EBITDA measures a company's operating performance by calculating earnings before interest, taxes, depreciation, and amortization, offering a clear view of core profitability. This metric helps investors and management evaluate cash flow potential and compare businesses across industries without accounting for financial and accounting decisions. Discover how understanding EBITDA can enhance your financial analysis by reading the rest of the article.

Table of Comparison

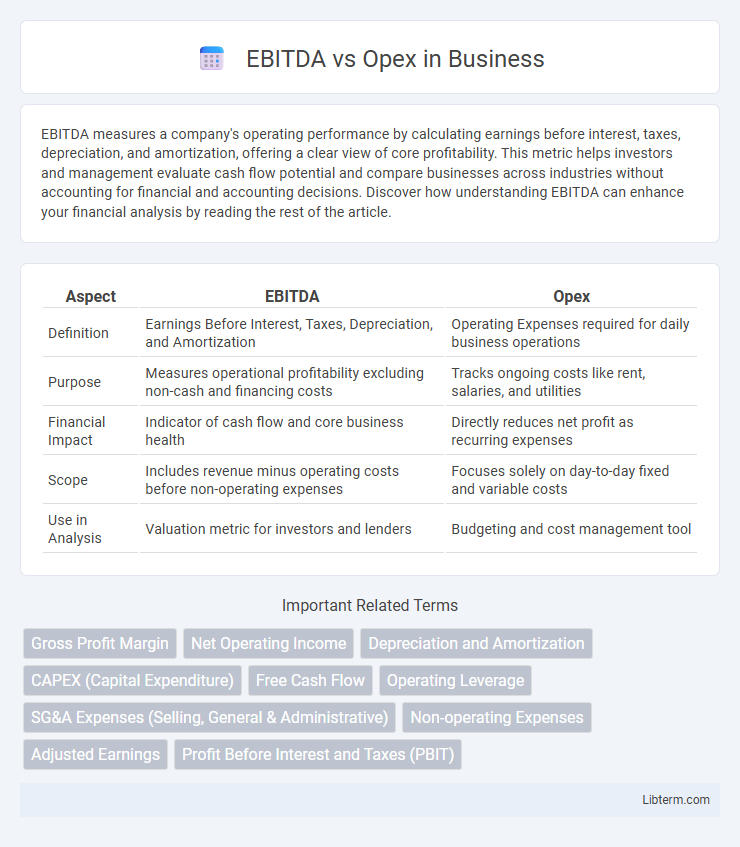

| Aspect | EBITDA | Opex |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Operating Expenses required for daily business operations |

| Purpose | Measures operational profitability excluding non-cash and financing costs | Tracks ongoing costs like rent, salaries, and utilities |

| Financial Impact | Indicator of cash flow and core business health | Directly reduces net profit as recurring expenses |

| Scope | Includes revenue minus operating costs before non-operating expenses | Focuses solely on day-to-day fixed and variable costs |

| Use in Analysis | Valuation metric for investors and lenders | Budgeting and cost management tool |

Understanding EBITDA: Definition and Importance

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operational expenses, providing a clearer view of core business performance. Opex (Operating Expenses) includes day-to-day costs like salaries, rent, and utilities necessary for running a business but does not account for non-cash expenses captured in EBITDA. Understanding EBITDA is crucial for investors and analysts to evaluate cash flow generation and operational efficiency independently of capital structure and accounting policies.

What is Opex? A Comprehensive Overview

Opex, or operational expenditures, refers to the ongoing costs a company incurs to run its day-to-day business activities, including expenses such as salaries, utilities, rent, and maintenance. Unlike EBITDA, which measures earnings before interest, taxes, depreciation, and amortization, Opex directly impacts a company's profitability by reflecting the actual spending required to maintain operational efficiency. Effective management of Opex is crucial for optimizing cash flow and improving overall financial performance.

Key Differences Between EBITDA and Opex

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's overall financial performance by excluding non-operational expenses, while Opex (Operating Expenses) refers to the routine costs a business incurs to maintain daily operations. EBITDA highlights profitability by focusing on core business earnings before non-cash and financing costs, whereas Opex directly impacts cash flow as it includes expenses like salaries, rent, and utilities. Key differences center on EBITDA representing earnings potential and Opex reflecting ongoing operational costs needed to generate revenue.

How EBITDA and Opex Impact Financial Analysis

EBITDA reflects a company's operational profitability by excluding non-operating expenses, depreciation, and amortization, providing a clearer picture of cash flow generation. Opex, or operating expenses, directly reduce EBITDA and impact the overall cost structure, influencing margin analysis and operational efficiency assessments. Financial analysts use EBITDA to evaluate earnings potential, while monitoring Opex helps identify cost control effectiveness and operational scalability.

EBITDA vs Opex: Implications for Business Valuation

EBITDA represents a company's earnings before interest, taxes, depreciation, and amortization, serving as a key indicator of operational profitability by excluding non-cash and financing costs. Opex, or operating expenses, includes day-to-day costs required to run the business, such as rent, utilities, and salaries, directly impacting net income but excluded from EBITDA calculations. Understanding the relationship between EBITDA and Opex is crucial for business valuation as EBITDA highlights cash flow potential, while high Opex can signal operational inefficiencies that may reduce overall enterprise value.

Managing Opex to Improve EBITDA

Efficiently managing operating expenses (Opex) plays a crucial role in improving EBITDA by directly reducing costs that impact operating profitability. Implementing cost control measures in areas such as labor, utilities, and maintenance can enhance cash flow and increase EBITDA margins. Companies focusing on strategic Opex management often achieve stronger financial health and better investor appeal through higher EBITDA performance.

EBITDA and Opex in Different Industries

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) varies significantly across industries due to differences in capital intensity and operational structures, with tech companies often showing high EBITDA margins due to lower capital expenditures compared to manufacturing sectors where Opex (Operating Expenses) dominates due to labor and material costs. In retail, Opex is a substantial component impacting profitability, reflecting expenses like rent, wages, and logistics, whereas service-based industries may have lower Opex but also lower EBITDA margins. Understanding the balance between EBITDA and Opex helps investors assess operational efficiency and profitability trends tailored to industry-specific cost structures.

Common Misconceptions About EBITDA and Opex

EBITDA is often mistaken as a direct indicator of cash flow, but it excludes capital expenditures and working capital changes that significantly impact a company's financial health. Operating expenses (Opex) represent the day-to-day costs essential for running a business, yet some assume reducing Opex always improves profitability without considering quality or growth trade-offs. Understanding EBITDA and Opex correctly requires recognizing EBITDA's role in assessing operational performance before non-cash expenses and Opex's influence on long-term sustainability and efficiency.

Reporting and Disclosure: EBITDA vs Opex

EBITDA, representing earnings before interest, taxes, depreciation, and amortization, highlights operational profitability by excluding non-operational expenses, making it a key metric in financial reporting and valuation analysis. Opex, or operating expenses, includes costs necessary for day-to-day business operations such as salaries, rent, and utilities, which must be disclosed consistently in financial statements for transparency and compliance. Accurate reporting of EBITDA and Opex allows stakeholders to assess operational efficiency and cash flow generation, enabling better investment and management decisions.

Strategic Decision Making: Balancing EBITDA and Opex

Strategic decision-making requires balancing EBITDA and Opex to optimize profitability and operational efficiency. Companies that effectively manage operating expenses (Opex) can improve EBITDA margins, enhancing their financial health and attractiveness to investors. Prioritizing cost control while maintaining revenue growth enables sustainable business performance and informed resource allocation.

EBITDA Infographic

libterm.com

libterm.com