics in real time. Over-the-counter (OTC) trading occurs directly between two parties without a centralized exchange, often involving customized contracts or less standardized instruments, resulting in less price transparency and higher counterparty risk. Both methods serve different market needs, with auction-based trading prioritizing liquidity and price discovery, while OTC trading offers flexibility and tailored agreements.

How Auction-Based Markets Operate

Auction-based markets operate by matching buyers and sellers through a centralized platform where bids and offers are submitted competitively, ensuring transparent price discovery based on real-time supply and demand. These markets use a call auction or continuous auction mechanism, facilitating liquidity by aggregating orders and determining a clearing price that balances transaction volumes. Price formation in auction-based systems is influenced by market participants' valuation, order size, and timing, promoting efficiency and minimizing information asymmetry.

The Structure of Over-the-Counter Transactions

Over-the-counter (OTC) transactions are privately negotiated agreements conducted directly between two parties without the involvement of an auction or exchange platform. These deals typically offer greater flexibility in customizing contract terms, such as pricing, volume, and settlement dates, to meet specific needs. OTC markets often involve dealers or brokers who facilitate trades in less liquid or more complex financial instruments, ensuring confidentiality and tailored execution outside standardized auction settings.

Price Discovery: Auctions vs OTC

Auction-based markets provide transparent price discovery by matching multiple buyers and sellers in real-time, resulting in competitive pricing that reflects current supply and demand dynamics. Over-the-counter (OTC) transactions lack centralized pricing, often leading to less price transparency and wider bid-ask spreads driven by negotiation between counterparties. The auction mechanism typically delivers more efficient price discovery, while OTC markets offer flexibility and customization at the expense of clear market price signals.

Transparency and Regulation Differences

Auction-based markets offer high transparency due to publicly available bid and ask data, promoting price discovery through competitive bidding. Over-the-counter (OTC) markets lack centralized exchanges, resulting in less transparency and reliance on private negotiations between parties. Regulatory frameworks are stricter in auction-based markets, with oversight ensuring fair trading practices, whereas OTC markets operate under more flexible or fragmented regulations, increasing counterparty risk.

Liquidity Considerations in Both Models

Auction-based markets typically provide higher liquidity due to transparent price discovery and competitive bidding processes, attracting multiple buyers and sellers simultaneously. Over-the-counter (OTC) markets often experience lower liquidity as trades are negotiated privately between parties, which can lead to wider bid-ask spreads and less immediate execution. The choice between auction-based and OTC trading significantly impacts market liquidity, influencing transaction speed, price transparency, and overall market efficiency.

Risk Management in Auction-Based and OTC Systems

Auction-based risk management relies on transparent price discovery and competitive bidding, reducing counterparty risk through centralized clearinghouses that guarantee contract fulfillment. Over-the-counter (OTC) systems face higher counterparty risk due to bilateral contracts without centralized intermediaries, necessitating robust collateral management and credit assessments. Effective risk mitigation in OTC markets demands continuous monitoring and customized credit support annexes to manage exposure and liquidity risk.

Use Cases: Ideal Scenarios for Each Market Type

Auction-based markets excel in scenarios requiring transparent price discovery and high liquidity, such as IPOs, government bond sales, and commodities trading. Over-the-counter (OTC) markets are ideal for customized, less standardized trades like derivatives, large block trades, and foreign exchange where flexibility and privacy are paramount. Institutional investors often prefer OTC markets for negotiating bespoke contracts, while auction-based platforms attract retail investors seeking market-driven pricing.

Comparing the Pros and Cons: Auction-Based vs Over-the-Counter

Auction-based trading offers transparency and price discovery through a centralized marketplace, enhancing liquidity and reducing the risk of price manipulation. Over-the-counter (OTC) trading provides privacy and flexibility, allowing large trades without impacting market prices but often with less transparency and higher counterparty risk. Choosing between the two depends on priorities such as transparency, liquidity, transaction size, and risk tolerance.

Auction-Based Infographic

libterm.com

libterm.com