The asset-based approach focuses on leveraging existing resources and strengths to maximize value and drive growth. Emphasizing tangible and intangible assets enables organizations to optimize their potential and create sustainable competitive advantages. Explore the rest of this article to discover how your business can benefit from adopting an asset-based strategy.

Table of Comparison

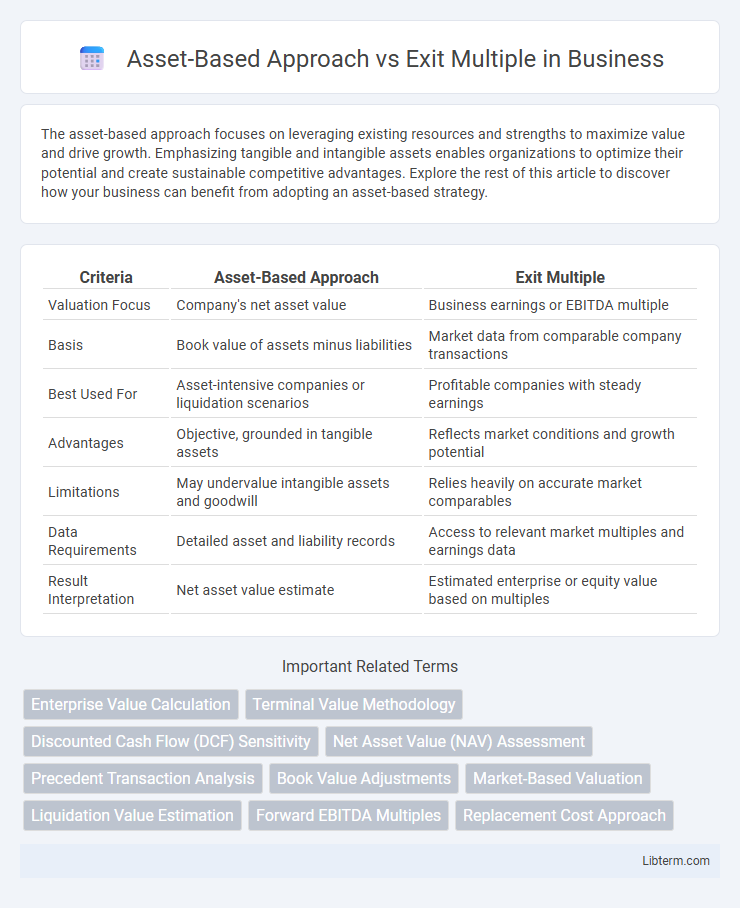

| Criteria | Asset-Based Approach | Exit Multiple |

|---|---|---|

| Valuation Focus | Company's net asset value | Business earnings or EBITDA multiple |

| Basis | Book value of assets minus liabilities | Market data from comparable company transactions |

| Best Used For | Asset-intensive companies or liquidation scenarios | Profitable companies with steady earnings |

| Advantages | Objective, grounded in tangible assets | Reflects market conditions and growth potential |

| Limitations | May undervalue intangible assets and goodwill | Relies heavily on accurate market comparables |

| Data Requirements | Detailed asset and liability records | Access to relevant market multiples and earnings data |

| Result Interpretation | Net asset value estimate | Estimated enterprise or equity value based on multiples |

Introduction to Business Valuation Methods

The Asset-Based Approach values a business by calculating the net value of its assets minus liabilities, emphasizing the company's tangible and intangible resources on the balance sheet. In contrast, the Exit Multiple method estimates valuation based on a multiple of financial metrics such as EBITDA or revenue, reflecting market conditions and comparable company transactions. Both methods offer distinct perspectives: the Asset-Based Approach provides a snapshot of intrinsic value, while the Exit Multiple method captures potential future earnings power and market sentiment.

Understanding the Asset-Based Approach

The Asset-Based Approach values a company by calculating the total value of its tangible and intangible assets minus liabilities, providing a clear snapshot of its net asset value. This method is particularly useful for businesses with significant physical assets or in liquidation scenarios, ensuring fair valuation based on actual holdings rather than market speculation. Unlike the Exit Multiple method, which relies on future earnings potential and comparable company metrics, the Asset-Based Approach emphasizes a grounded assessment of current asset worth.

Key Components of Asset-Based Valuation

The key components of asset-based valuation include the identification and accurate appraisal of both tangible and intangible assets, such as real estate, equipment, patents, and trademarks, as well as liabilities that must be deducted to determine net asset value. This approach emphasizes the company's balance sheet strength and liquidation value, providing a baseline for assessing a firm's intrinsic worth independent of market fluctuations. Unlike the exit multiple method that relies on market-based projections and earnings multiples, asset-based valuation offers a fundamental perspective grounded in the actual recorded assets and liabilities.

What Is the Exit Multiple Method?

The Exit Multiple method estimates a company's value by applying a financial metric, such as EBITDA or revenue, multiplied by a comparable industry multiple derived from recent transactions or market data. This approach provides a market-driven valuation reflecting investor expectations and potential exit prices in mergers and acquisitions. It contrasts with the Asset-Based Approach, which values a company based on the net book value or liquidation value of its tangible and intangible assets.

How Exit Multiples Are Determined

Exit multiples are determined by analyzing comparable company transactions within the same industry, focusing on financial metrics such as EBITDA, revenue, or earnings per share to establish a valuation benchmark. Market sentiment, growth prospects, and macroeconomic factors also influence the selection of appropriate multiples, ensuring alignment with current market conditions. Unlike the asset-based approach, which values based on net asset value, exit multiples emphasize future earnings potential derived from peer market performance.

Comparing Asset-Based and Exit Multiple Approaches

The Asset-Based Approach values a company based on the net book value of its assets minus liabilities, providing a clear snapshot of the firm's tangible worth, often used for asset-heavy businesses or liquidation scenarios. The Exit Multiple Approach estimates company value using a financial metric like EBITDA multiplied by industry-specific exit multiples derived from comparable company sales, reflecting market expectations and future earnings potential. Comparing both, the Asset-Based Approach is more conservative and grounded in actual asset values, whereas the Exit Multiple Approach captures growth prospects and market conditions, making it more suitable for ongoing operations and investment analysis.

Pros and Cons of the Asset-Based Approach

The Asset-Based Approach calculates a company's value by summing the fair market value of its assets minus liabilities, providing a clear, tangible asset measurement ideal for companies with significant physical or financial assets. It offers simplicity and objectivity but may undervalue companies with strong intangible assets such as brand value, intellectual property, or growth potential. This method can be less effective for operating businesses focused on future earnings, as it ignores cash flow generation and market conditions reflected in Exit Multiples.

Advantages and Limitations of Exit Multiples

Exit multiples offer a straightforward valuation method by applying industry-standard financial ratios such as EV/EBITDA or P/E to estimate a company's future sale price, enabling quick comparisons across peers. This approach benefits from market data transparency and adaptability to changing market conditions but may suffer from limitations including reliance on recent transactions that might not reflect intrinsic value and susceptibility to market volatility. Unlike asset-based valuations grounded in tangible book value, exit multiples can overestimate prospects in inflated markets or underestimate value during downturns, necessitating cautious interpretation.

Choosing the Right Valuation Method

Choosing the right valuation method depends on the specific attributes of the business and industry context. The Asset-Based Approach values a company based on its net asset value, making it ideal for asset-heavy businesses or those facing liquidation. Exit Multiple valuation, relying on industry benchmarks and future earnings potential, suits companies in growth phases or service-based sectors with less tangible assets.

Conclusion: Strategic Insights for Business Valuation

The Asset-Based Approach emphasizes the company's tangible and intangible asset values, providing a grounded perspective in cases of liquidation or asset-heavy businesses. Exit Multiple valuation leverages comparable company data and future earnings potential, offering dynamic market-based insights especially useful for growth-oriented firms. Strategic business valuation often integrates both methods to balance intrinsic asset worth with market-driven expectations for comprehensive decision-making.

Asset-Based Approach Infographic

libterm.com

libterm.com