Workhorse electric vehicles combine durability, efficiency, and advanced technology to revolutionize commercial transportation. Designed for medium and heavy-duty applications, these vehicles offer impressive range and performance while reducing emissions and operating costs. Explore the detailed benefits and features of Workhorse models throughout this article to see how they can elevate your business operations.

Table of Comparison

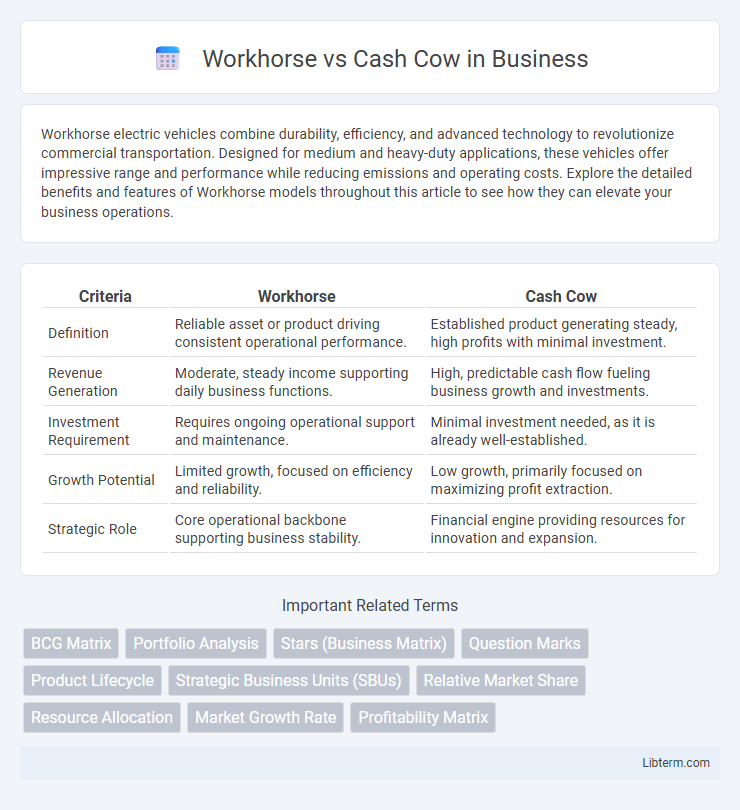

| Criteria | Workhorse | Cash Cow |

|---|---|---|

| Definition | Reliable asset or product driving consistent operational performance. | Established product generating steady, high profits with minimal investment. |

| Revenue Generation | Moderate, steady income supporting daily business functions. | High, predictable cash flow fueling business growth and investments. |

| Investment Requirement | Requires ongoing operational support and maintenance. | Minimal investment needed, as it is already well-established. |

| Growth Potential | Limited growth, focused on efficiency and reliability. | Low growth, primarily focused on maximizing profit extraction. |

| Strategic Role | Core operational backbone supporting business stability. | Financial engine providing resources for innovation and expansion. |

Introduction: Defining Workhorse and Cash Cow

A Workhorse refers to a product, service, or business unit that consistently generates steady revenue and requires moderate investment to maintain its market position. A Cash Cow is a highly profitable asset or segment that produces significant cash flow with minimal ongoing investment, often supporting other parts of a business. Both concepts originate from the BCG matrix, where Workhorses are vital for stability and Cash Cows for funding growth opportunities.

Origins and Popularity of the Terms

The term "Cash Cow" originates from the marketing framework of the Boston Consulting Group (BCG) matrix, introduced in the 1970s to describe business units generating steady, reliable profits with minimal investment. "Workhorse" emerged as a colloquial expression, symbolizing dependable and hardworking assets or employees valued for consistent performance rather than flashy results. Popularity of "Cash Cow" surged in corporate and financial discussions due to strategic business analysis, while "Workhorse" gained broader use across various industries emphasizing reliability and endurance.

Key Characteristics of Workhorses

Workhorses are business units or products that generate consistent revenue with moderate market growth, characterized by stable cash flow and strong market share in mature industries. They require sustained investment to maintain their performance but lack the high growth potential of stars or question marks. Their key attributes include reliability, efficiency, and the ability to support company operations through steady profits without significant innovation demands.

Main Features of Cash Cows

Cash cows generate consistent, high revenue with minimal investment, dominating established markets where growth is slow but profits remain strong. Their main features include stable demand, high market share, and low growth rate, allowing companies to use their cash flow to fund other business areas. These products or services often require little marketing effort, emphasizing efficiency and cost control to maximize profitability.

Differences Between Workhorses and Cash Cows

Workhorses generate consistent revenue by maintaining steady performance and reliability, often requiring ongoing effort and resources to sustain output. Cash Cows produce high profits with minimal investment, capitalizing on established market dominance and strong brand loyalty. The fundamental difference lies in workhorses' emphasis on continuous operational input versus cash cows' ability to yield substantial returns with low reinvestment.

Strategic Roles in Business Portfolios

Workhorses serve as dependable revenue generators in business portfolios, maintaining steady cash flow with moderate growth potential through core products or services. Cash cows, characterized by high market share and low growth markets, provide substantial and consistent profits to fund other business units or strategic initiatives. Both roles are essential for portfolio balance: workhorses ensure operational stability while cash cows supply financial resources for innovation and expansion.

Benefits and Drawbacks of Workhorses

Workhorses provide consistent, reliable performance essential for steady business operations, making them valuable for sustaining regular revenue streams. Their drawbacks include slower innovation and limited scalability compared to cash cows, which generate substantial profits with less effort. Workhorses often require continuous investment in maintenance and management to avoid operational inefficiencies and revenue stagnation.

Advantages and Disadvantages of Cash Cows

Cash Cows generate steady revenue with minimal investment, enabling businesses to fund other strategic areas and maintain financial stability. Their reliable cash flow supports operational expenses but may limit growth opportunities as market saturation or declining demand can reduce profitability over time. Dependence on Cash Cows carries the risk of stagnation if innovation and diversification are neglected.

Choosing Between a Workhorse and a Cash Cow

Choosing between a workhorse and a cash cow depends on business goals and resource allocation. Workhorses offer consistent, reliable performance ideal for operational stability, while cash cows generate substantial profit with minimal investment, fueling growth and innovation. Evaluating market conditions and long-term strategy helps determine whether steady output or high cash flow aligns better with company objectives.

Conclusion: Optimizing Business Value

Focusing on workhorses ensures stable, consistent revenue streams while investing in cash cows maximizes profitability with minimal risk. Balancing these assets optimizes business value by combining reliability and high returns, driving sustainable growth. Strategic resource allocation between workhorses and cash cows enhances competitive advantage and long-term financial health.

Workhorse Infographic

libterm.com

libterm.com