An internal control letter outlines the procedures and policies a company uses to ensure the accuracy and reliability of its financial reporting and compliance with regulations. It highlights key areas where risks may arise and recommends improvements to strengthen controls. Explore the full article to understand how your business can benefit from implementing robust internal control letters.

Table of Comparison

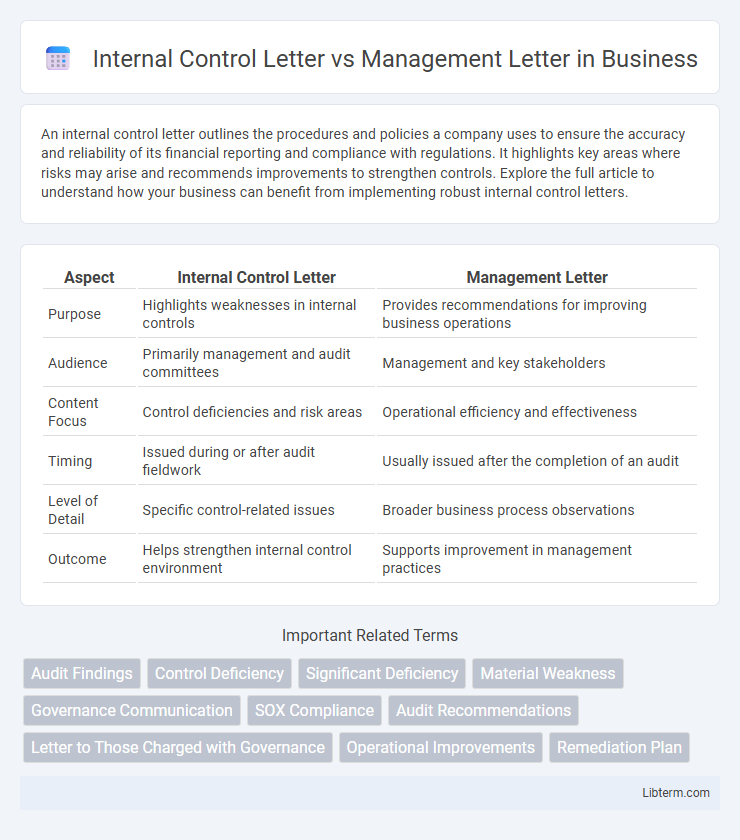

| Aspect | Internal Control Letter | Management Letter |

|---|---|---|

| Purpose | Highlights weaknesses in internal controls | Provides recommendations for improving business operations |

| Audience | Primarily management and audit committees | Management and key stakeholders |

| Content Focus | Control deficiencies and risk areas | Operational efficiency and effectiveness |

| Timing | Issued during or after audit fieldwork | Usually issued after the completion of an audit |

| Level of Detail | Specific control-related issues | Broader business process observations |

| Outcome | Helps strengthen internal control environment | Supports improvement in management practices |

Introduction to Internal Control Letter and Management Letter

Internal Control Letters provide detailed assessments of a company's internal control systems, highlighting weaknesses and recommending improvements to enhance operational efficiency and compliance. Management Letters focus on communicating audit findings to a company's management, emphasizing areas for operational improvements, risk management, and financial reporting accuracy. Both serve as essential tools for bolstering corporate governance and ensuring effective oversight.

Definition of Internal Control Letter

An Internal Control Letter is a formal document issued by auditors that highlights deficiencies and weaknesses in an organization's internal control systems, aiming to improve risk management and operational efficiency. It specifically addresses control issues identified during the audit process without including financial statement opinions. This letter is distinct from a Management Letter, which provides broader recommendations on management practices and operational improvements beyond internal control matters.

Definition of Management Letter

A Management Letter is a formal document prepared by auditors to communicate significant internal control weaknesses, operational improvements, and compliance issues discovered during an audit. Unlike the Internal Control Letter, which focuses specifically on control deficiencies, the Management Letter provides broader recommendations for enhancing overall management practices and business processes. This letter assists company leadership in addressing risks and improving organizational efficiency.

Key Differences Between Internal Control and Management Letters

Internal Control Letters specifically address weaknesses in an organization's internal control systems, focusing on risk management and compliance issues identified during an audit. Management Letters highlight operational improvements and recommendations for enhancing overall business efficiency and effectiveness beyond internal controls. The key difference lies in their purpose: Internal Control Letters emphasize control deficiencies and compliance risks, whereas Management Letters provide broader suggestions for management to improve organizational performance.

Purpose and Objectives of Each Letter

Internal Control Letters primarily focus on identifying and evaluating the effectiveness of an organization's internal controls, aiming to highlight weaknesses and recommend improvements to mitigate risks. Management Letters serve to communicate broader observations related to financial reporting, operational efficiencies, and compliance issues, providing actionable recommendations to enhance overall management practices. Both letters support organizational governance by promoting transparency, accountability, and continuous improvement in financial and operational processes.

Typical Contents of an Internal Control Letter

An Internal Control Letter typically includes detailed assessments of a company's internal control systems, highlighting control deficiencies, risk exposure, and recommendations for strengthening control processes. It focuses on areas such as segregation of duties, authorization procedures, and IT controls to ensure operational efficiency and reliability of financial reporting. This letter provides actionable insights to management for mitigating risks and improving governance frameworks.

Typical Contents of a Management Letter

A Management Letter typically contains detailed observations on internal control weaknesses, operational inefficiencies, and recommendations for improvement identified during an audit. It highlights non-compliance issues with policies, risk management concerns, and suggestions to enhance financial reporting accuracy. The letter serves as a tool for management to strengthen internal processes and governance beyond the scope of the audit opinion.

Who Prepares and Receives Each Letter

The Internal Control Letter is typically prepared by external auditors and addressed to the client's management or audit committee, highlighting significant deficiencies or weaknesses in internal controls. The Management Letter is also prepared by auditors but is more comprehensive, containing recommendations for operational improvements, and is usually sent exclusively to senior management or the board of directors. Both letters serve distinct purposes in the audit process, with the Internal Control Letter focusing on control issues and the Management Letter on broader management concerns.

Importance in the Audit Process

Internal Control Letters highlight significant deficiencies in an organization's internal controls, crucial for auditors to assess risk areas and plan the audit accordingly. Management Letters provide recommendations for improving operational efficiencies and control weaknesses, offering valuable insights beyond mere compliance. Both documents are essential in the audit process, ensuring transparency, enhancing financial accuracy, and fostering continuous improvement in governance.

Conclusion: Choosing the Right Letter for Your Organization

Selecting between an Internal Control Letter and a Management Letter depends on your organization's specific needs for risk assessment and operational improvement. Internal Control Letters emphasize compliance and control deficiencies, crucial for regulatory environments, while Management Letters offer broader insights into financial reporting and operational efficiency. Evaluating your organization's priorities and regulatory requirements ensures the right letter enhances governance and supports strategic decision-making.

Internal Control Letter Infographic

libterm.com

libterm.com